Weaponization of Essential Materials for Advanced Industries Such as Defense, Energy, and Robotics

Special Permission from Chinese Government Required for Export

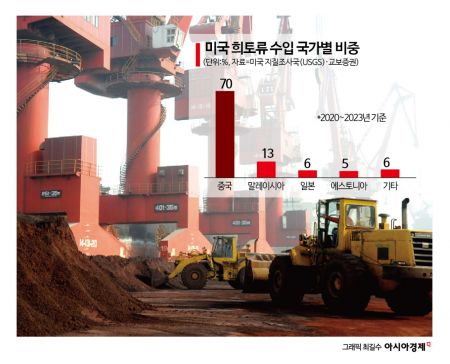

U.S. Depends on China for 70% of Supply... Concerns for South Korea as Well

China has blocked exports of rare earth resources in retaliation against U.S. President Donald Trump's tariff attacks. The intention is to weaponize rare earths used in advanced industries such as defense, energy, and robotics to exert comprehensive pressure on the United States. The U.S., which depends on China for 70% of its rare earth supply, plans to keep all response options open and under review. Although the measure is effectively aimed at the U.S., China has formally imposed export controls on all countries worldwide, causing anxiety in South Korea's battery industry as well.

White House: "All options under review"

Kevin Hassett, Chairman of the U.S. White House National Economic Council (NEC), said on the 14th (local time) at the White House in response to questions about China's rare earth export controls, "It is concerning." He added, "The rare earth restrictions are being very carefully reviewed. We are currently reviewing all options."

The New York Times (NYT) reported the day before that the items China began controlling exports of from the 4th include seven types: heavy rare earths such as gadolinium, terbium, dysprosium, lutetium, scandium, yttrium, and rare earth magnets. China produces 99% of the world's heavy rare earth supply and 90% of rare earth magnets. Heavy rare earth metals are used in electric motors, which are key components of cars, drones, robots, missiles, and spacecraft. They are also used in jet engines, lasers, headlights, and are essential in AI servers and smartphone power supplies. Going forward, exporting these items outside China will require special permission from the Chinese government.

Japanese companies, which experienced China's rare earth export halt in 2010, hold more than a year's worth of rare earth inventory, but U.S. companies have almost no stockpiles, so the impact is expected to be greater. James Litinsky, Chairman and CEO of U.S. rare earth company MP Materials, expressed particular concern about rare earth supply to defense contractors, stating, "Drones and robotics are considered the 'future' of warfare, and now we are seeing the future supply chain for critical materials being shut down." Daniel Pickard, Chairman of the U.S. Trade Representative (USTR) and Department of Commerce's 'Critical Minerals Advisory Committee,' also urged the U.S. government to resolve the rare earth issue swiftly.

U.S. continues negotiations to reduce dependence on China

The U.S. has been conducting behind-the-scenes talks with Ukraine, Russia, and others to reduce its dependence on China for rare earths. Earlier, President Trump attempted to sign a mineral agreement during the U.S.-Ukraine summit in February, but it was ultimately canceled after a verbal dispute between the two leaders. Although high-level talks resumed, the two countries have yet to narrow differences over a peace agreement draft that demands more concessions from Ukraine. President Trump is also continuing discussions with Russian President Vladimir Putin on rare earth mineral development, but it is expected to take time before concrete results emerge.

China's export restrictions do not only impact the U.S. Although the measures are effectively aimed at the U.S., China has formally imposed rare earth export restrictions on all countries worldwide. The British daily Financial Times (FT) noted, "China is designing a new export control system applicable to all countries," adding that "this is intended to avoid appearing as unilateral retaliation." The New York Post also analyzed that China aims to isolate the U.S. by pressuring multilateral supply chains involving U.S. allies.

South Korea also heavily depends on China for rare earths and key minerals, making it difficult for the domestic battery industry to avoid impact. According to the Korea International Trade Association, 82.5% of rare earth resources such as battery material additives are supplied from China. The Ministry of Trade, Industry and Energy has identified that public stockpiles and private inventories of rare earths amount to a maximum of six months' supply. The government plans to strengthen cooperation with rare earth-holding countries such as Australia and continue supporting technology development for reduction, substitution, and recycling.

However, Australia, which has emerged as an alternative to China, is also likely to begin strategic stockpiling of rare earths domestically. The FT reported that the Australian government is considering strategic stockpiling of key resources such as dysprosium and terbium in response to China's rare earth export restrictions. Initially, Australia announced plans to stockpile strategic critical minerals in response to the Trump administration's 10% tariffs on Australian goods, but China's rare earth restrictions are expected to accelerate this policy. This is a measure to secure the stability of the rare earth supply chain, and the Australian government is reportedly considering purchasing resources from domestic producers for stockpiling.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)