0.71 New Shares per Existing Share... Plan to Raise 53.9 Billion Won

Funds to Be Used for Acquisition of Wia's Machine Tool Division

Balance Underwriting Agreement Signed with Korea Investment & Securities

Machine tool manufacturer Smac has launched a large-scale paid-in capital increase to acquire Hyundai Wia's machine tool division. The process involves a rights offering followed by a general public subscription for any unsubscribed shares, which will be underwritten by the lead manager, Korea Investment & Securities. If the subscription by existing shareholders and the general public fails to attract sufficient interest, Smac will face increased fee burdens, and Korea Investment & Securities may end up holding a larger-than-expected stake in Smac.

According to the Financial Supervisory Service's electronic disclosure system on the 15th, Smac plans a paid-in capital increase allocating 0.71 new shares per existing share. The planned issue price is 1,924 KRW per share, with a total of 28 million shares to be issued. The 53.9 billion KRW raised will be fully used to acquire shares in Wia's machine tool division.

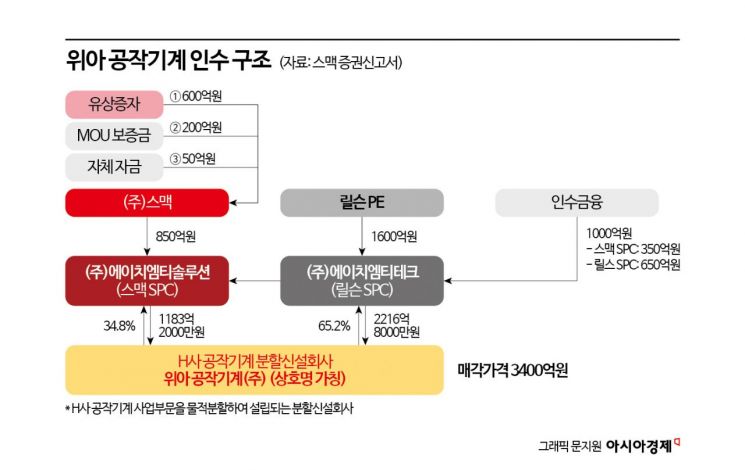

Previously, regarding the acquisition of Wia's machine tool division, Smac signed a memorandum of understanding (MOU) with the seller in October last year and finalized the main contract on the 18th of last month. Of the total purchase price of 340 billion KRW, Smac will bear 118.3 billion KRW to acquire a 34.8% stake. Financial investor Rilson Private Equity (PE) will contribute the remaining 221.7 billion KRW.

Smac's market capitalization was 120.3 billion KRW based on the previous day's closing price, which is close to the 118.3 billion KRW needed for the acquisition of Wia's machine tool division. Smac explained that the reason for pursuing this large-scale merger and acquisition (M&A) is the expected significant synergy effects with Wia's machine tool division. They anticipate increasing market share by combining Wia's strengths. While Smac's machine tools focus on cutting power and are specialized for industries such as railroads and medical devices, Wia's machine tool products are mainly used in the automotive industry and high-end markets that require high speed and productivity. They also expect to strengthen their sales network by sharing overseas networks. Smac emphasized that by utilizing production bases in China and Vietnam, they can establish an efficient supply chain from raw material procurement to finished product transportation.

The success of the capital increase is crucial. Smac's largest shareholder, CEO Choi Young-seop, holds an 8.78% stake and has announced a 100% subscription for the 2.52 million new shares allocated to him. Apart from the largest shareholder, there are no major shareholders holding more than 5%. The success of the paid-in capital increase depends on how much participation there is from minority shareholders. The greater the difference between the planned issue price and the current stock price, the stronger the incentive for minority shareholders to participate. However, in a situation where dilution of shareholder value due to the large issuance of new shares is a concern, a decline in the stock price on the listing day of the new shares is inevitable.

If the unsubscribed shares remaining after the rights offering are not absorbed in the general subscription, Korea Investment & Securities will take up the remaining shares. The underwriting fee for the remaining shares is 15% of the unsubscribed amount. Paying this fee means that Smac's funding plan could be disrupted. If Korea Investment & Securities takes on more than a certain level of remaining shares, it may also face difficulties in liquidating them.

There have been numerous cases in the past where lead managers suffered large losses due to underwriting remaining shares. A financial investment industry official stated, "It is important for Smac to properly communicate the benefits of acquiring Wia's machine tool division," adding, "Given the increasing external uncertainties, shareholders will continue to weigh their decision on whether to participate in the capital increase."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)