Net Selling Streak Ends After 10 Days

11 Trillion Won Sold Over 9 Days

Easing Tariff Concerns, Stable Exchange Rate, and Valuation Seen as Positive

However, a Full-Fledged Buying Shift Remains Unlikely

As concerns over tariffs eased, the stock market surged sharply, and foreign investors contributed to the rise in stock prices by buying for the first time in 10 days. Foreigners purchased Hanwha Aerospace the most.

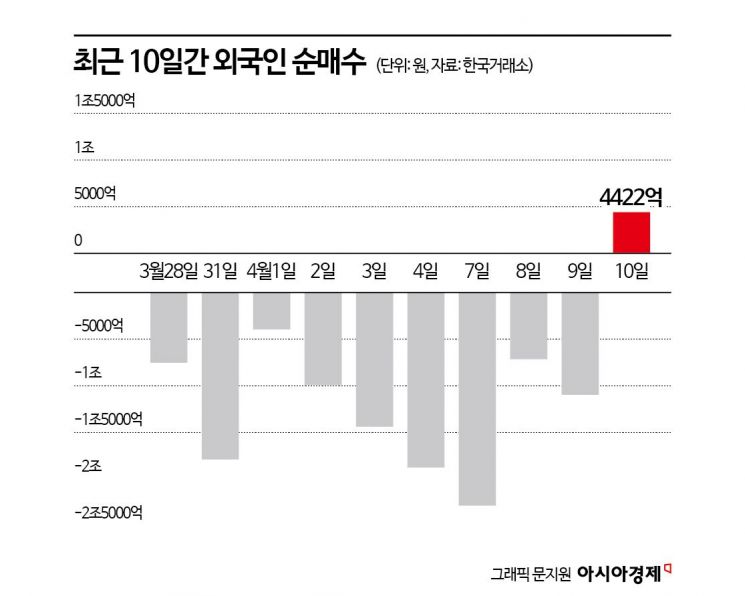

According to the Korea Exchange on the 11th, foreign investors net bought 442.2 billion won in the domestic stock market the previous day. They bought 330.7 billion won in the KOSPI market and 111.5 billion won in the KOSDAQ market. Along with this, they also showed strong buying momentum by net buying over 1 trillion won in the futures market.

Previously, foreign investors had continued a nine-day consecutive net selling streak in the domestic stock market since the 28th of last month. During this period, they dumped more than 11 trillion won worth of stocks.

The reason foreign investors stopped their selling streak was due to the easing of tariff concerns that had suppressed global stock markets. The day before, U.S. President Donald Trump decided to postpone reciprocal tariffs for 90 days, causing the U.S. stock market to surge, and the domestic market closed with the KOSPI rising 6.6% and the KOSDAQ up 5.97%, respectively.

The stock most purchased by foreign investors who turned to net buying after a long time was Hanwha Aerospace. Foreigners bought 72.5 billion won worth of Hanwha Aerospace shares that day. Following that, they net bought HD Hyundai Heavy Industries (50.3 billion won), SK Hynix (35.5 billion won), and HD Hyundai Electric (27.6 billion won). By sector, they bought defense and shipbuilding stocks. Besides Hanwha Aerospace, defense stocks purchased included Hyundai Rotem (17 billion won), Korea Aerospace Industries (13.1 billion won), and LIG Nex1 (10.6 billion won). In shipbuilding, along with HD Hyundai Heavy Industries, HD Hyundai Korea Shipbuilding & Offshore Engineering (10.2 billion won) was also net bought.

Semiconductors and automobiles showed mixed trends. While SK Hynix and Hyundai Motor (13.7 billion won) were net bought, Samsung Electronics and Kia were net sold.

With the reciprocal tariff suspension expected to ease volatility caused by tariff risks for the time being, attention is focused on whether foreign buying momentum can continue. Lee Seong-hoon, a researcher at Kiwoom Securities, said, "Considering that the KOSPI’s 12-month forward price-to-book ratio (PBR) fell to 0.79 due to recent reciprocal tariff issues, there is sufficient room for entry into the domestic stock market," adding, "Therefore, it is necessary to pay attention to whether large-scale capital inflows from foreigners can proceed."

The won-dollar exchange rate, which had soared to its highest level in 16 years since the financial crisis, also stabilized, likely having a positive effect on foreign buying. On that day, in the Seoul foreign exchange market, the won-dollar exchange rate closed the weekly trading session at 1,456.4 won, down 27.7 won from the previous day.

However, a full-scale inflow of foreign funds into the stock market is not expected to be easy. Choi Seong-rak, head of the Capital Outflow and Inflow Analysis Department at the International Finance Center, said, "With a clear slowdown in growth, the possibility of the Bank of Korea adjusting the pace of interest rate cuts, and the negative impact of Trump’s tariff policies on the economy, foreign investment will be limited," adding, "Despite valuation merits and expectations for semiconductor industry improvement, foreign stock investment funds are expected to remain flat due to poor macroeconomic conditions such as growth until the end of the year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.