Growth Driven by Domestic Building and Plant Sectors

Brand Overhaul Underway: 'Lumini' Rebranded as 'Lotte Castle'

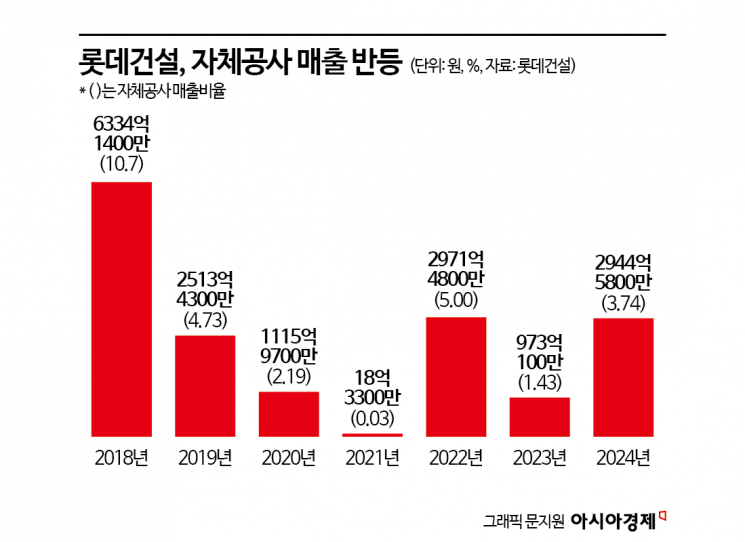

After the liquidity crisis, Lotte Construction, which embarked on structural improvement, has raised its in-house construction sales back to the 290 billion KRW level. As its in-house projects, which were on the brink of discontinuation, show signs of recovery, it is evaluated that the company has taken a step closer to securing structural stability.

According to the Financial Supervisory Service on the 9th, Lotte Construction's in-house construction sales last year amounted to approximately 294.458 billion KRW, more than tripling compared to the previous year (about 97.3 billion KRW). The proportion of in-house construction sales in total revenue also more than doubled, increasing from 1.43% to 3.74%. Although still lower than the 2018 level (633.4 billion KRW, 10.7%), it represents significant growth compared to the 1.8 billion KRW (0.03%) recorded in 2021.

The resumption of in-house construction, a business difficult to pursue without a certain level of financial stability, indicates that Lotte Construction has passed through a period of high PF contingent liability risk and borrowing burden, and its financial indicators are gradually stabilizing. Unlike subcontracted projects acquired externally, in-house construction is led by the company through the entire process from land acquisition to planning, construction, and sales. Although it requires bearing initial capital and risks, profitability is higher. A Lotte Construction official said, "Sales temporarily expanded as a major project was completed in 2022," adding, "After a gap period, in-house projects resumed last year, leading to a recovery in performance."

Industry insiders analyze this as the effect of CEO Park Hyun-chul (Vice Chairman) improving Lotte Construction's structure. CEO Park is known as a leading 'financial expert' within the group, having served as head of the Management Improvement Office at Lotte Holdings and the Coordination Office at Lotte Policy Headquarters before being appointed CEO of Lotte Construction at the end of 2022. At that time, the company was experiencing a liquidity crisis due to a sharp increase in real estate PF contingent liabilities, prompting private capital contributions and financial injections at the group level.

Since then, CEO Park has focused on restructuring the financial structure. Lotte Construction's debt ratio fell to 196% last year, down about 39 percentage points from 235% the previous year. The reliance on borrowings decreased by 7.3 percentage points to 24.3%. PF contingent liabilities were nearly halved from 6.8 trillion KRW at the end of 2022 to 3.6 trillion KRW at the end of last year. Last year's sales reached 7.8632 trillion KRW, an increase of about 1 trillion KRW compared to the previous year.

By business division, domestic building construction led external growth with sales of 5.2137 trillion KRW last year, up 1.2836 trillion KRW (33%) from the previous year. Domestic civil engineering (559 billion KRW) and plant construction (1.134 trillion KRW) also increased by 100.2 billion KRW (22%) and 133.9 billion KRW (10%), respectively. On the other hand, overseas business shrank amid profitability concerns. Overseas building construction plummeted nearly 88%, from 224.3 billion KRW to 26.8 billion KRW. Overseas plant construction also nearly halved, decreasing from 910.5 billion KRW to 507.4 billion KRW. It appears the company adopted a selective order strategy rather than aggressive overseas bidding.

Lotte Construction is currently conducting external consulting on assets worth about 1 trillion KRW, including its headquarters building, material warehouses, and idle land. A Lotte Construction representative stated, "Once this work is completed, the debt ratio is expected to decrease to 150% by 2026, and operating profit could increase by more than 100 billion KRW."

Internal restructuring efforts to improve operational efficiency, such as brand strategy adjustments and changes in exhibition hall management, are also underway. The youth safety housing supplied in Yongsan-gu, Seoul, originally named 'Yongsan Namyeong Station Lumini,' was recently renamed 'Yongsan Namyeong Station Lotte Castle Heritage.' To reduce reliance on outsourcing exhibition hall operations, adjustments to improve practical efficiency, such as adding restaurant business to the articles of incorporation at this year's regular shareholders' meeting, have also been completed.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)