Operating profit plummets last year after Blue Bottle's 2019 entry into Korea

Fixed costs and labor expenses weigh down... capital erosion begins

Blue Bottle, a premium coffee brand from California, USA, has expanded aggressively in the domestic market, but its profitability has deteriorated steadily. Last year, as it operated 17 stores, fixed costs and labor expenses increased, shrinking its cash assets to 1.9 million KRW and leading to capital erosion.

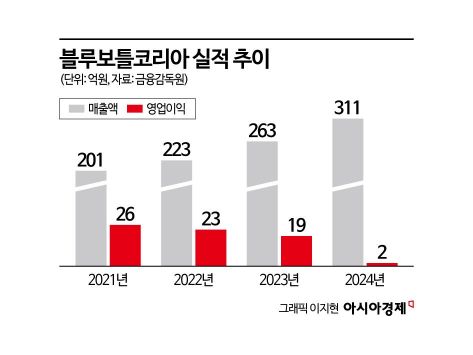

According to the Financial Supervisory Service's electronic disclosure on the 11th, Blue Bottle Coffee Korea, which operates Blue Bottle, recorded sales of 31.193 billion KRW and an operating profit of 248 million KRW last year. Sales increased by 17% compared to the previous year, but operating profit dropped by 87%. The operating profit margin was only 0.8%. Net loss for the period turned to 1.133 billion KRW.

Operating profit steadily declines to 200 million KRW last year

Blue Bottle's sales steadily increased from 20.163 billion KRW in 2021 to 31.193 billion KRW last year. On the other hand, operating profit sharply declined from 2.674 billion KRW in 2021, 2.333 billion KRW in 2022, and 1.945 billion KRW in 2023 to 248 million KRW last year. The decline in profitability was largely due to increased fixed costs. Last year, selling and administrative expenses rose by 4.385 billion KRW to 19.585 billion KRW compared to the previous year. Among these, labor costs amounted to 9.69 billion KRW, including salaries (8.289 billion KRW), retirement benefits (700 million KRW), and welfare expenses (691 million KRW). Labor costs increased by 58% compared to approximately 6.1 billion KRW in 2022.

Blue Bottle maintains a direct operation model. Without franchises, the headquarters directly operates stores and hires barista-centered staff, so labor costs increase as the number of stores grows. Currently, Blue Bottle operates 17 stores nationwide.

There was no significant improvement in gross profit margin either. Last year, Blue Bottle's gross profit was 19.833 billion KRW, a 15% increase from 17.216 billion KRW the previous year. Considering sales increased by 17% during the same period, the growth in gross profit was relatively lower, reflecting increased cost burdens.

As a result, Blue Bottle ultimately raised product prices. From the 1st of this month, prices of major beverages such as Americano and latte were increased by 300 to 900 KRW. Americano rose from 5,600 KRW to 5,900 KRW, and latte from 6,600 KRW to 6,900 KRW. Blue Bottle Coffee Korea explained, "Due to continuous increases in raw materials such as green coffee beans and milk, as well as labor costs, we adjusted prices for some products," adding, "We have absorbed the price increase factors through cost reduction efforts so far."

Cash depletion shakes financial structure

Expenses paid to overseas affiliates are also a burden. Last year, Blue Bottle paid about 4.3 billion KRW to related parties in the US, Japan, and Hong Kong under the names of green bean purchases, royalties, and service fees. Additionally, interest expenses from a long-term loan of 13.2 billion KRW (1.4 billion JPY) procured from Nestl?'s Japan corporation amounted to 1.04 billion KRW.

The financial structure is also unstable. At the end of last year, cash assets stood at only 1.9 million KRW. Operating cash flow for the same year recorded a net outflow of 257 million KRW. Facing liquidity difficulties, Blue Bottle took a short-term loan of about 1 billion KRW from Citibank Korea last year, and the long-term loan of 13.2 billion KRW (1.4 billion JPY) from Nestl? was also added. With a foreign exchange loss of 1 billion KRW reflected and net income turning negative, total equity dropped to 1 billion KRW, less than the capital stock of 1.7 billion KRW, entering capital erosion.

Blue Bottle is owned 75% by Blue Bottle Holdings and 25% by Nestl?. Blue Bottle entered the domestic market in 2019 by opening its first store in Seongsu-dong, Seoul. It focused on the Korean market, which has grown to become the world's fifth largest coffee specialty store market with a size of 8.5661 trillion KRW (based on Euromonitor 2023).

Blue Bottle maintains a premium pricing strategy by emphasizing specialty coffee and a premium brand strategy. However, it is evaluated to have a business model that struggles to generate profits due to a high proportion of raw material costs and a labor-intensive operational structure. An industry insider said, "While the premium image and aggressive expansion strategy have succeeded in growing the scale, structural limitations in profitability have become apparent," adding, "To ensure sustainable management, improvements in fixed cost structure and solid operational strategies are necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)