SK Hynix Reports Strong Q1 Results

Tariff Implementation Could Weaken Price Competitiveness

Strengthening Partnerships with Nvidia and Others

Clients Request Early Deliveries

Need to Enhance Production Stability and Technological Independence

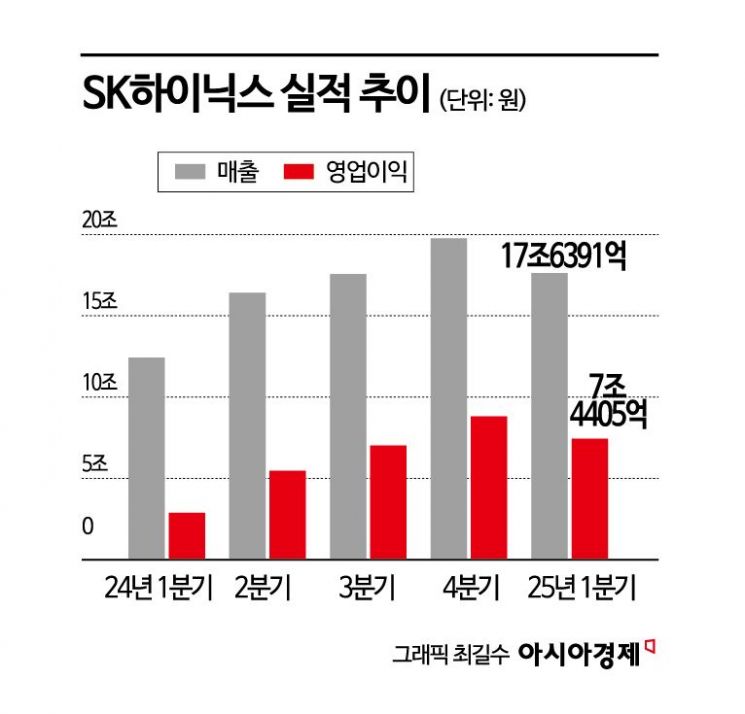

SK Hynix achieved improved first-quarter results, driven by preemptive purchasing demand from clients concerned about tariff uncertainties and a sales strategy focused on high-value-added products. Despite the off-season, the company maintained a stable profit structure, supported by strong sales of high-performance memory driven by expanding AI demand. However, it remains uncertain whether this trend will continue beyond the second quarter. While profitability has increased thanks to expanded sales of high-performance memory products, mid- to long-term performance remains clouded by supply chain instability and external variables.

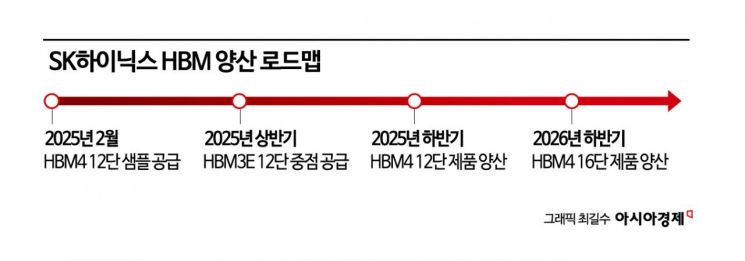

On April 24, SK Hynix announced its preliminary consolidated results for the first quarter and revealed plans to increase DRAM and NAND flash shipments in the second quarter by a little over 10% and more than 20%, respectively, compared to the previous quarter. The company also aims to raise the proportion of its HBM 3E 12-layer products to account for more than half of total shipments. However, there are still risk factors that make it difficult to be optimistic about continued performance improvement.

Tariff Risk May Also Act as a Demand Stimulus

The external variable SK Hynix is watching most closely is the semiconductor tariff announced by U.S. President Donald Trump. While President Trump has stated that tariffs will soon be imposed on semiconductors, no specific details have yet been disclosed. Given the complex supply chain characteristic of the semiconductor industry, there is ongoing debate about how the tariffs will be implemented. If realized, concerns have been raised that the price competitiveness of memory products such as HBM and DRAM could decline and that the supply system for U.S. clients could be affected.

