Lotte and Ottogi Decline, Samyang and Orion Rise

Performance Diverges as Overseas Markets Make the Difference

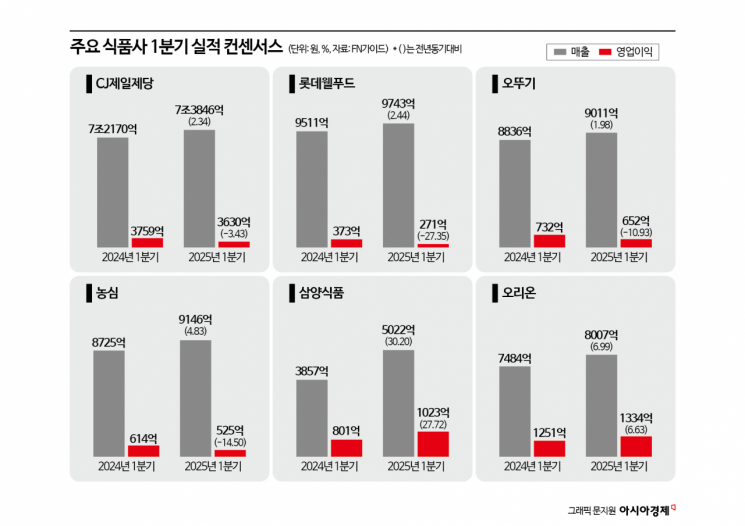

Domestic major food companies are expected to avoid a decline in operating profit in the first quarter of this year. Profitability has generally deteriorated due to a combination of domestic market stagnation and cost burdens caused by high exchange rates. In contrast, companies with a high proportion of overseas sales, such as Samyang Foods and Orion, succeeded in defending their performance, showing a clear contrast.

According to financial information company FnGuide and the food industry on the 10th, CJ CheilJedang's consolidated sales for the first quarter are estimated to increase by 2.3% year-on-year to KRW 7.3846 trillion. However, operating profit is expected to decrease by 3.4% to KRW 363 billion. Lotte Wellfood's sales are expected to increase by 2.4% to KRW 974.3 billion, but operating profit is forecast to plunge by 27.3% to KRW 27.1 billion. Ottogi and Nongshim are no exceptions. Ottogi's sales are estimated to increase by 1.9% year-on-year to KRW 901.1 billion, while operating profit is expected to decrease by 10.9% to KRW 65.2 billion. Nongshim's sales are projected to rise by 4.8% to KRW 914.6 billion, but operating profit is expected to fall by 14.5% to KRW 52.5 billion.

The poorer the performance, the higher the dependence on the domestic market. Major food companies with a domestic sales ratio exceeding 50% were directly hit by rising costs and shrinking consumption. Even CJ CheilJedang (49.2% overseas ratio) and Nongshim (38%) failed to offset domestic business sluggishness with overseas performance. Some companies also faced burdens from distribution variables such as inventory adjustments at Homeplus, which is under court receivership. This is because the inventory volume of marts is reflected in food companies' sales.

The effect of price increases is expected to take full effect from the second quarter. Food companies raised prices of major items such as ramen and sauces by 3-20% from early this year to offset rising costs and improve profits, but this was not reflected in first-quarter results, according to analysis.

On the other hand, Samyang Foods is expected to deliver an 'earnings surprise' due to strong overseas performance. First-quarter sales are projected to increase by 30.2% year-on-year to KRW 502.2 billion, and operating profit is expected to rise by 27.7% to KRW 102.3 billion. The popularity of K-ramen, such as Buldak Bokkeum Myun, overseas drove the performance.

Orion also defended its performance based on stable results in overseas markets. First-quarter sales and operating profit are expected to increase by 6.9% and 6.6%, respectively, to KRW 800.7 billion and KRW 133.4 billion. Stable performance in overseas markets such as China, Vietnam, and Russia was effective.

Domestic food companies' performance diverged in overseas markets. Samyang Foods and Orion, which have a high overseas ratio, can offset domestic sluggishness and rising raw material prices. The overseas sales ratio of Samyang Foods accounts for 77% of total sales. Orion's overseas sales ratio also reaches 65%. Of the sales of KRW 614.2 billion as of January-February, overseas sales accounted for KRW 409.9 billion (66.7%).

An industry insider said, "The first quarter was a heavy blow to domestic food companies that structured their business mainly around the domestic market," adding, "The structural dependence on the domestic market in the domestic food industry increases performance volatility, so securing competitiveness in the global market and expanding exports will be the key to improving performance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)