32.9 Won Down, Then 33.7 Won Up: "Exchange Rate Panic"

Tensions Rise as China Responds to U.S. Reciprocal Tariffs

Volatility Likely to Increase Further Depending on Negotiation Developments

The foreign exchange market is shaking due to the 'tariff panic.' With the imposition of tariffs by the United States and retaliatory tariffs by China, a tense standoff continues, making a period of high volatility inevitable.

On the 8th, the won-dollar exchange rate opened at 1,471.0 won, up 3.2 won from the previous day's weekly closing price (as of 3:30 PM), then slightly narrowed its gains and fluctuated in the high 1,460 won range as of 10 AM. Concerns over an escalation of the global trade dispute have deepened safe-haven asset preference, resulting in a rise for two consecutive trading days.

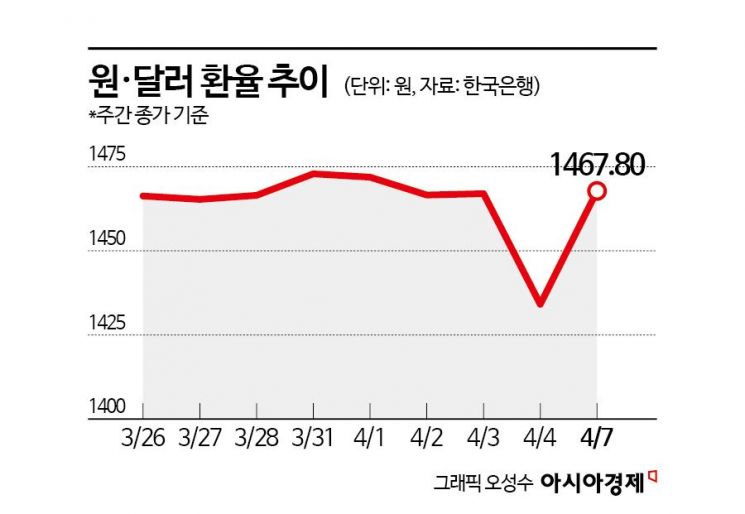

The won-dollar exchange rate has recently experienced sharp fluctuations due to domestic and international factors, increasing volatility. Following the Constitutional Court's decision on the 4th to dismiss former President Yoon Seok-yeol, the exchange rate dropped 32.9 won to the 1,430 won level (1,434.1 won), but rebounded 33.7 won on the 7th, just one trading day later, fully recovering the previous decline to reach 1,467.8 won. On the 4th, it recorded the largest drop in two years and five months since November 11, 2022 (-59.1 won), and on the very next trading day, the 7th, it posted the largest increase in about five years since March 19, 2020 (40.0 won), early in the COVID-19 outbreak.

The exchange rate spike the previous day was triggered by the U.S. announcement of reciprocal tariffs and China's subsequent retaliatory tariff announcement, raising concerns over a global trade dispute. China decided to impose a 34% tariff on U.S. goods starting from the 10th, matching the 34% reciprocal tariffs imposed by the U.S. Overnight, U.S. President Donald Trump warned that if China does not withdraw its retaliatory tariffs by the 8th, an additional 50% tariff will be imposed from the 9th. Although U.S. Treasury Secretary Scott Baesent left the door open for negotiations, he limited it to countries favorable to U.S. tariffs.

Experts predict that the market will be dominated by tariff issues for the time being. They expect a volatile market with sharp rises and falls depending on related hopes and concerns. Accordingly, the expected exchange rate fluctuation range for this week has been widened to 1,420?1,490 won. Min Kyung-won, a researcher at Woori Bank, said, "The announcement by Trump to raise tariffs on China again in response to China's retaliatory tariffs has intensified concerns over the expansion of the tariff war," adding, "Although the possibility of further negotiations remains open, the uncertain situation continues, and risk-averse sentiment will prevail in the financial market." However, it is expected that high-point selling by exporters and cautious micro-adjustments by authorities will limit the upper bound of the exchange rate.

NH Futures economist Wi Jae-hyun also noted, "The Australian dollar and the won, which have recently shown notable weakness, share the commonality of having a high export proportion to China," adding, "If the trade conflict between the U.S. and China intensifies, further depreciation of the won is inevitable. If no negotiation news comes from China today or tomorrow, volatility in the foreign exchange market will further increase."

The expansion of exchange rate volatility is also a significant variable for the Bank of Korea's base interest rate decision amid a rate-cut cycle. Most experts expect a hold this month. Kim Ji-na, a researcher at Eugene Investment & Securities, said, "Although the need to defend the economy due to higher-than-expected tariffs exists, the April rate cut requires an assessment of the tariff impact, and from a financial stability perspective, it is premature," adding, "I expect a rate cut in May."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)