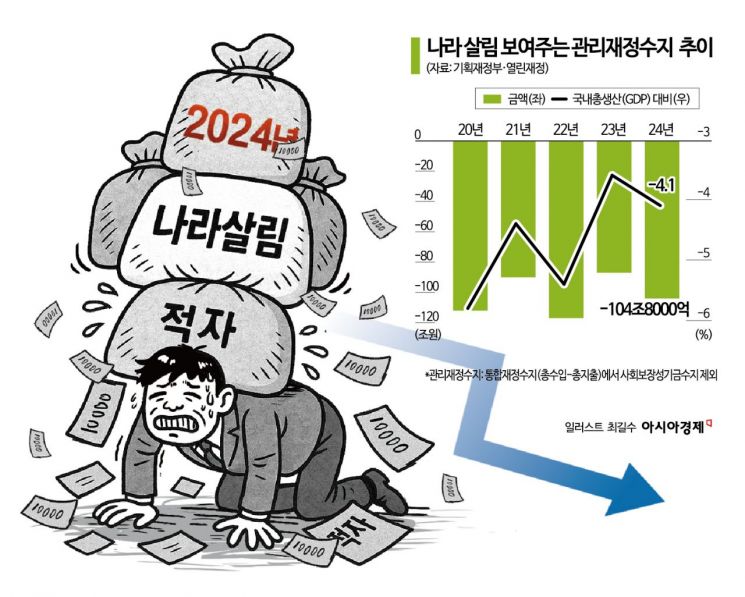

The managed fiscal balance deficit, which reflects the nation's finances, reached 104.8 trillion won last year, exceeding the government's expectations. The deficit ratio compared to the Gross Domestic Product (GDP) widened to 4.1% from the previous year. Although the Yoon Seok-yeol administration emphasized the fiscal rule benchmark (3%) from its inception, the deficit ratio exceeded 3% every year from 2022 through last year during its term.

On the 8th, the government held a Cabinet meeting at the Government Complex Seoul in Jongno-gu, Seoul, to review and approve the '2024 Fiscal Year National Settlement Report.' The managed fiscal balance deficit recorded in the report for last year was 104.8 trillion won, surpassing the deficit scale included in that year's budget (91.6 trillion won). The deficit increased compared to the previous year's deficit (87 trillion won), marking a triple-digit deficit again after two years since 2022 (-117 trillion won).

The managed fiscal balance is calculated by subtracting the social security fund balance, which includes the four major funds (National Pension, Private School Pension, Employment Insurance, Industrial Accident Insurance), from the integrated fiscal balance (total revenue minus total expenditure). It is considered an indicator that shows the country's actual fiscal situation.

Last year's managed fiscal balance deficit ratio to GDP was 4.1%, exceeding the government's forecast (-3.6%). As a result, the fiscal rule limiting the managed fiscal balance deficit ratio to GDP within 3% was not achieved. Since the launch of the Yoon Seok-yeol administration, the government has emphasized sound fiscal principles and pushed for the legislation of fiscal rules, but during the term, in 2022(-5.0%), 2023 (-3.6%), and last year, it became difficult to meet the target.

The Ministry of Economy and Finance explained that although revenue was insufficient compared to the budget last year, the deficit was inevitable as spending on livelihood-related projects was maintained. A ministry official said, "Revenue came in less than initially expected," adding, "The shortfall in tax revenue compared to the budget was a significant factor at 30.8 trillion won." They further explained, "Although revenue decreased, the figures reflect the result of maintaining projects directly related to people's livelihoods."

Last year's total revenue and total expenditure were 594.5 trillion won and 638 trillion won, respectively. The integrated fiscal balance, which is total revenue minus total expenditure, showed a deficit of 43.5 trillion won. This was less than the government's expected deficit (44.4 trillion won) but more than the previous year's deficit (36.8 trillion won). The deficit ratio to GDP was 1.7%, slightly lower than the government's forecast (-1.8%). The social security fund balance recorded a surplus of 61.2 trillion won.

Last year's total tax revenue was 535.9 trillion won, and total tax expenditure was 529.5 trillion won. The global surplus, calculated by subtracting total tax expenditure and carryover amount (4.5 trillion won) from total tax revenue, was 2 trillion won. The government plans to contribute 400 billion won of the general account global surplus to the Public Fund Repayment Fund and use it for debt repayment and other purposes. The special account global surplus of 1.6 trillion won will be handled as special account self-revenue according to relevant laws.

Last year, the national debt, combining central and local government debts, reached 1,175 trillion won. The debt-to-GDP ratio decreased by 0.8 percentage points from the previous year (46.9%) to 46.1%. According to financial statements, national assets increased by 212 trillion won to 3,221 trillion won, and national liabilities rose by 146 trillion won to 2,586 trillion won. Net assets increased by 66 trillion won from the previous year, reaching 635 trillion won.

A ministry official explained, "Central government debt was 1,141.2 trillion won, down 21.9 trillion won compared to the budget," adding, "19.2 trillion won less was issued in foreign exchange stabilization fund bonds, and housing bond issuance decreased by 4.6 trillion won." They also added, "Regarding national assets, the National Pension investment assets increased as the National Pension Fund's rate of return hit a record high of 15.0% last year."

The Ministry of Economy and Finance plans to submit the related report to the National Assembly by the end of next month after the Board of Audit and Inspection conducts a settlement audit.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)