Installment Payment Applications Accepted Until May 12

3.53 Million with Decreased Salaries to Receive 120,000 Won Refund per Person

This April, 10.3 million salaried workers whose annual salaries increased last year will have to pay an additional 200,000 won in health insurance premiums.

The National Health Insurance Service announced on the 22nd that it will issue notices for the April health insurance premiums for workplace subscribers, along with the settlement premiums reflecting changes in 2024 salary details.

For workplace subscribers to the national health insurance, the amount of insurance premiums must change whenever their monthly salary changes due to factors such as step increases or wage hikes. However, to reduce the administrative burden on employers who would otherwise have to report these changes every time, the premiums are initially charged based on the previous year’s salary, and then every April, the actual premiums that should have been paid over the past year are settled and charged accordingly.

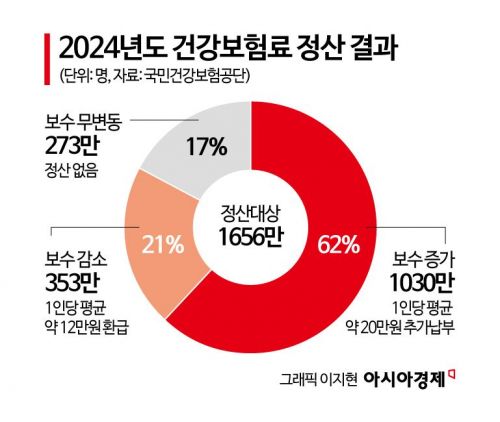

As a result of the 2024 health insurance premium settlement for earned income of workplace subscribers, the total settlement amount reached 3.3687 trillion won, an increase of about 8.9% compared to 2023 (3.0925 trillion won), but a decrease of about 9.4% compared to 2022 (3.717 trillion won).

Accordingly, out of 16.56 million workplace subscribers, 10.3 million people whose salaries increased last year will have to pay an additional average of about 200,000 won per person. On the other hand, 3.53 million people whose salaries decreased will receive an average refund of about 120,000 won per person. For the 2.73 million people whose salaries did not change, no settlement will be made.

Although the additional payment is billed as a lump sum, if the amount to be paid exceeds the monthly premium charged to the workplace subscriber, the subscriber can apply for installment payments (up to 12 times) through their employer by May 12.

A representative of the National Health Insurance Service explained, "The year-end settlement is conducted to ensure accurate premium charges based on income changes. The additional payment is not a premium increase, but rather the result of settling premiums to reflect wage increases and other changes that occurred in the previous year." The representative added, "If employers report salary changes such as wage increases, step increases, or bonuses to the NHIS immediately, the burden of additional payments at year-end settlement can be reduced."

Meanwhile, starting this year, the NHIS implemented year-end settlements using simplified wage statements received from the National Tax Service, without requiring separate reports from employers, following a business agreement signed with the National Tax Service in January. In this first year of the system improvement, 4.96 million people had their year-end settlements processed using simplified wage statements, as many employers continued to report total salary amounts as before.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.