Prolonged Political Uncertainty in 1Q and Concerns Over U.S. Tariffs

Wildfires and Deferred Demand for High-Performance Semiconductors Add to Challenges

There has been a diagnosis from the Bank of Korea suggesting that South Korea's real Gross Domestic Product (GDP) growth rate for the first quarter of this year may have recorded a negative (-) figure. It is also highly likely that this year's growth rate will fall below the February forecast of 1.5%.

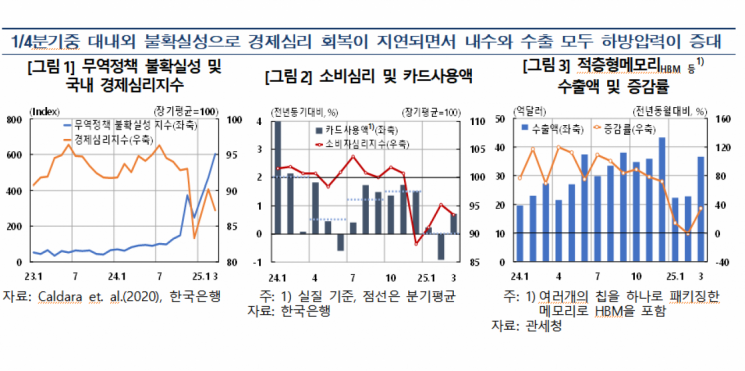

On the 17th, after the Monetary Policy Committee of the Bank of Korea decided to keep the base interest rate steady at 2.75% per annum, it released the 'April 2025 Economic Situation Assessment,' stating, "Domestic economic growth may fall short of the previous forecast path as economic sentiment recovery is delayed and global trade conditions worsen." It also noted that uncertainties regarding the growth path have significantly increased due to factors such as the development of trade negotiations, the scale and timing of supplementary budgets, and the speed of economic sentiment recovery.

The first-quarter growth rate is estimated to have fallen below the February forecast of 0.2%, with the possibility of negative growth also being pointed out. The Bank of Korea explained, "Economic sentiment contracted again in March due to prolonged domestic political uncertainty and concerns over U.S. tariff policies," adding, "Temporary factors such as large wildfires, suspension of construction at some sites, and deferred demand for high-bandwidth memory (HBM) chips compounded the downward pressure on both domestic demand and exports."

Considering the sluggish economy in the first quarter and the recent intensification of U.S. tariff measures, there is an increasing analysis that this year's growth rate is likely to fall below the February forecast of 1.5%. The Bank of Korea stated, "Downside risks to domestic growth have significantly expanded," and added, "While domestic demand is expected to improve as political uncertainty gradually resolves, exports are likely to be heavily affected by tariffs." It explained that exports to the U.S. are expected to decline due to reduced demand caused by rising import prices following tariff increases, and that China's retaliatory tariffs against the U.S. will reduce China's exports to the U.S., which may in turn decrease South Korea's exports of intermediate goods to China. The U.S. and China are South Korea's two largest trading partners, accounting for about 40% of its exports, and trade conflicts between the two countries have a significant impact on the Korean economy.

The Bank of Korea pointed out, "Tariff increases affect our economy not only through direct trade channels but also indirectly through increased trade policy uncertainty and heightened financial market volatility." Indeed, domestic and international financial markets fluctuated during the announcement of reciprocal tariffs by the U.S. and the intensification of U.S.-China trade conflicts. The Bank of Korea warned, "If the uncertain situation regarding how final tariffs will be decided by each country continues, companies may postpone major investment decisions, and employment and wages may also decrease."

Domestic and international forecasting institutions also have a bleak outlook for South Korea's economic growth rate this year. As of the 10th, the median forecast among about 40 major investment banks (IBs) and other market participants was 1.4%, with the lower 25% value at 1.1%. These figures have been revised downward from previous forecasts, and the distribution of forecasts has widened amid high uncertainty.

The Bank of Korea stated, "This year's domestic growth rate will be greatly influenced by the progress of global trade negotiations, the scale and timing of supplementary budgets, and the speed of economic sentiment recovery, so uncertainty is very high," adding, "Reciprocal tariffs by the U.S. are expected to be temporarily suspended, and full-scale negotiations between the U.S. and other countries will proceed, but depending on the outcome, our growth rate forecast will inevitably change significantly."

The Bank of Korea's Research Department plans to review the progress of trade negotiations and the development of major risk factors to announce specific forecast figures in next month's economic outlook.

Meanwhile, the current account surplus for this year is also expected to fall short of the previous forecast of $75 billion. However, although goods exports in the first quarter were weaker than expected, imports, mainly of raw materials, decreased more, resulting in a surplus exceeding initial expectations. The Bank of Korea predicted, "The current account surplus is expected to shrink mainly due to the goods balance affected by U.S. tariff policies," and added, "The services balance deficit will widen as the transport surplus decreases due to reduced goods trade caused by trade frictions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.