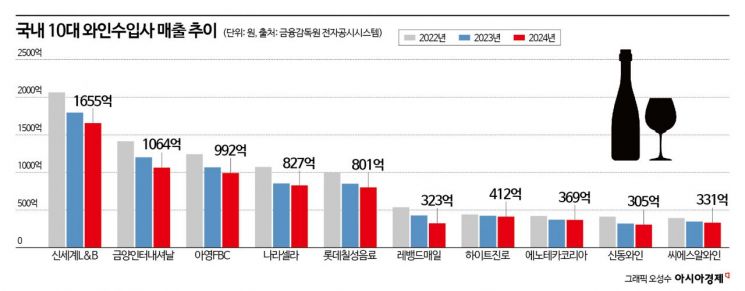

All Top 10 Domestic Wine Importers Saw Sales Decline Last Year

Shrinking Demand Due to Economic Recession

Competing This Year with Trend-Driven Wine Portfolios

Last year, domestic wine importers all saw their sizes shrink without exception. As wine demand declined due to factors such as a slowdown in consumption caused by the economic recession, they could not avoid a decrease in sales. With the domestic economy still sluggish and challenges such as the global tariff war expected to make this year difficult as well, companies are strategizing to improve profitability through active fixed cost management and market-tailored portfolio strategies.

Consumer Sentiment Weakens... Wine Importers’ Performance Declines Across the Board

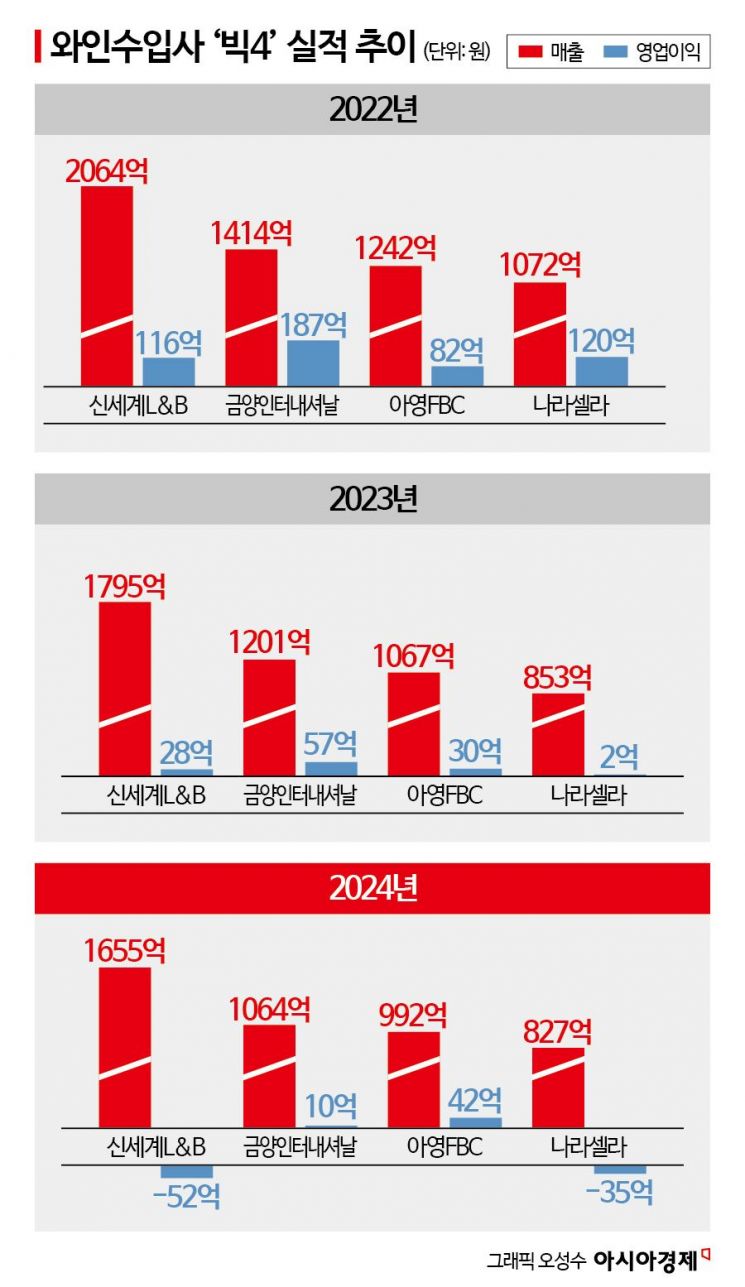

According to the Financial Supervisory Service’s electronic disclosure system on the 15th, last year, the sales of Shinsegae L&B, the industry leader, amounted to 165.5 billion KRW, down 7.8% from 179.5 billion KRW the previous year. Shinsegae L&B’s sales, which were around 107.2 billion KRW in 2019, nearly doubled to 206.3 billion KRW in 2022 after going through the COVID-19 pandemic. However, from the following year, market growth slowed, and sales declined for two consecutive years.

