Class101, MyRealTrip, and Jarvis & Villains

Building Growth Models Through Diversification of Revenue Streams

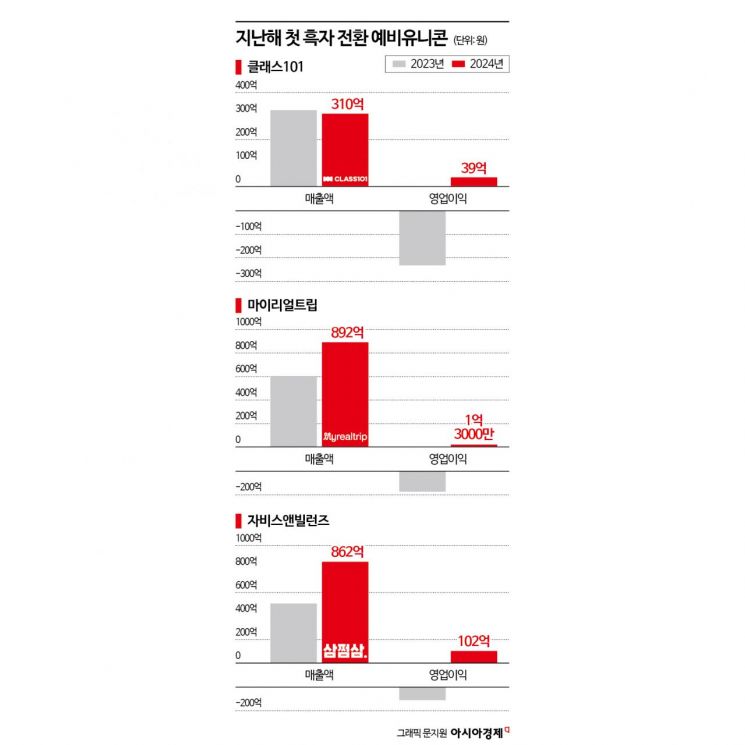

Among the 'pre-unicorns,' several companies recorded operating profit surpluses for the first time last year. These include Class101, MyRealTrip, and Jarvis & Villains. Pre-unicorns are promising startups with a corporate value of over 100 billion KRW, representing the stage before becoming unicorns, which are unlisted companies valued at 1 trillion KRW. Despite the ongoing investment winter, these companies succeeded in turning a profit, leading to expectations for their leap to unicorn status.

According to industry sources on the 11th, Class101, MyRealTrip, and Jarvis & Villains recently announced that they turned profitable for the first time in 2024. Content platform Class101 recorded an operating profit of 3.9 billion KRW and a net profit of 1.8 billion KRW last year, achieving its first annual profit since its founding in 2015. Although revenue decreased by 5% to 31 billion KRW compared to the previous year, operating profit improved by 27 billion KRW and net profit by 27.3 billion KRW year-on-year. Travel app MyRealTrip also turned an annual profit for the first time since its establishment in 2012, with revenue of 89.2 billion KRW and an operating profit of 130 million KRW last year. Jarvis & Villains, which operates the tax refund platform 'SamzzumSam,' also realized its first operating profit of 10.2 billion KRW since its founding in 2015.

These pre-unicorn companies, established just over 10 years ago, share the commonality of having passed through a long tunnel and built a sustainable growth foundation through diversification of revenue models rather than simple cost-cutting. Class101’s creator-centric strategy, accelerated since last year as it transitioned into a creator content platform, proved effective. A representative example is the environment it created allowing creators to freely design their desired business models on individual pages. Class101 aims for a 50% revenue increase this year through the introduction of AI-based personalized course recommendation services, expansion of subscription services for enterprises, and enhancement of creator home features.

MyRealTrip’s first profit was achieved by steadily growing its core business centered on tours and activities in line with the recovery of overseas travel demand, while rapidly expanding its product range across all travel-related areas such as flights, accommodations, and MyPack. Among these, the transaction volume of the creator marketing program 'MyRealTrip Marketing Partner' increased more than tenfold compared to the previous year. Additionally, the use of AI technology to automate customer service and optimize work processes improved operational efficiency, which contributed to fixed cost reduction and revenue growth.

Jarvis & Villains’ profitability resulted from significantly increasing refund application amounts by strengthening service competitiveness. SamzzumSam greatly enhanced user convenience by completely eliminating the tax agent verification process required during the refund process in the second half of last year. As a result, the platform recently surpassed 23 million cumulative subscribers. The cumulative refund application amount increased by approximately 700 billion KRW in one year, soaring to 1.67 trillion KRW as of last month. The cumulative number of refund applications reached 12.19 million.

An industry insider said, "Even in a deteriorating funding environment, the cases of pre-unicorns that have clearly defined their core competitiveness and refined their business models provide important implications for many startups struggling between survival and growth," adding, "Startups with their own revenue-generating capabilities are less vulnerable to external environmental changes and will have an advantage in future fundraising."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)