DL E&C and GS Engineering & Construction Expected to See Over 20% Increase in Operating Profit Year-on-Year

Samsung C&T, Hyundai Engineering & Construction, and Daewoo Engineering & Construction to Show Negative Growth, but Likely to See 'Low Start, High Finish'

Securities Industry: "Low-Margin Sites Being Sequentially Completed... Gradual Recovery Trend Beginning"

Despite the economic downturn and the negative impact of unsold housing, some major construction companies are expected to recover profitability. It is analyzed that the completion of high-cost projects will lead to an improvement in performance. There are even forecasts that some construction companies may have hit their performance 'bottom.'

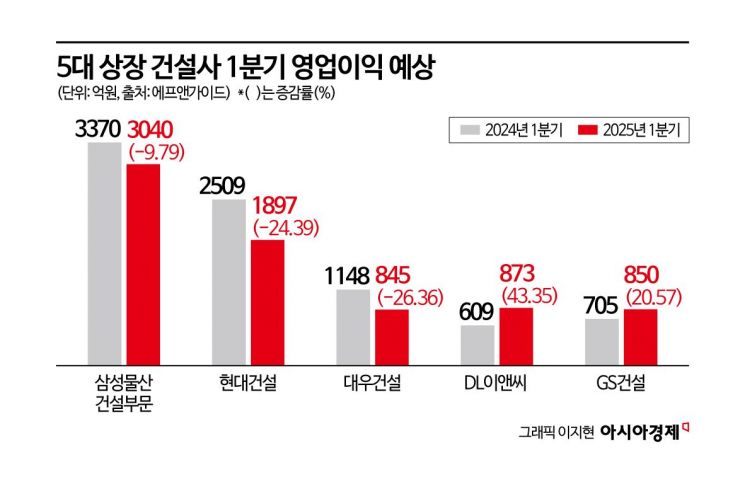

According to the earnings consensus (average forecast) from financial information provider FnGuide on the 15th, the combined expected operating profit for the first quarter of this year for the five major listed domestic construction companies (Samsung C&T Construction Division, Hyundai Engineering & Construction, Daewoo Engineering & Construction, DL E&C, and GS Engineering & Construction) was estimated at 750.5 billion KRW, a 9.99% decrease compared to 834.1 billion KRW in the same period last year. DL E&C and GS Engineering & Construction are expected to show a clear recovery trend. On the other hand, Samsung C&T, Hyundai Engineering & Construction, and Daewoo Engineering & Construction are expected to experience negative growth. Their first-quarter results are scheduled to be disclosed at the end of this month.

DL and GS, Signs of Rebound

The company expected to show the most prominent recovery is DL E&C. It is forecasted to record an operating profit of 87.3 billion KRW, a 43.35% increase compared to the previous year. Yoorim Song, a researcher at Hanwha Investment & Securities, explained, "Growth in the plant division partially offsets the decline in sales in the housing division and subsidiary DL Construction, and due to the base effect from the reflection of bad debt expenses in the first quarter of last year, operating profit will show a clear increase. With improvements in cost ratios, margins are expected to improve progressively toward the second half of this year."

GS Engineering & Construction is also expected to see a 20.57% increase in operating profit to 85 billion KRW compared to last year. Eunsang Lee, a researcher at NH Investment & Securities, said, "The proportion of housing sites started before 2022 is gradually decreasing, leading to improvements in cost ratios." In particular, the stable sales and margins of its subsidiary, water treatment company GS Inima, are expected to contribute to performance growth. However, GS Engineering & Construction has been pursuing the sale of GS Inima since last year to secure financial soundness.

Samsung, Hyundai, and Daewoo Expected to Show 'Low Start, High Finish'

Samsung C&T Construction Division is expected to report an operating profit of 304 billion KRW in the first quarter of this year, a 9.79% decrease compared to the previous year. The decline is attributed to a reduction in sites due to the completion of major high-tech projects and overseas plants. However, there is a forecast that performance recovery will be possible from the second half of this year when construction of Samsung Electronics' Pyeongtaek Campus 5th Plant (P5), for which Samsung C&T is the contractor, is likely to resume.

Hyundai Engineering & Construction is expected to report an operating profit of 189.7 billion KRW, a 24.39% decrease compared to the previous year. Kiryong Kim, a researcher at Mirae Asset Securities, analyzed, "Among the 23 sites with high cost ratios sold in 2021-2022, 10 complexes were completed in the first quarter, so the margin increase effect will be limited in the first quarter." He added that since many high-cost sites were resolved in the first quarter, performance is expected to gain momentum from the second quarter. However, due to costs related to the Anseong highway accident involving its subsidiary Hyundai Engineering, the annual profit is expected to slightly fall short of the guidance of 1.18 trillion KRW.

Daewoo Engineering & Construction is expected to see the largest decline in performance among major construction companies. Its operating profit for the first quarter is expected to be 84.5 billion KRW, a 26.36% decrease compared to the previous year. Seho Bae, a researcher at iM Securities, analyzed, "The margin improvement from the resolution of high-cost sites is not yet clear." The relatively high proportion of local housing projects compared to other construction companies is also a factor lowering profitability. Junghyun Cho, a researcher at IBK Investment & Securities, pointed out, "Winning orders for projects such as the Iraq Al-Faw naval base, Libya reconstruction projects, and the Czech nuclear power plant will be important tasks for profitability recovery."

The securities industry evaluates, "Although first-quarter results this year are expected to be mixed, some companies are already signaling to the market that they have passed the bottom." Kiryong Kim of Mirae Asset Securities forecasted, "Low-margin housing sold in 2021-2022 is being sequentially completed, leading to improvements in cost ratios in the housing and construction sectors. A gradual improvement trend will continue." However, since uncertainties about U.S. interest rates and the domestic housing market downturn have not been fully resolved, some believe that a full recovery across the industry will require more time.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.