In preparation, SK Hynix is strengthening its cooperation framework with key partners such as Nvidia and TSMC. It is known that SK Group Chairman Chey Tae-won visited Taiwan earlier this month to discuss cooperation measures related to U.S. tariffs with local semiconductor companies including TSMC.

During a conference call that day, Kim Woohyun, Chief Financial Officer (CFO) of SK Hynix, said, "The possibility of tariffs being imposed on memory has increased uncertainty," adding, "Nevertheless, global clients are maintaining their previously discussed demand, and some clients are even requesting early deliveries." He explained, "For consumer products such as PCs and smartphones, there is a trend of rushing purchases before price increases," and stated, "If tariff risks materialize, market impact will be inevitable, but for now, the short-term impact is limited."

Although about 60% of SK Hynix's AI-related product sales are linked to U.S. clients, the proportion actually exported directly to the U.S. is not high. Due to the complex nature of the supply chain, many deliveries are made through countries outside the U.S., so the actual impact of tariffs can only be assessed once the policies are clarified.

Thus, while SK Hynix is strengthening its profit structure centered on HBM, the company faces dual variables: changes in the external environment and internal supply chain adjustments. The possibility of U.S. semiconductor tariffs could directly impact transaction schedules and pricing strategies with global clients, while ensuring production stability amid changes in equipment suppliers has also emerged as an immediate challenge.

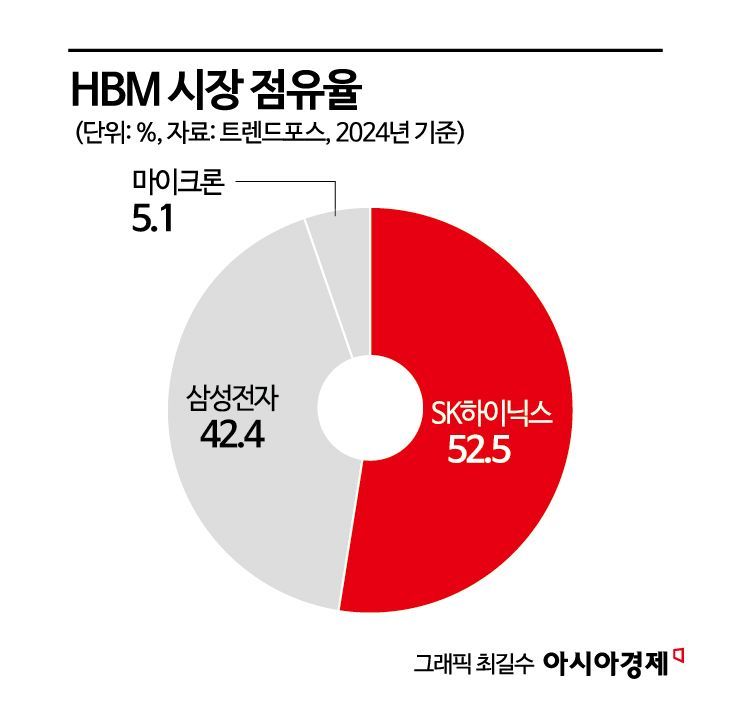

Internal Coordination Challenges Amid Supply Chain Diversification

In particular, diversifying core equipment such as TC bonders could, in the long term, be an opportunity to enhance technological independence, but it also brings uncertainties regarding compatibility with existing equipment, quality verification, and the transition of maintenance systems. With both tariffs and equipment replacement as overlapping variables, SK Hynix is now being tested on its ability to respond to the market and maintain production continuity. Recently, SK Hynix signed a TC bonder supply contract worth 21 billion KRW with Hanwha Semitec, beginning to split the supply system previously monopolized by Hanmi Semiconductor. Hanwha Semitec equipment will be deployed in 10 new HBM production lines, with additional orders under consideration. In response, Hanmi Semiconductor is raising equipment prices for the first time in eight years and is moving to charge for maintenance services. The industry views this supply chain diversification as a transitional friction, and SK Hynix believes that successfully navigating this period will be crucial for maintaining its leadership in the high-bandwidth memory market going forward. Kim Woonho, a researcher at IBK Investment & Securities, said, "The HBM3E 12-layer is expected to become the main product in the second half of the year, and SK Hynix is still the only supplier of this product," adding, "The company's position in HBM is expected to remain strong throughout this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.