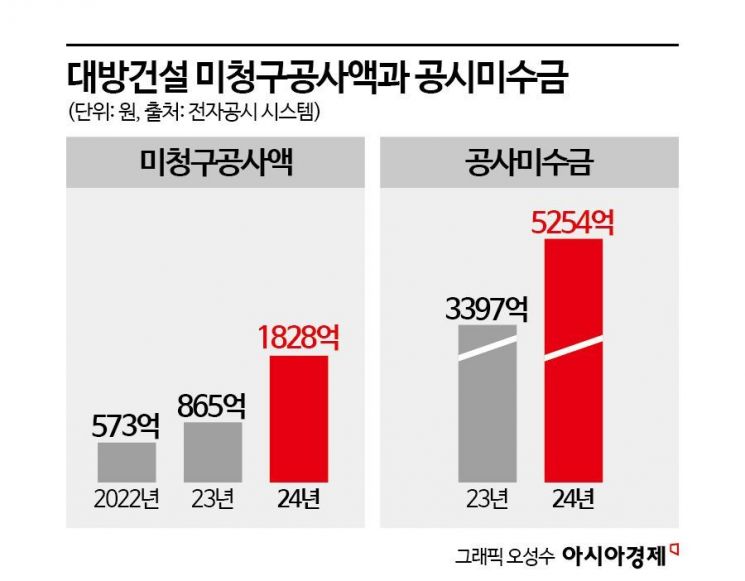

Unbilled Construction Amount Reaches 182.8 Billion KRW

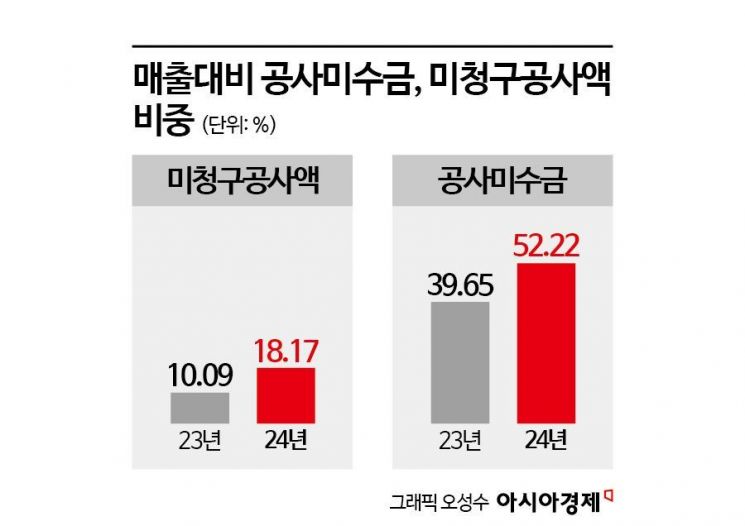

18.2% of Total Sales

Construction Receivables Surpass 500 Billion KRW

Concerns Over Financial Soundness Deterioration

Last year, Daebang Construction's unbilled construction amount more than doubled compared to the previous year. Construction receivables also exceeded 500 billion KRW. While Daebang Construction explained that this was a temporary flow caused by an increase in construction sites, some experts point out that it could be a trigger for deteriorating financial soundness.

According to the Financial Supervisory Service's electronic disclosure system on the 18th, Daebang Construction recorded sales of 1.0061 trillion KRW and operating profit of 110.5 billion KRW last year. Sales and operating profit increased by 17.4% and 29.8%, respectively, compared to the previous year. Unlike other construction companies suffering from poor performance due to the construction market downturn, Daebang Construction achieved strong results.

Unbilled Construction Amount Increased 2.1 Times Compared to Previous Year

Contrary to solid performance, last year's unbilled construction amount reached 182.8 billion KRW, increasing 2.1 times from 86.5 billion KRW the previous year. The proportion of unbilled construction amount in sales rose from 10.09% in 2023 to 18.2% last year. This trend has continued for several years. The unbilled construction amount was 57.3 billion KRW in 2022, 86.5 billion KRW in 2023, and sharply increased to 182.8 billion KRW last year.

