Korea Zinc, the Only Domestic Producer and Supplier

Antimony Price Quadruples in One Year Due to China’s Export Restrictions

Korea Zinc, the only domestic producer and supplier of the rare metal antimony, is accelerating its strategy for exports to the United States. There are also expectations that antimony, whose price has surged due to tariff issues and the global supply chain restructuring, could emerge as a new bargaining chip for Korea.

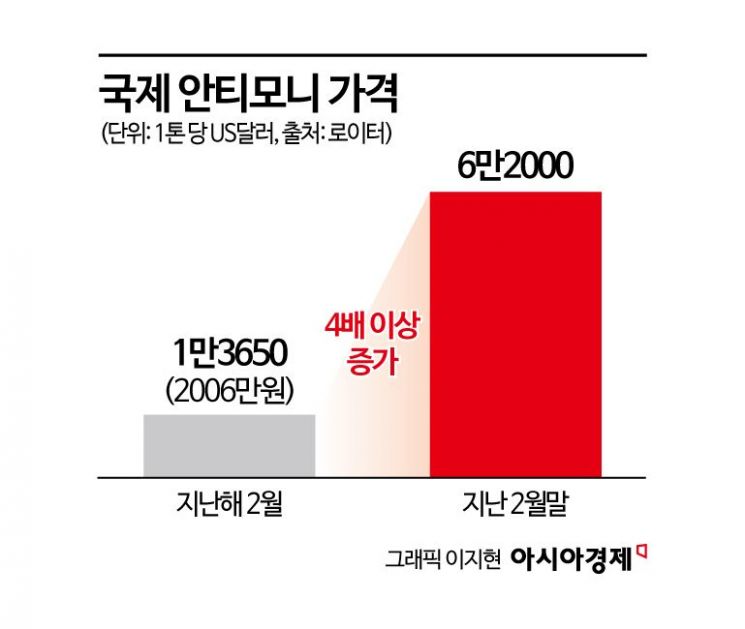

According to industry sources on the 9th, Korea Zinc is currently establishing specific strategies, including selecting importers, with a goal of exporting 350 tons of antimony to the U.S. this year. As of February last year, the price of antimony was $13,650 (20.27 million KRW) per ton, but it soared to $62,000 by the end of February this year, increasing more than fourfold in one year. If the planned export volume is successfully achieved, it would open a market worth over 32.2 billion KRW annually. Korea Zinc plans to first open the door this year and then gradually expand export volumes in the future.

Antimony is one of the 28 key minerals designated under the Special Act on National Resource Security. It is a strategic material essential for the production of military supplies such as ammunition, missiles, and shells, and its use is increasingly expanding in heat-resistant materials for vehicle dashboards, tents, and advanced industrial fields. Moreover, since it is excluded from the U.S. reciprocal tariff list effective from today, it is expected to benefit amid trade dispute situations.

Earlier, in September last year, China, which accounts for more than half of the world's production, restricted exports of domestically produced antimony and related technologies, intensifying global supply chain instability. Since the U.S. has depended on China for 62% of its total imports, securing alternative supply sources is urgent. According to the U.S. Geological Survey (USGS), China's antimony production last year was estimated at 83,000 tons, accounting for about half of the global supply.

Korea Zinc extracts antimony as a byproduct from zinc and lead smelting processes without using concentrates, employing a wet smelting method using diaphragm electrolysis technology. Unlike conventional metal electrolysis methods, this technology can produce antimony with ten times higher purity. Last year, the annual production reached 3,604 tons, with 70% supplied domestically and 30% exported to Europe, Japan, and other regions. This year, the production target is 3,800 to 4,000 tons.

An industry insider said, "Antimony is evaluated not just as a simple raw material but as a geopolitical asset," adding, "Since few companies have proprietary smelting and refining technologies, those with a high level of technology internalization will be able to seize the benefits of the global supply chain restructuring."

Meanwhile, Korea Zinc applied to the Ministry of Trade, Industry and Energy last November for designation of two of its smelting technologies as national core technologies. These technologies include antimony metal manufacturing technology using diaphragm electrolysis and hematite manufacturing technology in zinc sulfate solution, with the designation decision expected as early as this month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)