Individuals net-buy 4.2 billion won in Sangji Construction after record high... Evaluation loss rate at -22.7%

Rapid rotation of political theme stocks increases individual investor losses

As the early presidential election scheduled for June 3 draws nearer, interest in political theme stocks is growing in the domestic stock market. With both the People Power Party and the Democratic Party of Korea launching their respective primary processes to select presidential candidates, statements by prominent politicians are having a direct impact on stock prices. Sangji Construction has surged by as much as 12 times this month, fueling speculative sentiment toward political theme stocks. Stock market experts have warned that even if some stocks experience sharp gains, it is not easy to actually realize profits, highlighting the risks of chasing theme stocks.

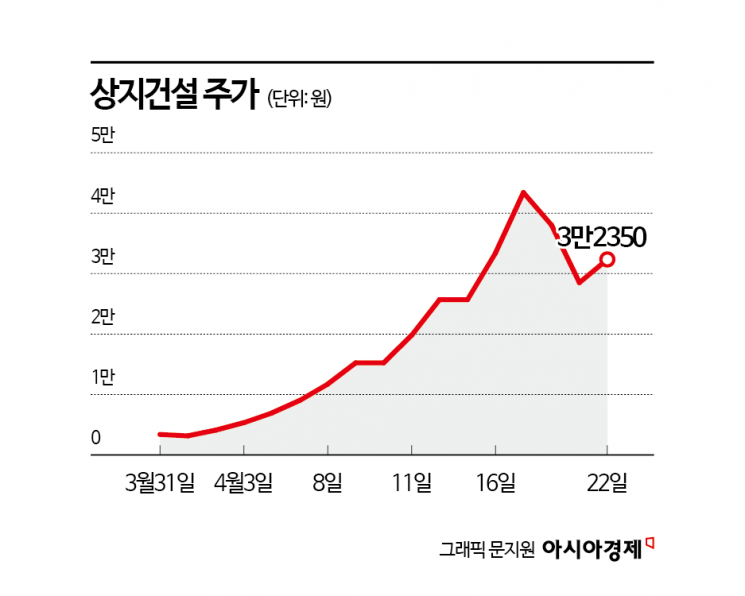

According to the financial investment industry on the 23rd, individual investors have made net purchases of Sangji Construction shares worth 6.55 billion won so far this month. The average purchase price was 34,207 won, and based on the previous day's closing price of 32,350 won, the evaluation loss rate stands at -5.4%.

Sangji Construction, which closed at 3,400 won at the end of last month, soared to as high as 43,400 won during trading on the 17th. The fact that Lim Mooyoung, former outside director of Sangji Construction, joined the presidential campaign of Lee Jaemyung, then a Democratic Party of Korea presidential primary candidate, during the 2022 presidential election, served as a trigger for the stock's surge. The rally continued until news broke on the 18th that the conversion rights for convertible bonds (CB) worth 11.5 billion won had been exercised. Over the two trading days of the 18th and 21st, the stock price plunged by 34.3%. During this period, individual investors recorded net purchases of 4.2 billion won, with an evaluation loss rate of -22.7%. This means that investors who entered during the correction phase of Sangji Construction?the fastest rising political theme stock?are now recording losses.

Many individual investors are experiencing losses after investing in political theme stocks in this way. In the early stages of a sharp rise, trading is often not active, so investors are unable to chase the rally. When trading volume surges as the stock price stalls, most individuals buy in at this stage and experience losses. If the stock price surges again and reaches a new high, it is possible to recover losses. However, with theme stock rotations happening rapidly in the current market, many stocks are quickly forgotten after a single sharp rally.

Erkos, which showed a sharp uptrend until the 14th, has recently been trading sideways. The previous day's closing price was 23,400 won, down 34.8% from the 35,900 won recorded on the 14th. From the 14th to the 22nd, individual investors made net purchases of 900 million won, with an evaluation loss rate of -14.7%. TS Investment also hit a record high on the 18th, and individual investors who entered afterward are currently facing a loss rate of over 20%.

An official from the financial investment industry explained, "Some political theme stocks have surged sharply in a short period, fueling speculative sentiment," and added, "With new political theme stocks constantly emerging, it is impossible to predict stock price movements."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.