"Tariffs, National Debt, and Emerging Powers Are Destructive Changes"

"Worst-Case Scenario: Collapse of Monetary, Political, and Geopolitical Orders"

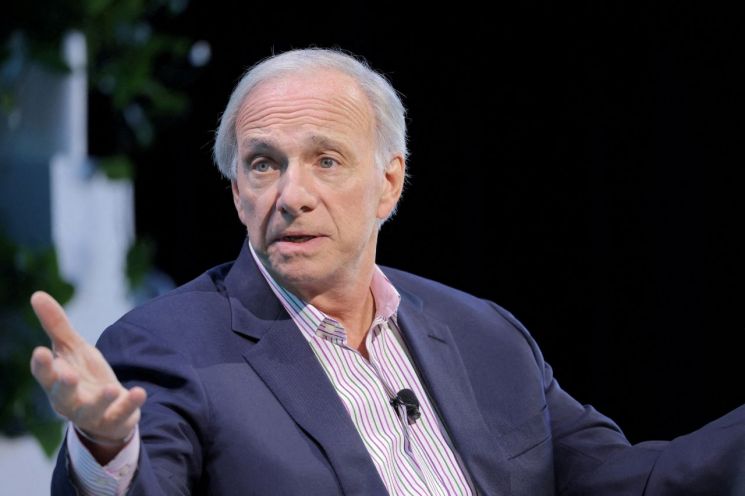

Ray Dalio, founder of the world's largest hedge fund Bridgewater Associates and known as the "godfather of hedge funds," expressed concern that if U.S. President Donald Trump does not properly handle economic policies including tariffs, a situation more severe than a recession could occur.

On the 13th (local time), Dalio appeared on NBC's "Meet The Press" and said, "President Trump's tariff policies and the increase in U.S. debt are creating a new unilateral world order," adding, "If this issue is not properly addressed, a situation more serious than a recession could arise."

Founder of the world's largest hedge fund, Bridgewater Associates, Ray Dalio. Photo by Reuters Yonhap News

Founder of the world's largest hedge fund, Bridgewater Associates, Ray Dalio. Photo by Reuters Yonhap News

Dalio pointed to the combination of import tariffs, excessive national debt, and "emerging powers challenging the existing powers," calling it a "very destructive change." He especially noted that the recent increase in U.S. debt is unsustainable and urged reducing the fiscal deficit to around 3% of the Gross Domestic Product (GDP). He warned, "Otherwise, alongside other problems, we will face supply and demand issues related to debt, and the outcome will be more severe than a typical recession."

Dalio has previously warned that due to the unsustainable rise in U.S. debt and the decline of U.S. manufacturing, the country will become dependent on other nations for essential goods production.

When asked to explain his concerns about the worst-case scenario, he replied, "I worry about the collapse of the monetary order, internal conflicts that are not the normal democratic processes we know, international disputes causing major disruptions to the global economy, and even situations that could lead to military conflicts."

According to NBC, Bridgewater predicted the 2008 financial crisis. Before the crisis hit, in 2007, Bridgewater warned that "the risks inherent in the system are quite significant," and later stated, "interest rates are expected to rise until cracks appear in the financial system." A few months later, the recession began.

On the 8th, Dalio pointed out on social media platform X (formerly Twitter) that investors were too narrowly focused on tariffs. At that time, he warned, "The much more important point is that we are witnessing the collapse of the macro monetary, political, and geopolitical order. Such a collapse is a once-in-a-lifetime event, but similar unsustainable conditions have repeated multiple times throughout history."

Concerns about the economy are growing among Americans as well. According to a poll released on the 13th (local time) by CBS News and YouGov, conducted from the 8th to 11th among 2,410 U.S. adults (margin of error ±2.4 percentage points), 75% of respondents expected that the Trump administration's tariff policies would cause short-term price increases. Regarding the long-term impact of tariffs, 48% anticipated price increases, while 30% expected prices to decrease.

Regarding the short-term impact of tariffs on the U.S. economy, 65% said it would worsen, while only 8% believed it would improve. In the long-term impact survey, 42% expected worsening, and 34% expected improvement.

Regarding President Trump's tariff and trade policy goals, 51% said they "liked" them, but 63% said they "did not like" the approach.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)