Attention on Soaring Stocks 'MicroAlgo, Bit Origin'... Rise of 'Inverse ETFs'

Distinct Investment Tendencies by Age...

20s-30s Employ 'Bidirectional Strategies', 40s-50s Focus on 'Growth Stocks'

Kakao Pay Securities analyzed the average returns and top purchased stocks of users who traded U.S. stocks through its platform last month. As market volatility increased compared to the previous month, users appeared to respond with various strategies.

The average return for all users was -2.8%, showing a decline compared to February (4.0%), indicating that investing in the U.S. stock market has become more challenging.

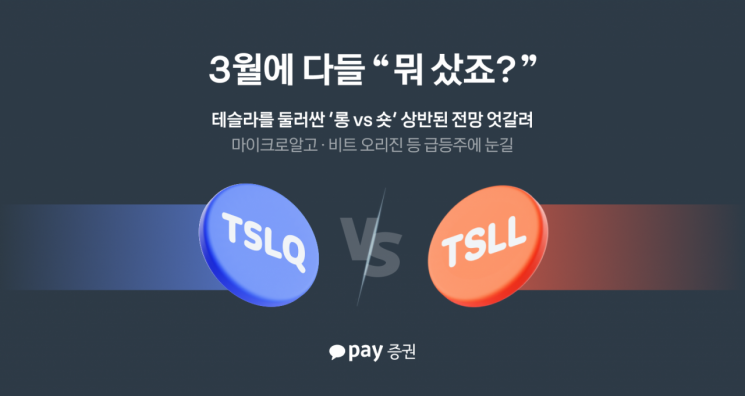

The Tesla 2x Leverage ETF (TSLL) ranked first in purchase amount for March, following February. Interest in major tech stocks such as Tesla (2nd) and Nvidia (3rd) continued. However, inverse ETFs betting on declines newly entered the rankings, reflecting divergent outlooks on investment direction.

Attention on Soaring Stocks 'MicroAlgo, Bit Origin'... Rise of 'Inverse ETFs'

‘MicroAlgo (MLGO)’, which ranked 4th in purchase amount among all users in March, drew significant attention with a 482% return over the month. In addition to large tech stocks, short-term soaring stocks such as ‘Bit Origin (BTOG)’ and ‘Tenon Medical (TNON)’ entered the rankings, highlighting attempts to seize opportunities amid volatile market conditions.

Notably, inverse ETFs like TSLQ (5th) and TSLZ (9th), which bet on Tesla’s decline, ranked high. This trend was prominent among users in their 20s and 30s and is interpreted as reflecting contrasting views on Tesla.

Distinct Investment Tendencies by Age... 20s-30s Employ 'Bidirectional Strategies', 40s-50s Focus on 'Growth Stocks'

Investment tendencies by age group showed clear differences. Users in their 20s and 30s concentrated on leveraged and inverse products such as TSLL, TSLQ, TSLZ, and MSTZ (MicroStrategy Inverse ETF), responding to market volatility with both upward and downward strategies. Their average return was -3.1%, lower than the overall average, but showed an active investment attitude.

In contrast, users in their 40s and 50s maintained a buying strategy focused on individual stocks, attempting a more stable approach. Although some leveraged ETFs like TSLL and SOXL (Semiconductor 3x Leverage ETF) were included, their bets were generally weighted toward growth stocks. Their average return was -2.4%, showing relatively defensive performance.

Kakao Pay Securities explained, "March was a period of increased market uncertainty, with bidirectional strategies appearing simultaneously for the same stocks," adding, "This indicates a shift beyond a simple correction phase to a full-fledged 'heightened volatility market'."

Meanwhile, detailed information on Kakao Pay Securities users’ investment trends in March can be found in the 'Muji Useful Investment News' provided under the 'Discover' tab in the 'Securities' menu at the bottom of the Kakao Pay app.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)