The Day U.S. Indices Plunged 20% in a Single Session

Economic Anxiety and Market Greed Collide

"If Tariffs Are Not Halted, We Will Head Toward an Economic Nuclear Winter"

As U.S. President Donald Trump's imposition of reciprocal tariffs causes major stock markets to exhibit extreme volatility within just one to two trading days, concerns are growing that the 'Black Monday' of 1987 could be reenacted. That year, marked by a combination of fears over the U.S. fiscal deficit and economic crisis, is remembered as the worst stock market crash in history.

The Worst Day in Stock Market History... The Ever-Remembered Black Monday

Black Monday refers to the stock market crash that occurred on October 19, 1987, at the New York Stock Exchange (NYSE). On that single day, the Dow Jones Industrial Average plummeted by 22%, while the tech-heavy Nasdaq closed down 11%. The Nasdaq was less affected than the Dow simply because the system malfunctioned due to an overwhelming number of sell orders.

Black Monday remains the worst single trading day in NYSE history. Despite numerous financial crises since then?including the dot-com bubble, the U.S. invasion of Iraq, the subprime mortgage crisis, and the COVID-19 pandemic?the largest one-day market drop still belongs to Black Monday. For this reason, days of significant market crashes are often prefixed with 'Black' to denote their severity.

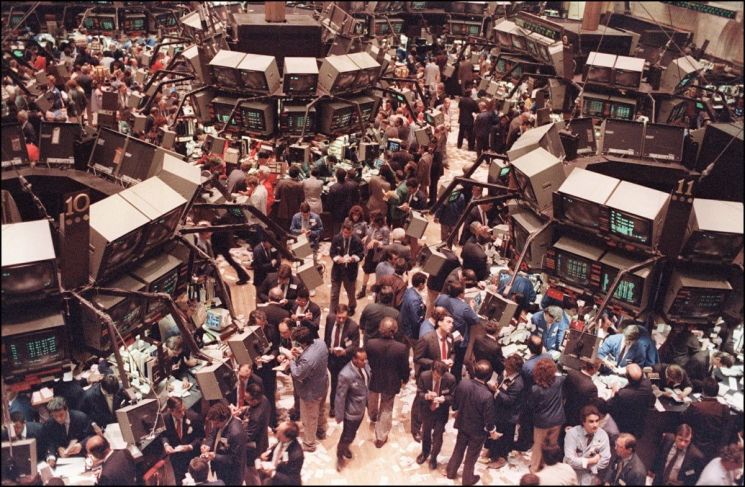

The New York Stock Exchange (NYSE) on Monday, October 19, 1987, when the US stock market recorded its largest crash in history. Photo by AFP Yonhap News

The New York Stock Exchange (NYSE) on Monday, October 19, 1987, when the US stock market recorded its largest crash in history. Photo by AFP Yonhap News

U.S. Deficit Sparks Anxiety, Market Greed Amplifies Fear

The causes of the 1987 Black Monday were complex. At the time, the global economy had barely emerged from hyperinflation triggered by the 1970s oil shocks, but inflation remained high and growth was sluggish, dampening market sentiment. The Ronald Reagan administration sought to stimulate the real economy through sweeping tax cuts known as 'Reaganomics.' As a result, government revenues fell sharply relative to spending, pushing the U.S. into a 'twin deficit' situation with both fiscal and trade deficits.

U.S. economic experts view the twin deficit problem as the starting point of Black Monday. A 2013 Federal Reserve essay analyzing the event noted, "In mid-October 1987, the federal government announced a larger-than-expected trade deficit, causing the dollar to decline and unsettling the markets. From October 14 onward, significant daily losses began to occur across various markets."

However, it was market greed that magnified the index drop to over 20%. The Fed explained, "During the pre-1987 boom, U.S. investment firms developed a new product called 'portfolio insurance,' which extensively used high-risk instruments such as options and derivatives. This caused initial stock price losses to trigger further selling." It also pointed out that "at the time, stock exchanges lacked mechanisms to intervene in massive sell-offs and rapid market declines."

Because of this, Black Monday became the starting point for volatility protection mechanisms now implemented by stock exchanges worldwide. After Black Monday, the NYSE introduced the 'circuit breaker' system, which temporarily halts trading if the S&P 500 index falls by 7%, 13%, or 20% in a single session. The Korean stock market adopted this system in 1998, shortly after the 1997 Asian financial crisis.

"No Investment Without Market Stability... We Could Head Toward an Economic Nuclear Winter"

On the 7th, Japan's Nikkei 225 fell 7.8% at closing, Hong Kong's Hang Seng Index dropped 13%, and South Korea's KOSPI index plunged 5.5%. The U.S. S&P 500 managed a modest 0.23% decline, but combined with the two days of sharp drops last week, it has fallen about 10%. It is difficult to directly compare the 2025 market to the 1987 Black Monday, when major indices fell more than 20%. However, the S&P 500 has already declined 13.7% year-to-date. Although volatility has not reached 1987 levels, investor sentiment has already severely frozen.

Analysts say the direction of the strained investor sentiment depends on the 'Trump tariffs.' Bill Ackman, a billionaire U.S. investor and founder of Pershing Square Capital Management, stated on his X (formerly Twitter) account on the 7th (local time), "By imposing massive tariffs not only on our enemies but also on our friends, we have started a global economic war, effectively destroying our relationships with our own trading partners, business associates, and investors."

He added, "If the stock market crashes, there will be no new investments. Consumers will stop spending money, and companies will have no choice but to cut back on investment decisions or lay off workers. If President Trump does not halt his tariff plans, we will head toward an economic nuclear winter."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)