The Reduction Rate Will Be Reduced to 10% for Gasoline and 15% for Diesel

The government has decided to extend the temporary reduction of fuel taxes, which was set to expire at the end of this month, by an additional two months until the end of June. However, it will partially roll back the extent of the reduction. This decision was made because, despite the continued decline in international oil prices, inflationary pressures persist due to increased volatility in exchange rates, which are reflected in the price of imported crude oil.

The Ministry of Economy and Finance announced this policy on April 22 and plans to pre-announce amendments to the Enforcement Decree of the Transportation, Energy, and Environment Tax Act and the Enforcement Decree of the Individual Consumption Tax Act from April 23 to 24. This is the 15th extension of the sunset provision since the temporary fuel tax cut was first introduced in November 2021.

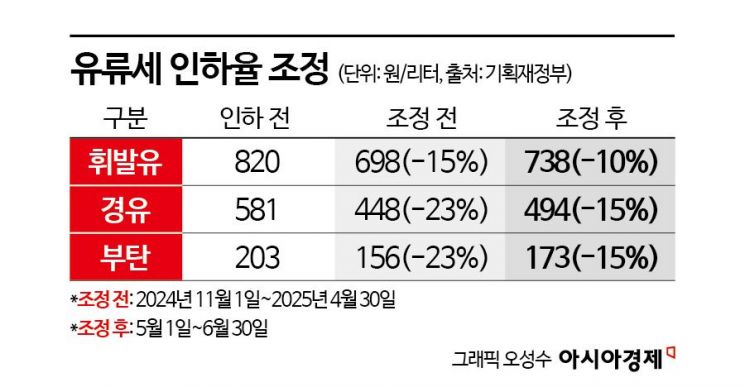

Currently, the fuel tax is being reduced through an adjustment of the flexible tax rate, with gasoline taxed at 698 won per liter, a reduction of 122 won (15%). Diesel is taxed at 448 won per liter, down by 133 won (23%). The government expanded the fuel tax reduction rate for gasoline and diesel to as much as 37% starting in July 2022 to stabilize prices, but has gradually reduced the rate since 2023 while extending the sunset provision.

With this new measure, the reduction rate for gasoline will be reduced from 15% to 10%, and for diesel and liquefied petroleum gas (LPG) butane, from 23% to 15%. As a result, starting next month, gasoline will be taxed at 738 won per liter and diesel at 494 won per liter, increases of 82 won and 87 won, respectively, compared to the previous month. Butane will also rise by 30 won to 173 won per liter. This reduction measure will remain in effect until the end of June.

International oil prices have been falling sharply amid growing concerns over a global economic slowdown triggered by a full-scale tariff war initiated by the United States. Given the current U.S. tariffs and the 90-day mutual tariff suspension, it is projected that global trade volume will decrease by 0.2% year-on-year, and the ongoing trade dispute is exerting downward pressure on crude oil demand. As a result, West Texas Intermediate (WTI) crude oil recently dropped to a four-year low of $59 per barrel before fluctuating.

Dubai crude oil, which serves as the benchmark for imported crude prices, has plunged 7% just this month. Factors such as the planned production increase by Russia and OPEC+ (a group comprising OPEC member countries and non-OPEC partners), as well as U.S. crude oil production remaining at record-high levels, are also cited as reasons that could further depress oil prices, as the oversupply situation is expected to persist for the time being. Since international oil prices are reflected in domestic gasoline and diesel prices with a lag of two to three weeks, domestic fuel prices are also likely to continue their downward trend for the time being.

Despite the drop in oil prices, inflationary pressure from the high exchange rate remains a risk factor. According to Statistics Korea, the consumer price index rose by 2.1% year-on-year last month, with petroleum products rising by 2.8%. This is a slower increase compared to February, when petroleum products rose by 6.3%. In February, petroleum products contributed 0.24 percentage points to overall inflation, but this contribution dropped to 0.11 percentage points in March. However, the high exchange rate that has persisted since the end of last year is being reflected in consumer prices with a lag, causing processed food prices to trend upward. Although the won-dollar exchange rate, which at one point threatened to surpass 1,500 won per dollar, has fallen to the 1,420-won range, the won remains undervalued despite the weaker dollar.

The government has stated its intention to minimize increases in administered prices by freezing public utility rates in the first half of the year. While the government assesses the current inflation level as stable, it believes that if the fuel tax cut is withdrawn, consumer prices?which had entered a period of stability?could spike again or further dampen already weakened consumer sentiment. The Ministry of Economy and Finance explained, "Taking into account recent trends in oil prices and inflation, as well as the impact on public finances, we have decided to partially roll back the fuel tax cut in order to prevent a significant increase in fuel costs for the public."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.