Available on KB Star Banking App and Website Starting from the 15th

The Small Enterprise and Market Service (SEMAS) announced that it will implement the 'Non-face-to-face Proxy Loan Service' in cooperation with KB Kookmin Bank starting from 9 a.m. on the 15th. This service is a measure following the 'Business Agreement for the Advancement of Small Business Support Services' signed between SEMAS and Kookmin Bank in January.By connecting the financial systems of both institutions, a non-face-to-face service environment has been established to enable small business owners to apply for policy funds more easily.

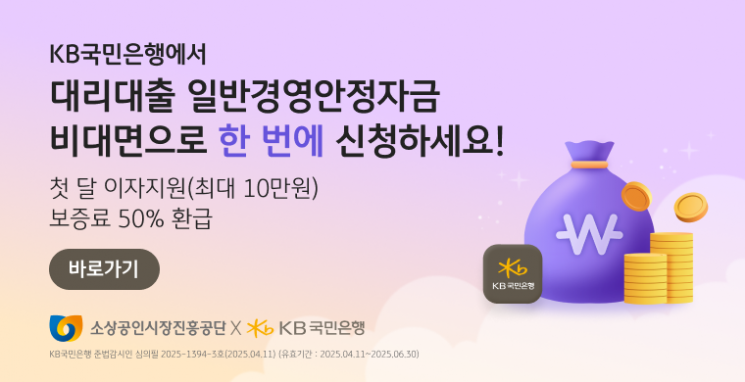

This service applies only to the General Management Stabilization Fund, which is processed through proxy loans among SEMAS policy funds, and plans to continuously improve functions and expand the target funds by collecting user feedback in the future. With the implementation of this service, not only will the proxy loan usage procedures for small business owners be simplified, but Kookmin Bank's win-win financial support plans for small business owners will also be provided.

Until now, small business owners had to apply for a confirmation of eligibility from SEMAS and then visit the Regional Credit Guarantee Foundation, banks, or apply through each website to use SEMAS proxy loans, which was inconvenient. However, with the introduction of the non-face-to-face proxy loan service, the application procedure has been improved to allow proxy loan applications to be made at once through the KB Star Banking app or the KB Kookmin Bank website.

Additionally, as part of its win-win finance initiative, Kookmin Bank is also conducting a first-month interest support and guarantee fee refund event for small business owners who have taken out policy fund proxy loans through the 'Non-face-to-face Proxy Loan Service.'

Park Seong-hyo, Director of SEMAS, said, "We expect to enhance the convenience and financial accessibility of small business owners by simplifying the policy fund application process through the non-face-to-face proxy loan service," adding, "We will expand public-private cooperation to improve financial services that small business owners can feel and take the lead in preparing more diverse measures and policy support in the future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)