A 'Cash Cow' for Holding Company Income

Showbox Resumes Dividends After Five Years

Orion Holdings has earned solid profits from its content investments. Its long-struggling subsidiary Showbox turned a profit for the first time in five years, thanks to the success of the film "Pamyoh," and resumed dividend payments. Showbox's improved performance is also credited with boosting the contribution of Orion Holdings' holding division to overall earnings.

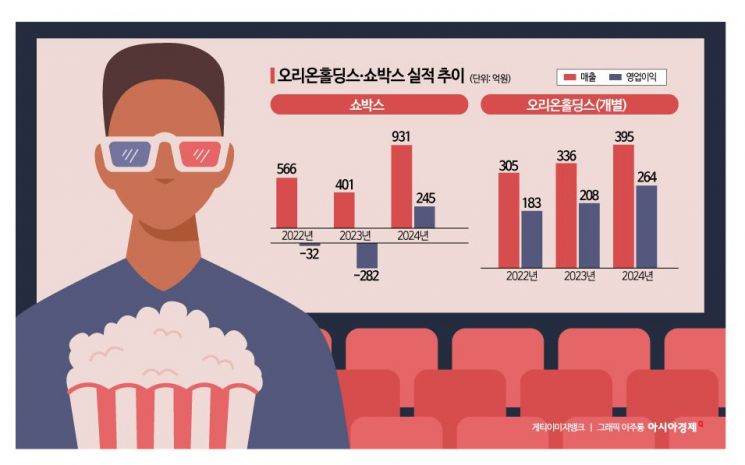

According to the Financial Supervisory Service on the 23rd, the holding company Orion Holdings recorded sales of 39.5 billion KRW and operating profit of 26.4 billion KRW on an individual basis last year. These figures represent increases of 17.3% and 26.8%, respectively, compared to the previous year. Orion Holdings' individual sales structure consists of dividend income from subsidiaries of 18.5 billion KRW (47%), brand royalties of 13.8 billion KRW (35%), and rental income of 7.1 billion KRW (18%).

A 'Cash Cow' for Holding Income... 5.4 Billion KRW Inflow from Dividends

Showbox has consistently paid dividends since its listing on KOSDAQ in 2006. Although it suspended dividends due to four consecutive years of losses after 2019 and a slowdown in content production caused by COVID-19, it resumed dividend payments last year following a performance rebound. It paid a cash dividend of 150 KRW per share, totaling 9.4 billion KRW, and the largest shareholder, Orion Holdings, secured 5.4 billion KRW in dividends based on its 57.47% stake. This accounts for 13.4% of Orion Holdings' total sales. Showbox is now regarded as a significant profit pillar in the non-food business sector.

Showbox posted consolidated sales of 93.1 billion KRW, operating profit of 24.5 billion KRW, and net income of 27.4 billion KRW last year. Sales increased by 132% year-on-year, and the company escaped four consecutive years of losses. Its flagship film "Pamyoh" proved its box office power by surpassing 11 million cumulative viewers, and other content lineups such as "Love's Hatchuping" and "Citizen Deokhee" also showed remarkable results. Last year, Showbox ranked second in the film distribution market with a 12.4% market share, following Disney (13.2%).

Showbox's revenue structure does not rely solely on simple theater screening income. During this period, theater screening distribution revenue was 61.9 billion KRW, accounting for 66.7% of total sales. Other revenues outside theaters also increased significantly, including video-on-demand (VOD) distribution (13.9 billion KRW, 15.0%), cable TV (CATV), terrestrial broadcasting, and other ancillary rights (approximately 3.5 billion KRW, 4%), and content planning and production (2.6 billion KRW, 2.8%). Adding overseas licensing revenue (10.2 billion KRW) and content production revenue (2.6 billion KRW), the non-theater sales ratio is about 33%. Diversifying revenue streams to reduce dependence on a single channel has been the foundation for stable performance, according to analysts.

Orion Holdings Diversifies Portfolio from Content to Bio

Showbox's return to profitability and resumption of dividends have led to a revaluation of the content business that Orion Holdings has been pursuing. After establishing Mediaplex in 1999, Orion Holdings operated movie screening and theaters through Megabox Cineplex and conducted film investment and distribution under the Showbox brand.

After selling Megabox in 2007, Orion Holdings focused its capabilities on film investment, distribution, and production planning. In 2015, it changed its name to Showbox to unify the brand and company name. Orion Holdings generates stable cash flow through its food business (Orion) while pursuing medium- to long-term portfolio diversification through investments in non-food sectors such as content and bio.

Showbox, responsible for the content division, had been a neglected entity within Orion Holdings. It struggled with losses from 2020 to 2023 following the COVID-19 outbreak. The deficit widened from 1.9 billion KRW in 2020 to 28.2 billion KRW in 2023. Operating losses during this period exceeded 30 billion KRW. Due to these difficulties, Showbox was unable to pay dividends, and Orion Holdings did not receive significant income from Showbox. With Showbox now making a clear contribution to profits, the investment results in the content business are becoming more visible.

An industry insider said, "Showbox is rapidly evolving beyond a simple film distributor into a global intellectual property (IP)-based content company," adding, "It will continue to strengthen the holding company's non-food revenue structure through ongoing content development and securing diverse distribution channels."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)