US-based Google and OpenAI Lead the Way

Intensifying AI Arms Race Drives Up Training Costs

Meta Spends 249.8 Billion KRW on LLaMA 3.1 Training

In a newly released 2025 survey of artificial intelligence (AI) model ecosystems by Stanford University in the United States, a Korean model was listed among the "notable AI models." This is seen as a partial redemption just one year after the humiliating result of having "zero countries" included in the previous report. However, while the US and China are actively engaged in AI arms races primarily in the private sector, it was confirmed that investment in Korea has rather decreased.

According to the "AI Index Report 2025" published on the 7th (local time) by Stanford University's Human-Centered AI Institute (HAI), Korea accounted for one notable AI model released last year. This increased from zero in the 2024 report to one. The model is known to be LG AI Research's "Exaone 3.5."

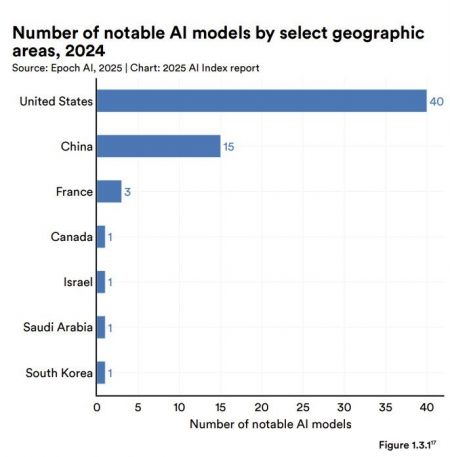

By company, Google and OpenAI each released seven notable AI models last year, followed by China's Alibaba with six, and Apple, Meta, and NVIDIA with four each. With US companies dominating, the concentration by country also intensified. By country, the US had 40 models, China had 15, France had three, and Canada, Israel, and Saudi Arabia each released one model, the same as Korea.

A notable achievement was Naver's "HyperCLOVA 82B" being mentioned alongside global AI models in terms of input costs for major AI models. Last year, HyperCLOVA 82B, along with "HyperCLOVA X," was recognized as a super-large AI model by the US research organization EPOCH AI, which provided the raw data for this report.

As in the previous year, the net increase in AI model training costs continued through last year. For example, Meta invested about $170 million (approximately 249.8 billion KRW) to train the AI language model "LLaMA 3.1-405B" released in 2024. French AI startup Mistral AI invested $41 million in "Large," and Elon Musk's xAI invested $107 million in "Grok-2."

The report noted, "As AI competition intensifies, companies tend to withhold information about training methods, making it increasingly difficult to estimate computational resource costs." It further explained, "As stated in previous reports, there is a direct correlation between AI model training costs and computational resource requirements," adding, "The greater the computational demand, the exponentially higher the training costs."

Under these circumstances, Korea's AI investment scale has rather decreased. In terms of AI investment by country, Korea's investment was $1.33 billion, slightly down from $1.39 billion the previous year. Its ranking in investment scale also dropped from ninth to eleventh.

During the same period, US investment increased by 63% from $67.2 billion the previous year, and China’s investment rose by 28% to $7.26 billion, widening the gap between the two countries from nine times to even more. Last year, private sector investment in AI was $109.98 billion (161.8 trillion KRW) in the US, more than ten times China's $9.29 billion.

AI talent outflow remains a serious issue. Korea was ranked third in AI talent outflow in 2022 but dropped to fifth in 2023, following Israel, India, Hungary, and T?rkiye.

However, Korea maintains strong performance in patent counts. The number of AI patent approvals per 100,000 population by country showed Korea at 17.27, ahead of Luxembourg (15.31), China (6.31), and the US (5.20). Korea also had the highest rate in 2022 at 10.26.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.