The unbilled construction amount refers to accounts receivable for construction completed but not yet billed to the client. It is classified as a contract asset in accounting, not a loss. However, if the client does not pay, it converts into a loss. Therefore, an increase in unbilled construction amount indicates growing potential insolvency.

Experts emphasize the need to carefully monitor the continuous increase in unbilled construction amount over several years. In Daebang Construction's case, the unbilled construction cost increased by about 29.1 billion KRW (from 57.3 billion KRW to 86.5 billion KRW) not only in the year when sales increased but also in 2023 when sales decreased compared to the previous year. Since unbilled construction potentially implies insolvency risk, it can act as a risk factor during the real estate market downturn with accumulated unsold properties.

Jung Do-jin, a professor of Business Administration at Chung-Ang University, explained, "The unbilled construction amount of construction companies should not be simply judged as the level of construction fees not yet billed according to accounting standards. While a temporary occurrence of unbilled construction amount is not a major issue, if there is a continuous upward trend or a sharp increase in its proportion, it is necessary to suspect problems in construction quality and financial soundness."

A significant portion of the unbilled construction amount occurred at external sites contracted through subsidiaries. Daebang Construction mainly earns profits by having subsidiaries participate as developers while Daebang Construction handles construction. Although these are projects ordered by subsidiaries and can be considered internal projects, Daebang Construction classifies them as subcontracted projects. The largest unbilled construction amounts were from Busan Eco Delta City Dietre The First (85.1 billion KRW) developed by subsidiary DB Construction, followed by Chungnam Naepo New Town Phase 1 Dietre Edu City (32.7 billion KRW) developed by Daebang ENC and Daebang Development Enterprise, and Incheon Geomdan New Town Dietre The Edu (21.2 billion KRW).

Regarding the large unbilled construction amounts in three projects including Chungnam Naepo New Town Phase 1 Dietre Edu City, which were subcontracted projects ordered by subsidiaries, Daebang Construction explained, "The reason for the large unbilled construction costs at these sites is due to the difference between the accounting revenue recognition criteria and the actual billing timing." They added, "In accounting, construction revenue is recognized according to the progress rate, but actual billing is conducted relatively later." Due to the nature of the construction industry where revenue is recognized based on construction progress, if the actual progress and billing timing differ, the unbilled construction amount can increase. This occurs when the construction progress estimated by the construction company does not match the progress recognized by the client.

PF Contingent Liabilities Increased 2.3 Times... Remaining Challenge of Financial Soundness Deterioration

Construction receivables (accounts receivable) that were billed to clients but not yet collected also increased significantly. As of last year, Daebang Construction's construction receivables amounted to 525.4 billion KRW, increasing by about 185.6 billion KRW from 339.7 billion KRW in 2023. The proportion of construction receivables in total sales also surged from 39.65% in 2023 to 52.22% last year.

Daebang Construction explained that the unbilled construction amount and construction receivables may temporarily increase as the company grows. Due to the nature of the construction industry, an increase in the number of construction sites under way can lead to a rise in unbilled construction amount. A Daebang Construction official said, "Since billing and collection are scheduled according to future progress rates, it is expected that there will be no significant impact on financial soundness."

Financial soundness deterioration due to PF (Project Financing) contingent liabilities remains a challenge. Last year, Daebang Construction's PF contingent liabilities amounted to 1.5155 trillion KRW, about 2.4 times higher than 655 billion KRW the previous year. Among these, subsidiaries such as DB E&C and DB Development provided joint guarantees worth 95.6 billion KRW for apartment projects in Suwon City, Gyeonggi Province, and Muan County, Jeonnam Province. Bridge loans have high interest rates and if the projects do not convert to the main PF and stall, they can negatively affect financial soundness.

However, Daebang Construction maintains that there is no difficulty in securing liquidity due to increased pre-sale revenue. Daebang Construction's pre-sale revenue rose from 4.7 billion KRW in 2023 to 75 billion KRW last year. The revenue grew as apartments supplied in key metropolitan areas attracted strong subscription demand. A Daebang Construction official explained, "Once the PF loan is repaid with the pre-sale proceeds, construction receivables will naturally be recovered."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.