Securing 150 Billion KRW in Cash Through Asset Sales and Subsidiary Liquidation

'Exit Signal' Emerges Ahead of Acquisition Financing Maturity

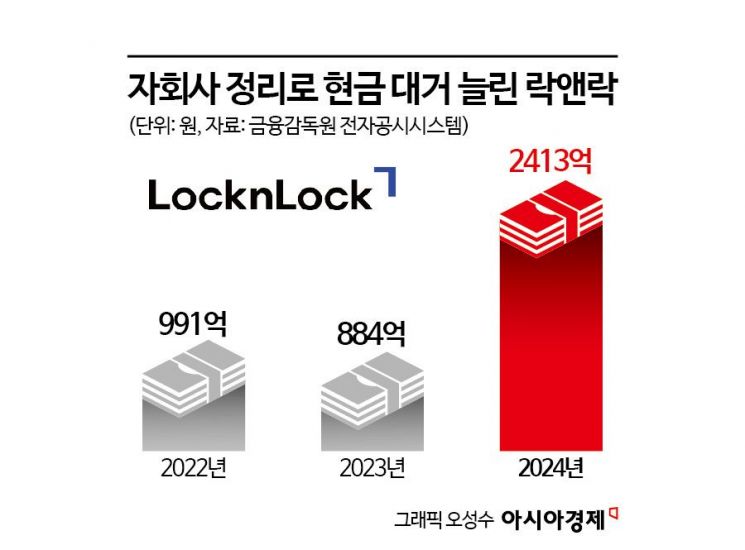

Lock&Lock significantly increased its cash holdings through the sale of assets. Industry insiders are paying attention to the possibility that the largest shareholder, Affinity Equity Partners, may seek to recover its investment through high dividends.

According to the Financial Supervisory Service's electronic disclosure system on the 18th, Lock&Lock's cash equivalents at the end of last year amounted to 241.3 billion KRW, a sharp increase of about 153 billion KRW compared to the previous year (88.4 billion KRW). Although cash generated from operating activities slightly decreased from 69.3 billion KRW in 2023 to 55.8 billion KRW in 2024, cash inflows from investment activities such as asset sales more than offset this decline.

A significant portion of the cash inflow originated from asset restructuring and subsidiary liquidation. Last year, Lock&Lock converted a total of 86.1 billion KRW into cash by disposing of real estate and tangible assets. Specifically, this included land sales worth 34.5 billion KRW, buildings worth 32.1 billion KRW, and production facilities such as machinery, molds, and vehicles. At the same time, Lock&Lock sold its only production base in China, Lock&Lock Daily Necessities (Suzhou) Co., Ltd., and the Vietnamese production subsidiary also entered liquidation procedures. Earlier this year, the Chinese subsidiaries Beijing Lock&Lock Trading Co., Ltd. and Lock&Lock Trading (Shenzhen) Co., Ltd. were liquidated, and the sale of the Indian sales subsidiary has also been announced.

In addition to asset sales, Lock&Lock has pursued profitability improvement through internal cost structure reorganization. Last year, research and development (R&D) expenses were reduced to 1.2 billion KRW, accounting for only 0.25% of sales. This represents a decrease of more than 70% compared to 4 billion KRW in 2023. The company also implemented comprehensive operational efficiency strategies, including expanding production outsourcing, optimizing inventory, and reducing selling and administrative expenses. As a result, Lock&Lock, which recorded an operating loss of 21 billion KRW in 2023, achieved an operating profit of 1.7 billion KRW last year, successfully turning to profitability.

With increased cash capacity, the possibility of Affinity pursuing high dividends is being raised again. Since 2021, Lock&Lock has secured cash through the sale of domestic and overseas factories and logistics centers, and has already recovered some funds through cash dividends in the 80 billion KRW range and a capital reduction of about 40 billion KRW. In 2023, it also transferred 292.2 billion KRW of capital surplus to retained earnings, increasing its dividend capacity. Currently, the amount Lock&Lock can use for dividends reaches approximately 515.6 billion KRW.

Another factor supporting the dividend possibility is the approaching maturity of acquisition financing. When Affinity acquired Lock&Lock in 2017, it raised acquisition financing totaling 375 billion KRW. The loan originally had a five-year maturity, but after negotiations with the lending group in 2022, the maturity was extended by three years, delaying the due date to this December. In exchange for the extension, Affinity is reported to bear a much higher interest rate than before. Since the interest burden increases as the maturity date approaches, Affinity faces an inevitable need for prompt fund recovery to protect the fund’s returns.

A Lock&Lock official stated, "There is no dividend plan decided yet for this year," adding, "We are focusing on strengthening the fundamental capabilities to maintain a profit trend by continuing a profitability-centered sales channel strategy such as online sales."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)