As growth stalled, profitability also declined. Operating profit, which had increased to 21.2 billion KRW in 2021, decreased every year thereafter, turning into an operating loss of 5.2 billion KRW last year. Most fixed costs, including selling and administrative expenses, remained at similar levels to previous years, but the reduced sales ultimately became a burden. In fact, inventory assets, which were 47.5 billion KRW in 2021, increased to 66.4 billion KRW last year, and the inventory-to-sales ratio nearly doubled from 22.4% to 40.0%. However, wine is a unique asset that recognizes the value of aging, so inventory is not a problematic bad asset. If stable customer demand is maintained in the future, its value as a premium asset could even increase.

Narasella, the first publicly listed domestic wine importer, also had a tough year. Last year, Narasella’s sales were 82.7 billion KRW, down 3.0% from 85.3 billion KRW the previous year. Despite two consecutive years of sales decline, costs such as selling and administrative expenses increased, resulting in an operating loss of 3.5 billion KRW and a return to the red. During this process, debt also increased. Short-term borrowings rose 61.6% in one year, from 10.9 billion KRW in 2023 to 17.7 billion KRW last year, causing the debt ratio to increase by 15.4 percentage points from 87.4% in 2023 to 102.8% last year.

Geumyang International, the industry’s second-largest company known for the so-called golf wine '1865,' also could not avoid the cold wind. Geumyang International’s sales last year were 106.4 billion KRW, down 11.4% from 120.1 billion KRW the previous year, and operating profit dropped 82.5% from 5.7 billion KRW to 1.0 billion KRW. Like its competitors, the decline in sales and increased financial costs due to volatile exchange rates negatively affected profit margins.

Ayung FBC attracted attention by achieving a slight improvement in profitability. Ayung FBC’s sales last year decreased 7.0% to 99.2 billion KRW from 106.7 billion KRW the previous year, shrinking in scale like its competitors, but operating profit increased from 3.0 billion KRW to 4.2 billion KRW. The company attributes this to effective fixed cost structure management and margin-focused product line operations. An Ayung FBC representative explained, "We focused on selective and concentrated distribution channels directly linked to sales," adding, "We concentrated marketing resources on general outlets and casual dining establishments to promote efficient operations." In fact, Ayung FBC strategically adjusted promotional expenses such as advertising, tasting fees, and commissions last year, reducing selling and administrative expenses by about 7%.

Another Challenging Year Ahead... "Responding with Cost-Effective and Premium Portfolios"

Last year, the domestic wine market saw a noticeable overall decline in sales due to the economic recession and weakened consumer sentiment. In a negative economic environment marked by recession and high inflation, it was still difficult for wine, classified as a luxury item, to increase sales volume, and importers could not avoid negative growth. From the importers’ perspective, despite the burden of rising import costs due to unstable exchange rates, it was a difficult year to raise prices amid sluggish market conditions, intensified competition, and consumer price resistance. In particular, consumption by the younger generation in their 20s and 30s, who had driven consumption after the COVID-19 pandemic, significantly decreased, leading to market contraction. The industry feels that the drop last year is felt more sharply due to the high growth experienced until 2022.

The domestic wine industry is expected to continue facing a tough year this year as well. With consumer sentiment recovery still uncertain and the impact of the U.S.-originated tariff war, the high exchange rates of the euro and dollar are expected to increase wine purchasing costs. To address this, most companies plan to more actively control and manage selling and administrative expenses, fixed costs, and inventory to defend profit margins. An industry insider said, "This year, improving profit margins through cost efficiency is the top management priority," adding, "Price increases for flagship products are also expected to be inevitable."

On the 22nd, visitors participating in the '2023 Seoul International Liquor & Wine Expo' held at COEX in Gangnam-gu, Seoul, are tasting wine. Photo by Jinhyung Kang aymsdream@

On the 22nd, visitors participating in the '2023 Seoul International Liquor & Wine Expo' held at COEX in Gangnam-gu, Seoul, are tasting wine. Photo by Jinhyung Kang aymsdream@

The industry expects the polarization of the wine market between cost-effective low-priced wines and high-priced premium wines to intensify this year, focusing on securing tailored portfolios. A Geumyang International representative said, "Reflecting the economic recession, we are working hard to develop ultra-low-priced wines while strengthening our high-quality wine lineup in line with the polarization trend in the premium wine market," adding, "Despite the difficult economic situation, we will target both consumers seeking reasonably priced wines and premium wine consumers pursuing differentiated value to secure market competitiveness and promote sales growth."

Additionally, companies plan to actively manage risks through other alcoholic beverages besides wine. A Narasella representative stated, "We plan to continuously expand the market share of sales outside of wine by complementing business capabilities in other alcoholic beverages such as whiskey and sake." An Ayung FBC representative also said, "We plan to increase sales opportunities by expanding the sales of spirit product lines such as Maison Perrin," and added, "We will establish detailed strategies, including diversifying sales channels beyond existing clients, such as Kakao Gift."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.