The Medical Certificate Was Forged, the Treatment Was a Show

Colluding with Doctors to Issue Fake Receipts

Splitting Receipts After Rhinitis Surgery... Inflating Actual Loss Insurance Claims

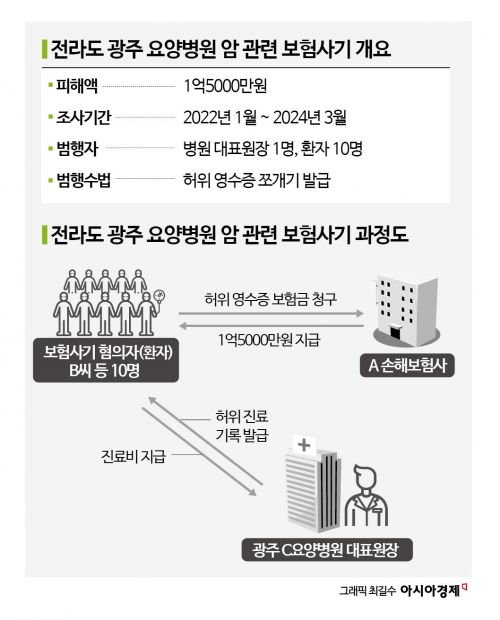

Asia Economy investigated the reality of insurance fraud involving "fake medical certificates and fabricated treatments." This scheme involved hospitals and patients colluding to create fake treatments, splitting up receipts, and inflating claims for reimbursement from private health insurance. Patients used cancer as an excuse to make four-hour round trips for outpatient care, while doctors recommended unnecessary nasal surgery and split a single day of treatment into several days for billing purposes. This exclusive report on such a case from Insurance Company A exposes the unfiltered reality that "the treatment is a show, and the medical certificate is staged."

In 2021, Company A detected suspicious insurance claims. A patient, Mr. B, who lived in Damyang, Jeonnam, was receiving outpatient cancer treatment at Hospital C in Gwangju. The fact that a cancer patient was making a four-hour round trip by car raised suspicions.

In December of the following year, an employee from Company A’s subsidiary visited Hospital C to launch an investigation. The investigation revealed that Mr. B had been diagnosed with breast cancer in 2017. Generally, if there is no recurrence for five years after a cancer diagnosis, it is considered cured. However, even though more than five years had passed, Mr. B continued to claim insurance payouts for outpatient treatment at Hospital C. Company A activated its Special Investigation Unit (SIU) for insurance fraud.

The SIU obtained Mr. B’s mobile phone base station records with his consent. When compared with the hospital’s records, it turned out that Mr. B had not visited the hospital on the days he claimed to have received treatment.

The SIU persuaded Mr. B, proposing that if he admitted to the fraud, the company would recover the insurance payouts from the hospital rather than from him. Mr. B then confessed, saying, "I colluded with the doctor to create fake receipts." Using this method, Mr. B fraudulently obtained about 10 million won in insurance payouts over several years.

Mr. B was not the only one. The SIU discovered nine more patients who had used the same method to claim insurance payouts. For these patients as well, the dates on their receipts did not match the actual hospital visit records.

After a large-scale investigation, the SIU found that Hospital C had systematically committed insurance fraud. Hospital C tailored medical expenses to match the 50 million won inpatient treatment coverage limit for private health insurance, and manipulated the number of treatment days or split a single day’s treatment into multiple days for billing purposes.

They even falsely recorded the use of expensive anti-cancer drugs. Medical receipts indicated that high-priced drugs such as Zadaksin (250,000?300,000 won per dose) or Abnoba (60,000 won per dose) were prescribed, but in reality, only nutritional supplements or general medications were used.

Ultimately, after a two-year and two-month investigation, Company A uncovered that the hospital’s chief director and ten patients had fraudulently received a total of 150 million won. The case was closed after the hospital’s chief director repaid the full amount.

Even mild rhinitis: "You can get more insurance money if you have surgery"

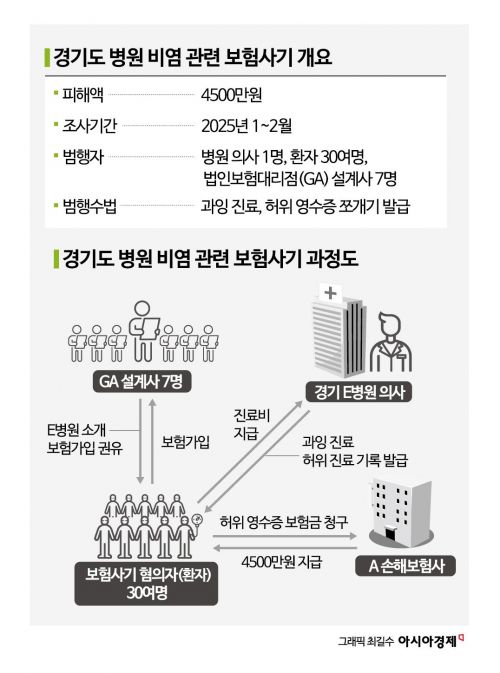

Company A also uncovered another insurance fraud case. This case involved patients with rhinitis at Hospital E in Gyeonggi Province, who unjustly received private health insurance payouts and surgical fees.

In December of last year, claims staff at Company A’s subsidiary noticed a surge in insurance claims related to rhinitis surgery. Suspiciously, most patients had no record of receiving any rhinitis treatment before surgery. They came to the hospital for the first time and immediately underwent surgery. Normally, surgery for rhinitis is performed only after multiple treatments have failed.

In January of this year, an SIU employee from Company A went undercover as a patient and visited Hospital E. The doctor there recommended surgery without any special examination. Although the surgery would be completed in a single day, the doctor offered to split the receipts over several days. The doctor also kindly explained that this would allow the patient to receive more insurance money.

Initially, there was insufficient evidence, but Company A traced the patients’ insurance enrollment routes and found a clue. All 30 or so patients had purchased insurance through seven planners affiliated with the same corporate general agency (GA).

The investigation found that these planners encouraged patients to purchase insurance products that included special riders for surgical benefits, saying, "You can get a large payout if you have surgery." They also advised, "It’s easy to get surgery at Hospital E." These riders paid out the full insured amount set at the time of enrollment as long as surgery was performed. The planners and the doctor at Hospital E exploited this product structure to recommend surgery and inflate insurance claims.

The doctor tempted patients referred by the planners by saying, "You can get more insurance money if you have surgery." After surgery, although only one day of treatment was provided, the doctor issued receipts as if treatment had taken several days. When pressed by Company A, the doctor at Hospital E admitted, "I tried to make money through insurance fraud because it was difficult to keep the hospital running."

In this case, the doctor at Hospital E, about 30 patients, and seven GA planners fraudulently obtained 45 million won in insurance payouts, but the full amount was recovered by Company A. The case was closed last month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.