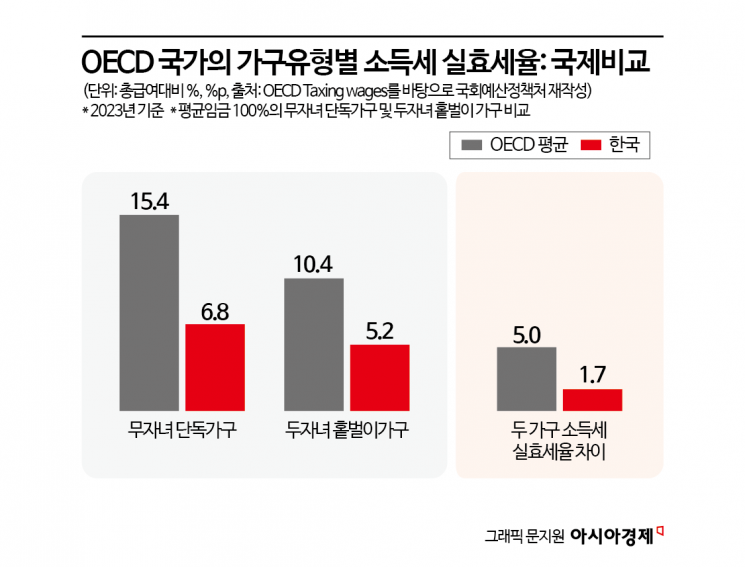

OECD Average: Households With Children Have Effective Tax Rate 5% Lower Than Childless Households

In Korea, the Gap Is Only 1.7%

Tax Benefits for Families With Children Are Far More Limited Than in Advanced Countries

In most OECD member countries, the effective tax rate for households with children is significantly lower than that for households without children. This is the result of active tax benefits provided for the costs of childbirth and child-rearing in major countries around the world. As low birth rates have emerged as a social challenge, some countries are notably offering bold tax benefits for the costs incurred during child-rearing. In France, income deductions are given even for living expenses paid to adult children, and in Hungary, women who have raised four or more children are completely exempt from income tax.

According to the "Republic of Korea Tax Report" published by the National Assembly Budget Office on the 7th, among 38 OECD countries, 26 countries showed that the effective tax rate for single-earner households with two children (households with two children at 100% average wage level) was lower compared to childless single-person households (households without children at 100% average wage level). In 11 of the 38 countries, the effective tax rate for single-earner households with two children was less than half that of childless single-person households.

As of 2023, the average effective income tax rate relative to total wages for childless single-person households in the OECD was 15.4%, while for single-earner households with two children it was 10.4%. The difference in income tax rates between the two household types was 5.0 percentage points. Couples with children pay less tax than childless households due to various deductions and exemptions related to marriage, childbirth, and child-rearing.

Among G7 countries, Germany had the largest gap in effective income tax rates by household type. The effective tax rate for childless single-person households in Germany was 16.97%, while for single-earner households with two children it was -0.18%. Households with children effectively do not bear income tax. The next largest gap was in the United States, where the effective tax rate for childless single-person households was 16.6%, but for single-earner households with two children it was 5.52%.

In the case of Korea, the difference in effective tax rates was not large. The effective tax rate for childless single-person households was 6.8%, while for single-earner households with two children it was 5.2%, a difference of only 1.7 percentage points. The Budget Office explained, "In Korea, the absolute level of the effective income tax rate has a significant impact."

Major OECD countries are actively implementing tax support measures centered on income tax for childbirth and child-rearing. In Germany, where the effective tax rate for single-earner households with two children is very low, active tax benefits are applied for child-rearing costs. To exclude the minimum living expenses necessary for children from the taxpayer's income tax, a child income deduction is implemented, and a special income deduction of 30% is applied to expenses for children's school education. Expenses for child care are also eligible for a special income deduction of up to two-thirds of the costs incurred.

Bold tax benefits are also notable by country. Since 2020, Hungary exempts income tax for all women who are raising four or more children or who have given birth to and raised four or more children in their lifetime. There are also income deduction benefits for mothers under 30 years old. France provides income deduction benefits even for living expenses paid to adult children. Tax credits for education expenses for children in school are also applied. In Japan, from 2024, a new system has been established and operated that allows special income deductions for part of the repair costs when eligible child-rearing individuals carry out home repairs for child-rearing and reside in that home.

Korea mainly provides tax support related to childbirth and child-rearing through income tax exemptions, income deductions, and tax credits. These include tax exemptions for childbirth and childcare allowances, basic deductions for dependent children, and tax credits for medical and educational expenses incurred for children. Full tax exemption benefits are provided for childbirth incentives given by companies to employees. Compared to advanced countries, tax benefits for households with children in Korea are considered very limited.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)