Lotte Chemical's Daesan Plant Under Regular Maintenance Until June

Inventory Pressure Eases... Cost Efficiency in Maintenance and Management Expected

Self-Rescue Measures Strengthened Through Sale of Non-Core Assets and Stakes

Investment in Future Growth Engines Like Bio Business Expanding

Last year, Lotte Group, which faced difficulties amid liquidity crisis rumors, is accelerating its business restructuring. The group is focusing on raising funds by readjusting underperforming businesses, selling non-core businesses, and disposing of shares held by the company. It is also strengthening investments in sectors identified as future growth engines and putting effort into improving its organizational structure. The atmosphere is that Chairman Shin Dong-bin's New Year's order to "overcome difficulties by efficiently utilizing the group's assets" is being actively implemented on the ground.

According to related industries on the 11th, Lotte Chemical, a chemical affiliate of Lotte, will undergo regular maintenance at its Daesan plant in Chungnam from the 12th until June 18, lasting about two months. Regular maintenance in the petrochemical industry is a legal obligation. During this period, the entire plant's production will be halted. The Daesan plant accounts for 16.81% of Lotte Chemical's total sales. A certain decrease in sales during the maintenance period is inevitable.

However, this is not entirely a negative issue for the company. It expects to clear accumulated inventory due to the sluggish petrochemical market and improve cost efficiency related to maintenance and management. As of last year, Lotte Chemical's inventory assets stood at 2.8184 trillion KRW, slightly up from 2.8017 trillion KRW the previous year. Lotte Chemical stated, "We plan to minimize the impact on sales during regular maintenance by utilizing the stockpiled inventory."

Lotte Chemical, which has served as Lotte Group's cash cow, suffered poor performance due to reduced demand caused by oversupply from China and the global economic downturn after COVID-19. Last year, sales increased by 2.4% to 20.4304 trillion KRW compared to the previous year, but operating profit plunged by 157.3%, resulting in a loss of 894.8 billion KRW. Including losses of 762.6 billion KRW in 2022 and 347.7 billion KRW in 2023, the cumulative deficit over the past three years exceeded 2 trillion KRW.

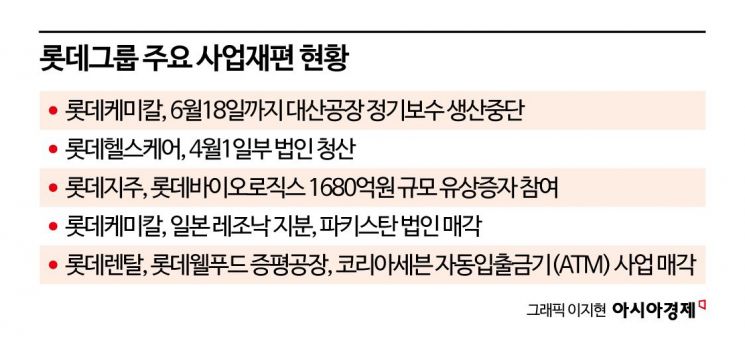

Because of this, at the end of last year, liquidity crisis rumors spread within Lotte Group, prompting asset lightening across non-core assets and efforts to improve financial structure by utilizing shares held by the company. On the 28th of last month, Lotte sold 4.9% of its shares in Japan-based company Resonac for 275 billion KRW. This was the entire stake purchased in 2020, and combined with dividends received so far, it realized a profit of about 80 billion KRW. Earlier last month, Lotte Chemical signed a price return swap (PRS) contract for 25% of its 49% stake in Lotte Chemical Indonesia, raising 650 billion KRW. Together with 660 billion KRW secured in October last year by leveraging a 40% stake in its U.S. subsidiary, the total amount raised reached 1.3 trillion KRW. In February this year, the Pakistan subsidiary was also sold for 97.9 billion KRW.

Lotte Healthcare, a subsidiary of Lotte Holdings, completed its liquidation process and withdrew as a subsidiary as of the 1st. Lotte Healthcare was established in April 2022 with a capital injection of 70 billion KRW from Lotte Holdings but failed to produce significant results and closed its business after about three years. Lotte Holdings had already recognized an impairment loss of 80.43 billion KRW on Lotte Healthcare last year. An impairment loss is an accounting loss recognized when the value of an asset held by a company falls below its book value. Lotte Holdings explained, "After carefully reviewing the healthcare market environment and business direction, we judged that personalized digital healthcare business would be difficult to sustain growth and decided to shift our business direction. We plan to promote the group's healthcare business in areas such as senior towns and food tech in the future."

Additionally, to secure liquidity at the group level, Lotte is pursuing a 'selection and concentration strategy' by selling Lotte Rental, Lotte Wellfood's Jeungpyeong plant, and Korea Seven's ATM business. In the group's major business sector, distribution, Chairman Shin Dong-bin is set to return as an inside director of Lotte Shopping for the first time in five years since 2020 and will lead the business as co-CEO. A Lotte Group official said, "Since distribution is a key business of the group, Chairman Shin intends to strengthen responsible management along with the chemical and food sectors."

Along with the sale of non-core assets, investment in future growth engines is being strengthened. Earlier, on the 26th of last month, Lotte Holdings decided to participate in a paid-in capital increase by Lotte Biologics to finance the construction of the first plant at the Songdo Bio Campus, bearing about 80% of the total amount of approximately 210 billion KRW, which is about 168 billion KRW. Lotte Holdings stated, "We decided to invest to maintain control over Lotte Biologics and enhance business competitiveness." The investment will be paid in two installments on the 7th of this month and the 12th of next month.

Since establishing Lotte Biologics in 2022, Lotte Holdings has participated in four paid-in capital increases, with the previous three investments totaling 637 billion KRW. Lee Dong-woo, Vice Chairman and CEO of Lotte Holdings, said at the regular shareholders' meeting last month, "We will secure profitability by strengthening fundamental competitiveness through business restructuring and focus on nurturing new growth engines to secure the group's future food sources. Starting in June, Lotte Biologics plans to provide antibody-drug conjugate (ADC) contract development and manufacturing organization (CDMO) services at its Syracuse plant in the U.S., elevating its business competitiveness to the next level."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)