Positive Performance Continues for Domestic Banks Expanding into Southeast Asia

However, Recent Local Economic Downturn Highlights Need to Strengthen Asset Soundness

Although domestic banks continue to expand into Southeast Asia, recent increases in non-performing loans (NPLs) in countries such as Vietnam and Cambodia have raised concerns about asset quality, prompting warnings that banks need to strengthen their asset soundness management.

Positive Outcomes Continue for Domestic Banks Expanding into Southeast Asia

According to a report titled "Status of Non-Performing Loans of Major Southeast Asian Banks and Implications" by Hana Financial Research Institute on the 10th, among the total assets of $210.2 billion held by domestic banks' overseas branches (as of the end of 2023), the largest portion?$55.5 billion (26.4%)?is concentrated in Southeast Asia. The total assets of domestic banks in Southeast Asia have been increasing annually, from $47.7 billion in 2021 to $54.0 billion in 2022, and $55.5 billion in 2023.

As total assets grew, earnings from Southeast Asia also increased. The net income earned by domestic banks in Southeast Asia jumped significantly from $153 million in 2022 to $480 million in 2023. In comparison, net income in the U.S. was only $5 million in 2023, while China and Japan recorded $135 million and $134 million, respectively.

Among Southeast Asian countries, Vietnam, Cambodia, and Singapore showed strong profitability. In particular, Vietnam's net income in 2023 reached $330 million, more than twice the combined net income of the U.S. and China. Although the asset size of Cambodian branches is smaller compared to China, the U.K., and Japan, their net income was $145 million, demonstrating high profitability.

However, the Indonesian overseas branch experienced an increase in net losses due to the deteriorating management performance of KB Kookmin Bank, which acquired Bank Bukopin, known for its high level of non-performing assets. Since acquiring a 67% stake in Bank Bukopin in 2018, KB Kookmin Bank has recorded a cumulative net loss of approximately KRW 1.1625 trillion over the past five years.

Jang Hyewon, Senior Researcher at Hana Financial Research Institute, explained, "Domestic banks, focusing on the growth potential and market accessibility of Southeast Asia, have made early efforts to enter local markets, resulting in favorable performance. The number of domestic bank branches in Southeast Asia has increased 2.5 times compared to 10 years ago, and asset size has nearly sextupled, accelerating investment."

Recent Local Economic Downturn Calls for Strengthening Asset Soundness

However, Senior Researcher Jang pointed out that problems such as rising non-performing loans (NPLs) have recently emerged in countries like Vietnam and Cambodia, where Korean banks have actively expanded. The NPL ratio of local banks in Vietnam was below 2% until 2021 but sharply increased after the end of 2022, approaching nearly 5% in the first half of last year. The rise in non-performing loans in Vietnamese banks is mainly due to a decline in housing demand following interest rate hikes after the pandemic, which led to sluggish construction and real estate sectors and caused related companies to fail in securing financing.

The NPL ratio of Cambodian banks exceeded 3% in 2022 and rose to 6.3% in the first half of last year, with the volume of non-performing loans nearly doubling compared to the previous year. This was due to the deterioration of real estate-backed loans, which had expanded during the housing market boom since 2020, as Chinese investment decreased starting in 2023.

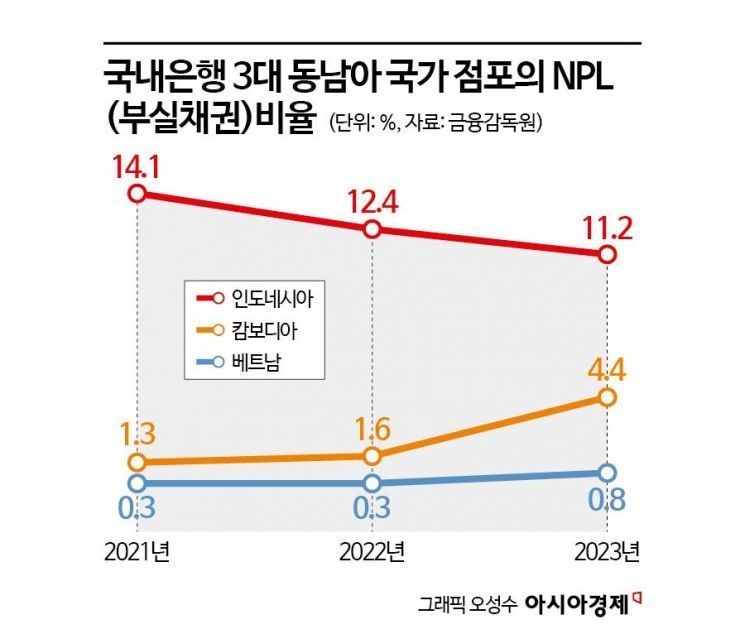

The NPL ratios of domestic banks operating in Southeast Asia are also on the rise. The NPL ratio of domestic banks in Vietnam increased more than twofold from 0.3% in 2022 to 0.8% in 2023. The NPL ratio of domestic bank branches in Cambodia rose nearly threefold from 1.6% in 2022 to 4.4% in 2023, with some branches exceeding 10%. Analysis indicates that while the overall volume of non-performing loans among Korean banks in Cambodia has increased, banks with a relatively high proportion of retail business have seen a sharp rise in NPL ratios.

Senior Researcher Jang emphasized, "Domestic banks operating in Southeast Asia need to focus on asset soundness management, including restructuring their loan portfolios, considering recent factors contributing to the expansion of non-performing loans. Despite improvements in macroeconomic conditions such as increased trade and price stability, the real estate market downturn in Vietnam and Cambodia continues, so domestic banks operating locally should strengthen soundness management of loans in the real estate, construction sectors, and retail business."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)