"Total Damage Estimated at $30 Trillion Including Consumer Losses"

Lawrence Summers, a Harvard professor who served as Treasury Secretary under the Bill Clinton administration, strongly criticized the tariff policy of the Donald Trump administration.

On the 7th, Yonhap News reported on a post Summers made on his X (formerly Twitter) account. He wrote, "This is the greatest self-inflicted harm ever done to the U.S. economy in history," adding, "We will face serious problems until the policy is reversed."

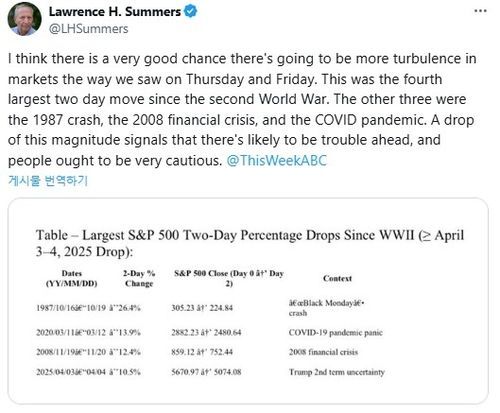

He also pointed out that the S&P 500 index recorded its largest daily drop in five years since March 16, 2020 (-12%). This recent plunge is noted as the fourth largest decline over two trading days since World War II, following the 'Black Monday' in October 1987 (-26.4%), the COVID-19 pandemic in March 2020 (-13.9%), and the financial crisis in November 2008 (-12.4%).

Summers warned, "I believe there is a very high possibility of more market turmoil, as we saw over the past 3 to 4 days," and added, "Such a drop indicates that difficulties lie ahead, and people need to be very cautious."

With the S&P 500 index down 17% from its February peak and on the verge of a bear market, he claimed, "The market estimates that corporate value is $5 trillion less than before the tariffs," and "Including consumer losses, a reasonable estimate of the total damage is about $30 trillion (approximately 44,000 trillion won)."

He further noted, "This is equivalent to economic losses as if all oil prices doubled," and said, "We have never seen anything like this."

Regarding the S&P 500 futures dropping more than 5% intraday, he said it reflects market disappointment and diagnosed, "The market is reacting to tariffs, which could be the most harmful economic policy in the U.S. since World War II."

Earlier, as optimism that the Trump administration would boost the stock market after the presidential election faded, some investment banks lowered their targets more than twice within just a few weeks. David Kostin of Goldman Sachs, Lori Calvasina of RBC, and Ed Yardeni of Yardeni Research each revised their S&P 500 targets downward twice.

Despite market instability, expectations for policy changes diminished after President Trump said on the 6th, "If the U.S.-China trade deficit is not resolved, we will not negotiate."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.