Nearly 5 Trillion Won in Net Profit for Four Major Financial Holding Companies in Q1

Interest Income Increases Thanks to Widening Loan-Deposit Interest Rate Spread

The four major financial holding companies (KB, Shinhan, Hana, and Woori) are expected to record nearly 5 trillion won in net profit in the first quarter of this year, drawing attention to whether they will break their all-time records. Initially, the outlook was dominated by expectations that the financial industry would struggle due to factors such as the launch of the Trump administration's second term and sluggish domestic demand. However, thanks to the expansion of net interest margin (profit from the difference between loan interest rates and deposit interest rates), it is anticipated that this year will also see record-breaking performance.

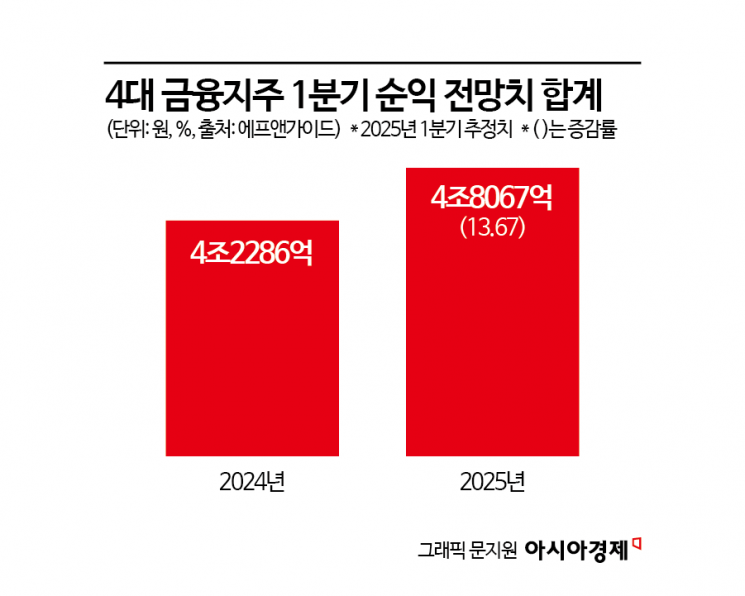

According to financial information firm FnGuide on the 9th, the net profit forecast for the four major financial holding companies in the first quarter of this year was 4.8067 trillion won. This is close to the 4.9015 trillion won recorded in the first quarter of 2023, which was the highest ever for a first quarter, and represents a 13.67% increase compared to the same period last year (4.2286 trillion won).

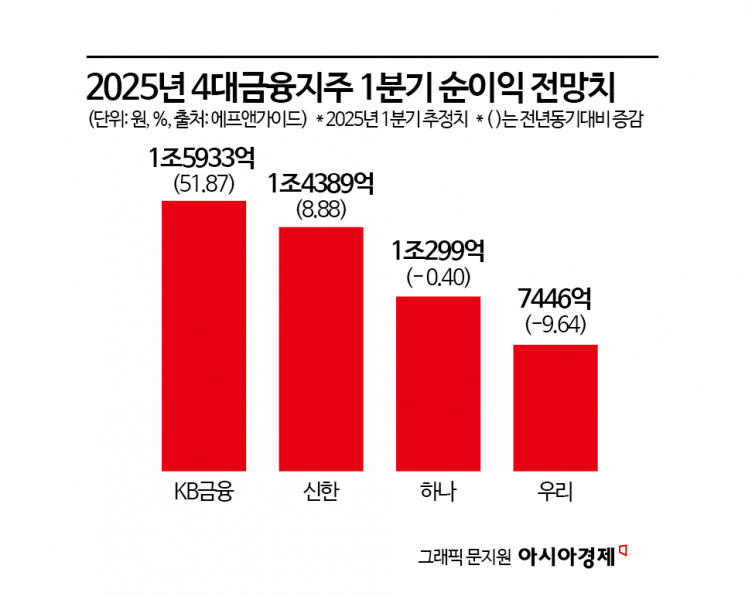

Among the financial holding companies, KB Financial showed the largest increase in net profit, rising more than 50% compared to the same period last year. KB Financial is expected to record a net profit of 1.5933 trillion won in the first quarter, a 51.87% increase from 1.0491 trillion won in the same period last year. This is attributed to the resolution of compensation burdens related to Hong Kong H-Share Index (Hang Seng China Enterprises Index, HSCEI) equity-linked securities (ELS). KB Financial had the largest outstanding balance of Hong Kong H-Share Index ELS sales, and last year in the first quarter, it reflected compensation payments of 900 billion won related to this, which had reduced net profit by about 30%.

Next, Shinhan Financial Group's net profit forecast for the first quarter of 2025 is 1.4389 trillion won, an 8.88% increase compared to 1.3215 trillion won in the same period last year. Hana Financial Group's net profit forecast for the first quarter of this year is 1.0299 trillion won, a slight decrease of 0.40% compared to 1.034 trillion won in the same period last year. Woori Financial Group is expected to see a 9.64% decrease to 744.6 billion won during the same period. Seunggeon Kang, a researcher at KB Securities, analyzed that "the reason Woori Financial is expected to see a decrease in profit compared to last year is because about 170 billion won in enterprise resource planning (ERP) costs, including voluntary retirement expenses, will be reflected."

The reason the four major financial holding companies were able to record excellent results in the first quarter of this year is also attributed to 'interest income.' Despite the interest rate cuts, the spread between loan and deposit interest rates widened. Although commercial banks lowered loan spread rates after mid-February due to pressure from financial authorities, deposit interest rates fell more sharply due to household debt management and base rate cuts. According to the Korea Federation of Banks, as of February this year, the spread between loan and deposit interest rates for household loans (excluding low-income financial products) handled by the five major banks (KB, Shinhan, Hana, Woori, and NH Nonghyup) was between 1.30 and 1.47 percentage points. This has expanded for seven consecutive months since August last year. By bank, NH Nonghyup Bank had the largest loan-deposit interest rate spread at 1.47 percentage points, followed by Shinhan and Hana (1.40 percentage points), KB Kookmin (1.33 percentage points), and Woori (1.30 percentage points).

If this trend continues, financial holding companies are expected to record record-breaking profits again this year. In particular, following KB Financial last year, Shinhan Financial Group's annual net profit forecast is expected to exceed 5 trillion won this year. KB Financial became the first in the financial sector to join the '5 trillion won club' by recording a net profit of 5.0782 trillion won last year. However, some concerns remain that it is too early to be reassured, as red flags have been raised regarding bank soundness due to the impact of tariffs on export companies and delinquency rates among small and medium-sized enterprises.

An official from a financial company said, "Regarding the expansion of net interest margin, it should be considered that household loans increased in conjunction with the recent lifting of land transaction permit zones (Toheoguyok), making it difficult to lower interest rates to manage household debt," adding, "The corporate situation is not good due to the impact of tariffs, and the delinquency rate on loans to small and medium-sized enterprises is also worsening, so it is not a situation to be reassured."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.