Sales Reached 833.3 Billion KRW Last Year... Operating Profit Surpasses 100 Billion KRW for Two Consecutive Years

Strong E-cigarette Sales Drive Continued Performance Improvement

Dividends Resumed After Nine Years Since 2015

Korea Philip Morris recorded operating profits exceeding 100 billion KRW for two consecutive years as sales of its dedicated device 'IQOS' and tobacco sticks 'TEREA' increased, driven by the growth of the domestic heated tobacco product market. With retained earnings exceeding 200 billion KRW, the company also resumed dividends from the headquarters, which had been suspended since 2015 due to tobacco consumption tax surcharges and other reasons.

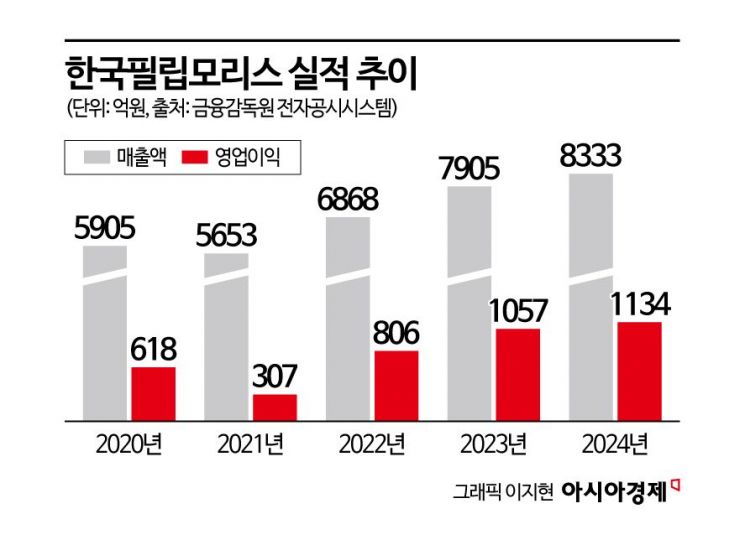

According to the Financial Supervisory Service's electronic disclosure system on the 16th, Korea Philip Morris's sales last year amounted to 833.3 billion KRW, a 5.4% increase from 790.5 billion KRW the previous year. The trend of profitability improvement continued. Operating profit during the same period was 113.4 billion KRW, up 7.3% from 105.7 billion KRW a year earlier, surpassing 100 billion KRW for two consecutive years.

The improvement in Korea Philip Morris's performance is analyzed as a result of regaining influence in the growing domestic heated tobacco product market. The company's sales recovering to the 800 billion KRW range is the first time in six years since 2018. Korea Philip Morris, which opened the heated tobacco product market by launching IQOS in 2017, recorded sales of 870.5 billion KRW and operating profit of 69.4 billion KRW the following year, securing market leadership. However, as the latecomer KT&G launched an offensive with 'lil,' Korea Philip Morris gradually lost market share, and with the decline in market share, sales fell to around 500 billion KRW, eventually losing the top position.

The counterattack began with the launch of the new product 'IQOS Iluma' at the end of 2022, the first in three years. Korea Philip Morris focused on expanding device distribution in 2023 with products such as 'IQOS Iluma One,' and last year increased the portfolio of its dedicated sticks 'TEREA' to 18 types. According to Philip Morris International (PMI), Korea Philip Morris's shipment volume of heated tobacco sticks last year was 5.7 billion units, an 11.4% increase from 5.1 billion units the previous year. As a result, the domestic market share of heated tobacco sticks (HTU), including TEREA, also rose to 8.1%, up 1.0 percentage point from 7.1% the previous year.

PMI's performance growth centered on smoke-free tobacco products such as IQOS also supports the claim that electronic cigarettes have driven Korea Philip Morris's performance growth. Last year, PMI achieved strong results with sales of 37.88 billion USD, up 7.7% year-on-year, and operating profit of 13.4 billion USD, a 16% increase. Among these, combustible tobacco sales grew by only 4% to 23.2 billion USD, but smoke-free tobacco sales increased by 14% to 14.6 billion USD. The sales proportion of electronic cigarettes also expanded from 32.1% in 2022 to 38.7% last year.

Korea Philip Morris plans to continue the recent positive trend this year through aggressive portfolio expansion. The company officially started selling the new heated tobacco device series 'IQOS Iluma Eye' in February, and this month expanded the sales channels nationwide for 'SENTIA,' a stick emphasizing a more authentic tobacco taste than the existing TEREA. Although the tobacco industry does not disclose market shares, it is reported that KT&G and Korea Philip Morris are competing closely around the 45% level, within about 1 percentage point.

Expanding export volumes in line with global demand growth is expected to be another key to performance growth this year. Currently, all domestic sales of Korea Philip Morris are produced at the Yangsan factory in Gyeongnam Province, with two-thirds sold domestically and the remaining one-third exported to 12 countries overseas. According to the company, the largest export market is Japan, where the shipment volume of heated tobacco sticks by Japan Philip Morris last year was 48.3 billion units, a 12.2% increase from 43.0 billion units the previous year. Based on this, the market share also rose by 3.1 percentage points to 29.8%.

With clear performance improvement, including operating profits exceeding 100 billion KRW for two consecutive years, Korea Philip Morris resumed dividends after a nine-year hiatus since 2015. According to Korea Philip Morris's audit report, the company paid out 44.4 billion KRW in dividends last year. The payment target was 'Philip Morris Brands Sarl,' a subsidiary of the U.S. corporation 'Philip Morris International Inc.,' which is a foreign-invested company holding 100% of Korea Philip Morris's shares.

As sales of IQOS Iluma and TEREA performed well, net profit increased, and Korea Philip Morris's undistributed retained earnings steadily accumulated. Undistributed retained earnings are surplus funds generated by a company that have not yet been allocated for specific uses and are retained internally for new investments or dividends. Korea Philip Morris's undistributed retained earnings, which were 6.6 billion KRW in 2020, increased annually to exceed 100 billion KRW in 2023 (160.7 billion KRW), and with last year's net profit of 80.9 billion KRW added, it rose to 241.6 billion KRW.

Previously, Philip Morris Korea earned inventory gains of around 200 billion KRW by holding tobacco stocks shipped before the government's tobacco tax hike in 2015 and selling them after the price increase. As a result, the government conducted a tax audit on Korea Philip Morris, and the company paid a surcharge of 271.9 billion KRW. Due to the impact of the surcharge payment, the company recorded a net loss of 159.7 billion KRW in 2016 and did not pay dividends for eight years until last year.

Meanwhile, the Yangsan factory, established in 2002, has continued facility expansion with cumulative investments exceeding approximately 48 million USD (about 685 billion KRW) to date. The factory's operating rate is reported to have reached its maximum capacity, and the company stated that it is difficult to comment on future additional investment plans.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)