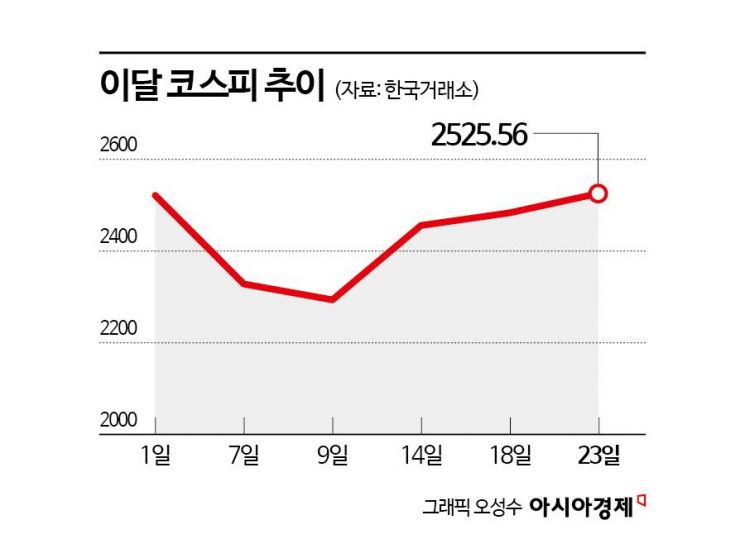

KOSPI Recovers 2,500 Level After Three Weeks

Rebounds After Hitting a Low on April 9... Eased Tariff War Concerns

Focus Shifts to Q1 Earnings and US-Korea Trade Talks

The KOSPI has recovered the 2,500-point level. As the KOSPI, which had experienced significant volatility earlier this month, appears to be stabilizing, there is growing interest in whether the upward trend will continue. As it is earnings season, corporate earnings results and tariff negotiations scheduled to begin on the 24th are expected to influence stock prices.

According to the Korea Exchange on the 24th, the KOSPI closed at 2,525.56 on the previous day, up 1.57%. This marks the first time in three weeks that the KOSPI has regained the 2,500-point level. On April 7, during the so-called "Black Monday" when global stock markets plummeted, the KOSPI fell by more than 5%, dropping into the 2,300-point range. On April 9, it even broke below the 2,300-point mark, showing signs of instability. However, after hitting its lowest point on April 9, it managed to rebound and has since risen steadily, reclaiming the 2,500-point level as well. Due to the sharp decline in the KOSPI this month, the year-to-date gains had been wiped out, turning returns negative, but the return has now climbed back to the 5% range. The KOSPI is up 5.25% compared to the beginning of the year.

The recovery of the KOSPI was led by institutional and individual investors. While foreign investors sold 10.4006 trillion won worth of shares just this month, institutions made net purchases of 3.6466 trillion won and individuals net purchased 5.1248 trillion won in the KOSPI market, thereby supporting the index.

The recovery of the KOSPI is attributed to the easing of concerns over the US-China tariff war, which had shaken the stock market. On the previous day, US Treasury Secretary Scott Besant mentioned that the US-China tariff war would ease in the very near future, leading the three major New York stock indices to rise by more than 2%. After the market closed, President Donald Trump stated, "(The current US tariff rate on China) at 145% is very high, and it will come down significantly." President Trump also said he had no intention of dismissing Federal Reserve Chair Jerome Powell, addressing market concerns that had been heightened by pressure for Powell to resign. Kim Ji-won, a researcher at KB Securities, analyzed, "The KOSPI recovered the 2,500-point level for the first time in three weeks since April 2, following President Trump's remarks aimed at calming the market. The impact of Secretary Besant's suggestion that the tariff dispute with China would ease led the US stock market to surge by 2% on the previous day, and after the market closed, President Trump's comments that he had never considered dismissing Chairman Powell further improved investor sentiment."

Now, market attention is expected to focus on first-quarter earnings and the US-Korea tariff negotiations. Cho Junki, a researcher at SK Securities, said, "The key variable this week is likely to be the earnings season," and added, "Although noise regarding tariffs will continue, as it peaks, the market's sensitivity to issues it should have been paying attention to will increase."

In the US, following Tesla's earnings report on the 22nd, companies such as Amazon and Intel are scheduled to announce their results. In Korea, SK Hynix, Hyundai Motor, KB Financial, Samsung SDI, Kia, and Shinhan Financial Group will release their first-quarter earnings. Lee Kyungmin, a researcher at Daishin Securities, explained, "Stock price fluctuations are expected based on the earnings results of leading companies in each sector and industry. Sectors that have secured price merit due to recent corrections are likely to attempt a rebound, but stocks with high price and valuation burdens could become targets for profit-taking, so caution is warranted." Lee Sunghoon, a researcher at Kiwoom Securities, said, "Expectations for domestic companies' current earnings estimates and first-quarter results do not appear to be high. The key will be how conservative companies' tones become regarding business conditions during conference calls, and how analysts' estimates change due to tariffs. As a result, sector and stock-specific market movements based on individual earnings results will become more pronounced."

The '2+2' US-Korea trade talks to be held in the US on the 24th could also be a variable affecting the market. Researcher Lee Kyungmin noted, "Along with expectations for tariff relief, key agenda items are likely to include defense cost-sharing and investments in liquefied natural gas (LNG) and shipbuilding. As market attention is focused on issues related to these sectors, it is important to pay attention to actual negotiation outcomes and stock price movements that may have already priced in expectations." Lee Jaewon, a researcher at Shinhan Investment & Securities, said, "If a favorable outcome is achieved, expectations for stocks that had suffered excessive declines due to concerns could increase."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)