49.5% of Yeongkkeul Borrowers Reside in the Seoul Metropolitan Area, 67.5% Are in Their 30s and 40s

Yeongkkeul May Further Drive Up Housing Prices During Real Estate Booms

Severe Yeongkkeul Leads to Weaker Consumption; Borrowing Within Repayment Capacity Is Advisable

It has been found that people in their 30s and 40s living in the Seoul metropolitan area play a role in further driving up housing prices through so-called Yeongkkeul (borrowing to the limit, even to the soul) loans during the real estate price rise phase. As Yeongkkeul intensifies, the reduction in consumption capacity can act as a factor weakening economic recovery, leading to calls for the government to manage excessive Yeongkkeul phenomena.

View of apartments in Seobu Ichon-dong from the 63 Building observatory. Photo by Hyunmin Kim kimhyun81@

View of apartments in Seobu Ichon-dong from the 63 Building observatory. Photo by Hyunmin Kim kimhyun81@

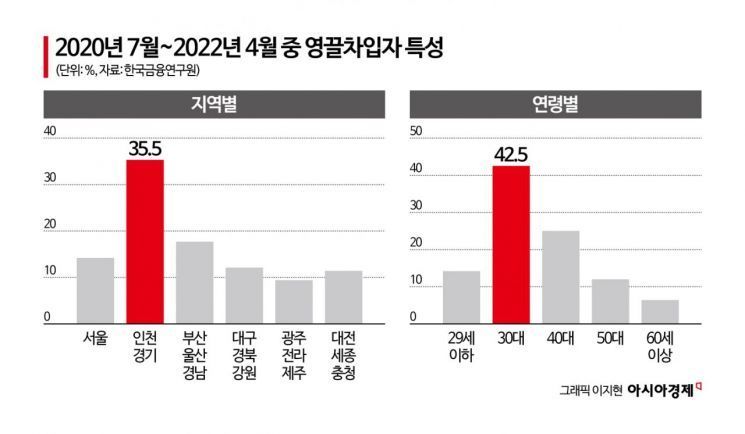

According to the report "Characteristics and Implications of the Yeongkkeul Phenomenon" by the Korea Institute of Finance on the 15th, 35.3% of Yeongkkeul borrowers in the domestic real estate market resided in the Incheon and Gyeonggi regions. Including the 14.2% residing in Seoul, residents of the Seoul metropolitan area accounted for 49.5%.

To identify the individual characteristics of Yeongkkeul borrowers, the report investigated real estate transactions that occurred between July 2020 and April 2022, a period during which apartment sale prices continuously rose by double digits. The investigation was based on sample data from Korea Credit Bureau (KCB) covering approximately 2.2 million borrowers. The criterion for Yeongkkeul borrowers was individuals who, for housing-related financial purposes, borrowed additional loans such as unsecured loans beyond mortgage loans from private financial companies (excluding policy housing loans).

By age group, those in their 30s accounted for 42.5% of Yeongkkeul borrowers, and those in their 40s accounted for 25%, totaling 67.5% for those in their 30s and 40s combined. Those aged 29 or younger made up 14.2%, those in their 50s 12%, and those aged 60 and above 6.4%. The proportion of Yeongkkeul borrowers among all mortgage loan borrowers mainly increased three months after apartment sale prices began to rise. Additionally, when the Bank of Korea's base interest rate fell, the number of Yeongkkeul borrowers increased five months later. This suggests that the proportion of Yeongkkeul borrowers mainly rises in the early phase of economic expansion, playing a role in fueling housing price increases.

Illustration of Yeongkkeuljok

Illustration of Yeongkkeuljok

However, Yeongkkeul borrowers tended to borrow both mortgage and other loans within the same financial sector rather than switching sectors, indicating that cases of "loan shopping" to find easier lending sectors were not common. Among mortgage loan borrowers in the banking sector, about 28.6% additionally borrowed other loans from the secondary financial sector.

The report pointed out that as the Yeongkkeul phenomenon intensifies, the rapid increase in repayment burdens leads to a reduction in consumption capacity, which is likely to weaken the strength of recovery during economic expansion. It also analyzed that the Yeongkkeul phenomenon is particularly evident in the early phase of economic expansion, and Yeongkkeul borrowers are likely consumers under financial constraints who find it difficult to borrow additionally. Borrowers under financial constraints showed a greater reduction in consumption because they found it difficult to borrow additionally to smooth consumption levels regardless of their income.

To alleviate the Yeongkkeul phenomenon, the report mentioned that the government should more actively utilize the Debt Service Ratio (DSR) system currently in place. Considering that most Yeongkkeul borrowers had a DSR of 50% or less, DSR regulation is crucial for mitigating the Yeongkkeul phenomenon. Lim Hyung-seok, senior research fellow at the Korea Institute of Finance, stated, "For borrowing practices within repayment capacity to be established, it is necessary to consistently pursue household debt management policies through the refinement of the DSR system currently implemented by the government."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.