iM Securities analyzed on the 15th that the possibility of Bitcoin replacing the dollar has increased following U.S. President Donald Trump's global tariff policies.

iM Securities made this forecast in a report titled 'The Impact of Weakening Dollar Trust on Cryptocurrencies' released that day.

iM Securities stated, "If foreign governments and central banks weaken their trust in the dollar, they may stop purchasing and increase selling of U.S. Treasury bonds," adding, "As trust in the dollar weakens, demand for safe assets that can replace the dollar increases."

They continued, "Larry Fink, CEO of BlackRock, raised concerns about the sustainability of U.S. fiscal policy and suggested the possibility of weakening dollar dominance," explaining, "Along with this, there is a possibility that virtual assets such as Bitcoin will emerge as a means to replace the dollar."

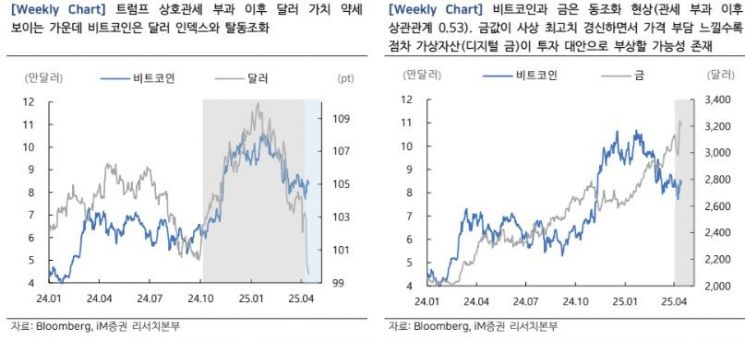

Furthermore, they noted, "Since Trump's election, Bitcoin showed movements synchronized with the dollar, but after the imposition of mutual tariffs, a de-synchronization phenomenon was observed," adding, "On the other hand, after the imposition of mutual tariffs, gold showed synchronized movements, and recently, the market seems to perceive virtual assets as a 'tariff safe haven' that can avoid the direct damage of tariffs, which also plays a role."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.