MSCI Korea Index Regular Review on May 14

Samyang Foods and Hanwha Systems Expected to Join

Watch for Investment Opportunities in Proactive Supply and Demand for Candidate Stocks

As the MSCI (Morgan Stanley Capital International) index reshuffling season approaches, the stock prices of the candidates mentioned are fluctuating. The securities industry predicts the addition of 2 to 3 new stocks, and there is an analysis that investment opportunities may arise centered on stocks experiencing proactive supply and demand.

According to the financial investment industry on the 17th, MSCI's regular May review is scheduled for the 14th of next month. Among the 10 trading days between April 16 and 30 (excluding the US market holiday on the 18th), one arbitrarily designated day will serve as the review reference date, and the review period will begin on the 17th of next month. The rebalancing is expected to take place on May 30.

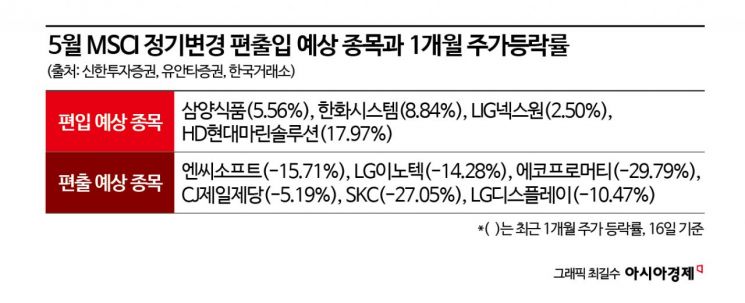

The securities industry expects that 2 to 3 stocks will be newly included in the MSCI index during this regular change. Notably, Samyang Foods, which is on the verge of becoming a 'Hwangjejeu' (emperor stock), has been mentioned. Samyang Foods, which surpassed 1 trillion KRW in overseas sales for the first time last year and is writing the 'Buldak (Hot Chicken) legend,' hit a 52-week high on this day amid expectations of MSCI inclusion. Hanwha Systems, which recently attracted attention by acquiring shares in the Australian shipbuilding and defense company 'Ostal,' is also a strong candidate for inclusion. Other stocks mentioned as possible inclusions include LIG Nex1, Doosan, HD Hyundai Marine Solutions, Rainbow Robotics, and HD Hyundai Mipo.

On the other hand, NCSoft and EcoPro Mety are at risk of being excluded from the MSCI index. The cutoff market capitalization (inclusion criteria) for the MSCI Korea index is estimated at 4.18 trillion KRW, and both companies fall significantly below this threshold. Laborngil, a researcher at Shinhan Investment Corp., explained, "With the current market cap cutoff adjusted to half of the Emerging Markets Global Minimum Market Cap Requirement (GMSR), NCSoft, which has the lowest market cap, is expected to be excluded," adding, "EcoPro Mety is expected to be excluded as it falls below the free-float market cap criteria." Generally, a stock must have at least 67% of the cutoff market cap and 33% of the cutoff free-float market cap to avoid exclusion. Additionally, LG Innotek, CJ CheilJedang, SKC, and LG Display have also triggered exclusion warnings.

As the MSCI regular change event approaches, movements to seek new trading opportunities are spreading. Researcher Noh said, "Regardless of short selling, stocks being included (excluded) have seen foreign demand inflows (outflows) from 60 trading days before the rebalancing day until the rebalancing day, showing an upward (downward) trend in stock prices," adding, "Based on this pattern, a long-short strategy between included and excluded stocks can be considered." Although stock prices of related stocks are diverging due to MSCI index inclusions and exclusions, the resumption of short selling has increased investment options.

The MSCI index is one of the most influential stock indices globally, adjusting its constituent stocks based on market capitalization and free-float market capitalization every February, May, August, and November. Inclusion in the index can attract passive (index-tracking) funds, but exclusion can be disadvantageous from a supply and demand perspective.

The presence of the Korean stock market in the MSCI index is gradually shrinking. The number of domestic stocks in the MSCI index, which reached 104 in August 2023, decreased to 92 in November last year, and further shrank to 81 after 11 stocks were massively excluded in February this year. Kyungbeom Ko, a researcher at Yuanta Securities, pointed out, "The upcoming May change has increased uncertainty in inclusions and exclusions due to heightened volatility in domestic and international markets following the Trump mutual tariffs announcement," adding, "As with the regular change in February, it is not impossible that only exclusions will occur without any inclusions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)