Net Fund Operation Reaches 215.5 Trillion Won, Up 55 Trillion... Highest Since Statistics Began

Decrease in New Apartment Move-ins Reduces Household-to-Corporate Fund Transfers

Corporates Cut Investment, Net Fund Procurement Falls to 65.5 Trillion Won

Household Debt Ratio to GDP at 90.1%

"Downward Trend Expected to Continue in Q1 This Year"

Last year, the surplus funds (disposable income) of households in South Korea increased by 55 trillion won. The increase in surplus funds was due to income growth outpacing expenditure growth and a decrease in new apartment move-in volumes.

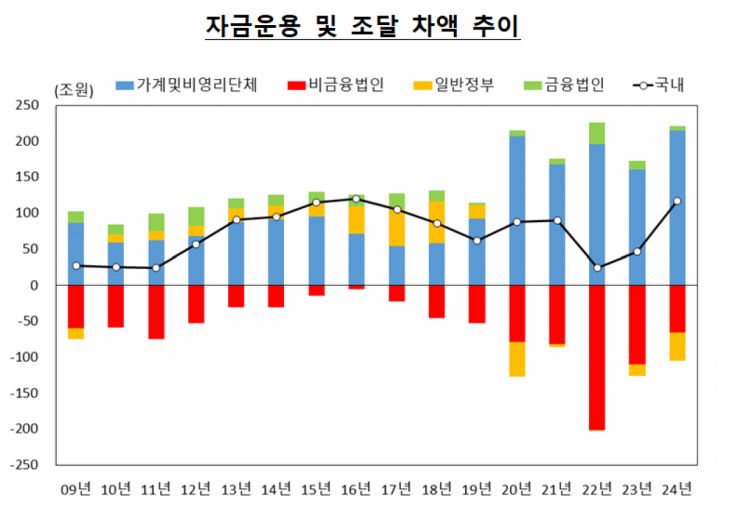

According to the '2024 Financial Flow (Provisional)' statistics released by the Bank of Korea on the 10th, the net fund operation amount of households and non-profit organizations last year was 215.5 trillion won, an increase of 55 trillion won from the previous year (160.5 trillion won). This is the highest level since the statistics were first compiled in 2009. The previous highest was 206.6 trillion won in 2020, when COVID-19 spread. The net fund operation amount is calculated by subtracting fund procurement from fund operation for the economic entity, and can be interpreted as the entity's surplus funds.

Kim Yong-hyun, head of the Financial Flow Team 1 at the Bank of Korea's Economic Statistics Department, explained, "The scale of net fund operation expanded compared to the previous year due to an increase in surplus funds caused by income growth exceeding expenditure growth and a decrease in new apartment move-in volumes." According to Statistics Korea, the household income growth rate increased from 2.8% in 2023 to 3.3% last year, while the household expenditure growth rate decreased from 6.1% to 3.2%. According to Real Estate 114, the nationwide new apartment move-in volume decreased from 367,000 households in 2023 to 363,000 households last year. In Seoul, it decreased from 37,000 households to 28,000 households. A decrease in new apartment move-ins reduces the flow of purchase funds from households to construction companies, thereby increasing the overall surplus funds in the household sector.

The fund operation amount of households and non-profit organizations increased from 194.8 trillion won in 2023 to 266.1 trillion won last year. Although deposits at financial institutions decreased, the equity securities and investment fund sectors increased due to increased investments in overseas stocks and overseas stock-type funds, and insurance and pension reserves also increased due to higher retirement pension contributions, expanding the scale of fund operation. Fund procurement amounted to 50.6 trillion won, increasing compared to 34.3 trillion won the previous year, mainly due to increased borrowing from deposit-taking institutions centered on mortgage loans.

Non-financial corporations (general companies) had a net fund procurement scale of 65.5 trillion won last year, down from 109.4 trillion won the previous year. This was due to a slowdown in investment growth amid expanded corporate net profits and increased domestic and international uncertainties. Fund operation was 68.7 trillion won, a significant increase from 9.3 trillion won the previous year. This was influenced by a turnaround in deposits at financial institutions and increased foreign direct investment. Fund procurement also expanded as trade credit increased with improved corporate sales, growing from 118.6 trillion won the previous year to 134.2 trillion won last year.

The general government’s net fund procurement scale expanded to 38.9 trillion won, up from 17 trillion won the previous year. This was due to government expenditures increasing more than revenues. It is the highest level since 2020, when COVID-19 spread. Fund operation decreased to 35.9 trillion won from 56.1 trillion won the previous year, as bond holdings increased but equity securities, investment funds, and deposits at financial institutions decreased. Fund procurement slightly increased to 74.8 trillion won from 73 trillion won the previous year. This was due to increased subscription savings in the household sector and a turnaround in other deposit balances following tax benefits such as raising the recognized limit for subscription savings contributions during year-end tax adjustments. The net difference between fund operation and procurement in the domestic sector last year was 116.6 trillion won, expanding compared to 46.8 trillion won the previous year.

The net fund procurement scale in the foreign sector increased to 116.6 trillion won, up from 46.8 trillion won the previous year, due to an expansion in the current account surplus. The scale of fund procurement greatly expanded as resident purchases of overseas bonds and overseas stocks increased and direct investment procurement also grew, exceeding the increase in fund operation scale and thus increasing net fund procurement. An increase in fund operation in the foreign sector indicates an increase in South Korea’s external debt, while an increase in fund procurement indicates an increase in South Korea’s external assets.

As of the end of last year, the financial assets of households and non-profit organizations amounted to 5,468.9 trillion won, an increase of 264.8 trillion won compared to the end of the previous year. Financial liabilities increased by 53.2 trillion won to 2,370.1 trillion won. Net financial assets increased by 211.6 trillion won to 3,098.8 trillion won compared to the end of the previous year, and the debt-to-financial asset ratio rose to 2.31 times from the previous year-end.

At the end of last year, the household debt ratio to nominal gross domestic product (GDP) was 90.1%, down 0.7 percentage points from 90.8% at the end of the third quarter of 2024. This marks five consecutive quarters of decline. On an annual basis, it fell 3.5 percentage points from 93.6% at the end of 2023. This is the third consecutive year of decline since 2021. It is expected that the downward trend continued in the first quarter of this year as well. Kim said, "Although the first quarter GDP has not yet been released, considering that bank loans, which are the main component of household loans, slightly decreased compared to the growth rate in the fourth quarter of last year and the first quarter outlook (0.2% increase in real terms), the trend is expected to continue."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)