Shinyoung Sees 40% Surge in Operating Profit Thanks to Brighten Hannam and Yeouido

MDM Faces Sharp Drop in Pre-sale Revenue... Defends Financial Soundness with 6% Debt Ratio

DS Networks Posts 160 Billion Won Loss Due to Poor Sales... Debt Ratio Soars to 745%

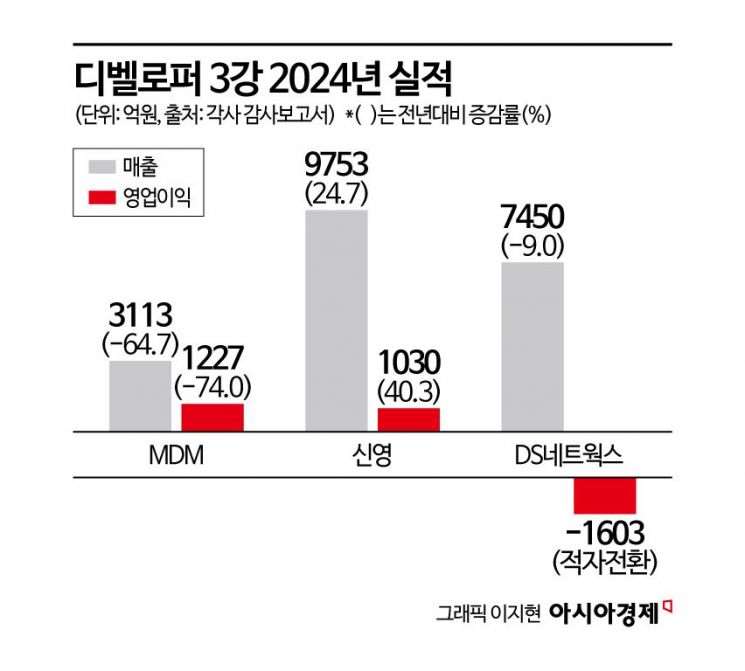

Amid a slump in the real estate market, the performance of the so-called “Big Three” major developers sharply diverged last year. Shinyoung saw a significant surge in profitability thanks to successful major project sales, while MDM’s results were cut in half, and DS Networks swung to a large-scale deficit. Since 2020, these companies have been regarded as the leading three in the development industry.

Shinyoung stood out the most. It was the only one among the three to see increases in both revenue and operating profit. According to the Financial Supervisory Service’s electronic disclosure system on April 25, Shinyoung posted revenue of 975.3 billion won and operating profit of 103.1 billion won last year. Compared to the previous year, revenue rose by 24.7% and operating profit by 40.3%. Shinyoung’s high-end brand “Brighten” performed well and drove the improved results. At Shinyoung Hannamdong Development PFV, the developer of “Brighten Hannam,” revenue reached 139.5 billion won (with a net profit of 49.4 billion won), while “Brighten Yeouido,” which was offered for lease before sale, generated 235.1 billion won in revenue (with a net profit of 13.2 billion won). Shinyoung has traditionally managed fewer projects than its peers. While its conservative strategy has led to slower external growth, it has also helped the company defend against deteriorating results during difficult market conditions, as seen last year.

MDM recorded revenue of 311.3 billion won and operating profit of 122.7 billion won. These figures represent decreases of 64.7% and 74.0%, respectively, compared to the previous year. The sharp drop in both revenue and profit was largely due to a steep decline in sales revenue, which fell from 879.9 billion won in 2023 to 309.9 billion won last year. In addition, major projects underway last year have yet to be reflected in the results. Although earnings declined, MDM maintained financial soundness by relying little on external borrowing. The company’s debt ratio, calculated as total liabilities divided by total equity, stands at just 6.4%. This is an exceptionally low figure, not only among developers but also across the entire construction industry.

DS Networks performed the worst among the three. Last year, its revenue reached 745 billion won, a 9.0% decrease from the previous year. The company posted an operating loss of 160.3 billion won, swinging into the red after recording operating profit of 45.6 billion won in 2023. As one of the most aggressive developers in terms of business expansion since the 2020s, DS Networks has been hit hardest by the market downturn. Many of its ongoing projects have suffered from low sales rates, directly impacting profitability. Notable examples include the Goyang Hyangdong Knowledge Industry Center (sales rate: 43.47%), Daegu Gamsang-dong mixed-use complex (sales rate: 51.15%), and Seoul Gildong mixed-use complex (sales rate: 82.16%). Financial soundness has also become a concern, with the company’s debt ratio soaring from 530% to 745%. Even considering that construction companies typically have higher debt ratios than general businesses, this is an extremely high level.

As the three companies’ results have diverged, the landscape of the development industry is also shifting. Based on revenue, DS Networks ranked first for three consecutive years starting in 2020, with MDM taking the top spot in 2023. Last year, Shinyoung became number one. In just five years, the leading company in the industry has changed repeatedly. An industry insider commented, “As the pre-sale market has yet to show a clear recovery, the polarization of results among developers is likely to intensify. Developers that can precisely time their project launches and have structures in place to recover profits in a timely manner will be the ones to withstand the crisis.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.