Songpa-gu Rises 4.28%, Four Times the Seoul Average

Gangnam and Seocho Record 3.52% Increases

Gwacheon in Gyeonggi Province Up 3.41%

Eight Districts Including Nodogang Decline... Polarization Intensifies

In the first quarter of this year, during the process of lifting and then re-designating the land transaction permit zone in Gangnam, Seoul, apartment prices in Songpa-gu recorded the highest rate of increase among all cities, counties, and districts nationwide. The reversal of the land transaction permit zone policy has further intensified the polarization of apartment prices between the three Gangnam districts and the northern areas of Seoul.

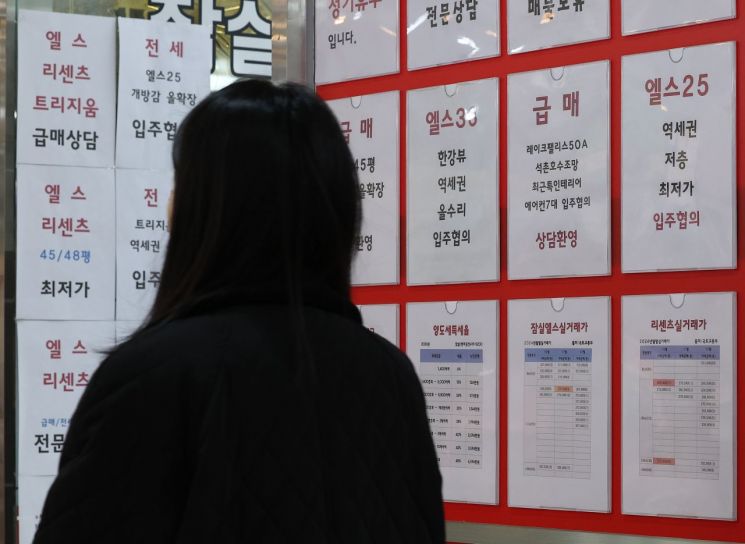

A real estate sales notice is posted at a real estate office in Songpa-gu, Seoul. (Photo by Yonhap News)

A real estate sales notice is posted at a real estate office in Songpa-gu, Seoul. (Photo by Yonhap News)

According to the nationwide housing price trend survey by the Korea Real Estate Board released on April 20, apartment prices in Songpa-gu, Seoul, rose by 4.28% in the first quarter of this year. This is more than four times the average increase in Seoul (1.06%) and represents the highest rate of increase among all cities, counties, and districts nationwide.

Gangnam-gu and Seocho-gu both saw apartment prices rise by 3.52%, ranking second nationwide after Songpa-gu.

After Seoul Mayor Oh Sehoon mentioned the possibility of lifting the land transaction permit zone in Gangnam on January 14, and then lifted the designation for the "Jamsamdaechung" area (Jamsil, Samsung, Daechi, and Cheongdam-dong) on February 13, apartment prices in the three Gangnam districts surged until March 24, when the permit zone was re-expanded and re-designated, just 39 days later.

On a monthly basis, the price increase in March?when the permit zone was lifted for more than three weeks?was the largest. In Songpa-gu, the monthly increase expanded from 0.26% in January and 1.35% in February to 2.63% in March. Gangnam-gu also saw increases of 0.04% in January, 0.83% in February, and 2.62% in March. Seocho-gu recorded 0.18% in January, 1.00% in February, and 2.31% in March.

In Seoul, excluding Gangnam, areas with redevelopment projects, such as the "Mayongseong" area (Mapo, Yongsan, and Seongdong districts), showed relatively strong performance. In the first quarter of this year, five districts recorded increases above the Seoul average: Seongdong-gu at 1.34%, Yongsan-gu at 1.27%, Yangcheon-gu at 1.13%, Mapo-gu at 1.09%, and Gangdong-gu at 1.07%.

In contrast, eight districts with a high concentration of mid- to low-priced apartments?including the "Nodogang" area (Nowon at -0.23%, Dobong at -0.17%, and Gangbuk-gu at -0.11%), as well as Jungnang-gu (-0.12%), Geumcheon-gu (-0.11%), Dongdaemun-gu (-0.09%), Guro-gu (-0.07%), and Eunpyeong-gu (-0.05%)?saw some upward movement in March due to heightened expectations following the lifting of the permit zone in Gangnam. However, on a quarterly basis, these districts still recorded declines.

In Gyeonggi Province, Gwacheon City recorded a 3.41% rise in the first quarter, ranking fourth nationwide after the three Gangnam districts. Gwacheon, which is close to Gangnam, saw strong demand for newly built and reconstructed apartments and benefited from the spillover effect of the Gangnam permit zone lifting, recording a 2.73% increase in March alone?higher than the three Gangnam districts.

Bundang-gu in Seongnam City, which has positive redevelopment prospects as a first-generation new town, also rebounded by 0.43% in March after declines in January and February, resulting in a cumulative increase of 0.25%. Due to the lifting of the permit zone, the number of apartment transactions in Seoul in March (based on contract date) reached 8,991 as of April 20, approaching 9,000.

Considering that there are still ten days left until the end of the reporting period at the end of this month, the total number of transactions in March is likely to reach around 10,000. After the permit zone was re-expanded on March 24, apartment sales transactions in the three Gangnam districts and Yongsan-gu have sharply declined. The March transaction volume surpassed last July's figure (9,223 transactions) and marked the highest level in four years and eight months since July 2020 (11,143 transactions).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)