Citigroup Revises Growth Forecast to 0.6% from 0.8%

Next Year's Projection Also Lowered by 0.3 Points to 1.3%

"First Quarter Contraction and Prolonged U.S. Tariff Policy Possible"

Base Rate Expected to Fall from 2.0% to 1.5%

Supplementary Budget Forecast Raised from 35 Trillion to 50 Trillion Won

Goldman Sachs Projects 0.5% Growth

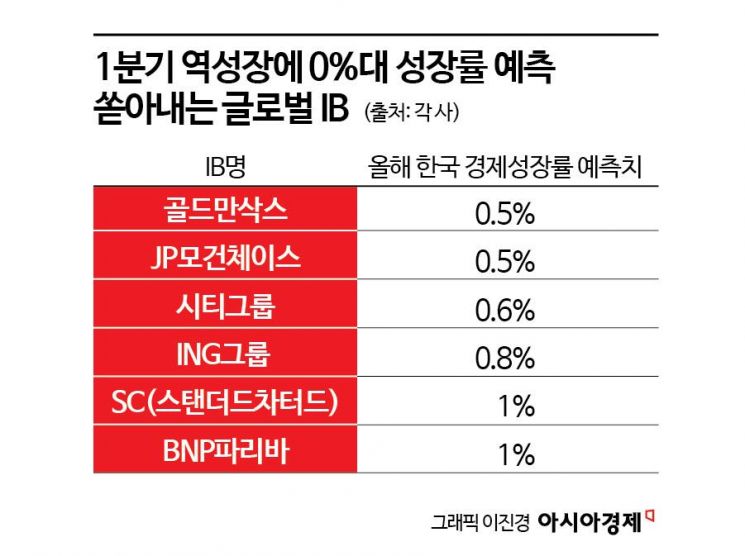

As South Korea's economic growth rate for the first quarter of this year fell short of expectations, global investment banks (IBs) have begun to lower their forecasts as well.

According to the financial sector on April 25, Citigroup announced that it is revising its 2024 economic growth forecast for South Korea down from 0.8% to 0.6%. This comes just 20 days after it had already lowered the forecast from 1% to 0.8%. The forecast for next year was also revised down from 1.6% to 1.3%. Kim Jinwook, Citigroup economist, explained, "The growth rate for the first quarter of this year was lower than expected, and there is a high likelihood that the impact of U.S. tariff policies will be prolonged."

However, Kim predicted that quarterly growth would improve from the second quarter onward compared to the first quarter. He stated, "If stronger fiscal policies are implemented, even with the negative impact of U.S. tariff policies, the economic growth rate (quarter-on-quarter) from the second to the fourth quarter could reach 0.4% to 0.5%." This is higher than the 0% average recorded from the third quarter of last year to the first quarter of this year.

Specifically, it was forecast that domestic private consumption would rebound, driven by a gradual recovery in economic sentiment and spending related to the presidential election to be held in June. While construction investment may remain weak in the second and third quarters of this year, facility investment is expected to gradually stabilize. External sectors such as exports and imports are projected to remain weak through next year.

Regarding next year's economic growth rate, Citigroup predicted that even if tariffs between the U.S. and China are substantially eased, there will still be a negative impact on South Korea's growth rate this year (by -0.2 percentage points) and next year (by -0.9 percentage points). The report also suggested that if the trend of household debt reduction continues, the economic boost sought by the Bank of Korea through rate cuts could be limited. The forecasts for next year's consumer price index and core inflation were also revised down by 0.1 percentage points each.

Citigroup also revised its outlook for Bank of Korea rate cuts. Previously, it expected the rate to be lowered by 0.25 percentage points in May, August, and November this year, reaching 2%. Now, it predicts additional cuts of 0.25 percentage points each in February and May of next year, ultimately bringing the rate to 1.5%. Although there is growing risk regarding both sluggish growth and inflation, and a 0.5 percentage point rate cut is being discussed for the next Monetary Policy Board meeting of the Bank of Korea next month, Citigroup expects that concerns over financial instability will likely limit the cut to 0.25 percentage points.

The scale of fiscal policy aimed at overcoming negative growth is also expected to increase. Citigroup now forecasts the size of the supplementary budget-previously expected to be 35 trillion won-to reach up to 50 trillion won (about 1.9% of South Korea's GDP). Kim Jinwook projected that an expanded supplementary budget could boost growth by about 0.38 to 0.77 percentage points over four quarters. However, he also warned of substantial downside risks to growth due to U.S. trade policy, the possibility of excessive tightening, the supplementary budget potentially falling short of expectations, and delays in fiscal policy implementation due to the presidential vacancy in the second quarter. He concluded, "There may be only a limited positive impact on the overall annual economic growth rate this year."

Meanwhile, global IBs are presenting negative outlooks, predicting that South Korea's economic growth rate will remain in the 0% range this year. On April 23, Jan Hatzius, Chief Economist at Goldman Sachs, said that their growth forecast had been revised down much more significantly than the International Monetary Fund (IMF), presenting a figure of 0.5%. JPMorgan Chase also lowered its forecast from 0.7% to 0.5%, while ING Group presented a forecast of 0.8%. Standard Chartered (SC) projected 1%. BNP Paribas also stated that downside risks to the economy have materialized, revising its forecast down by 0.6 percentage points to 1.0%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)