Transaction Volume Surges 40%, Record-High Prices in Major Complexes

Actual Resident Demand on the Move, Investment Inquiries Pour In

"Inquiries from Seoul Increasing"

"Growing Perception That Sejong Could Become a True Administrative Capital"

"After the rumors about the 'Presidential Office relocation to Sejong' surfaced, the many urgent sale listings were all cleared out. People moved early, thinking apartment prices would rise. Since the impeachment was upheld, demand will increase further."

This is the local real estate atmosphere conveyed by Jang Seok-cheon, head of the Sejong City Southern Branch of the Korea Association of Realtors. Amid the political upheaval of the presidential impeachment, the market moved in advance. The starting point was the news in early March that Lee Jae-myung, leader of the Democratic Party of Korea, instructed his party to consider relocating the Presidential Office to Sejong. There was no direct statement from Lee himself. However, the weight that the 'overwhelming No.1' position in the next presidential preference poll carries in the market was significant.

Chairman Jang said, "Although there is still some time until the presidential election, Lee Jae-myung is so prominent, isn't he?" He added, "Expectations for regime change and the Presidential Office relocation are intertwined, causing both actual demand and investment demand to move simultaneously." There is widespread hope that if the regime changes, Sejong City, often called a 'half-baked administrative capital,' could be reborn as a 'complete administrative capital.' In real estate communities, there are even comments like "Now is the last timing to bet on Sejong City."

Transaction Volume Soars 40%, Listings Drop Nationwide No.1... "A Sign of a Bull Market"

Sejong City's real estate has long been stuck in a slump. Most apartments have not recovered to the peak levels of 2019-2020. The transaction volume, which reached 9,404 cases in 2020, dropped to 4,476 last year. The cumulative apartment prices this year have also been declining.

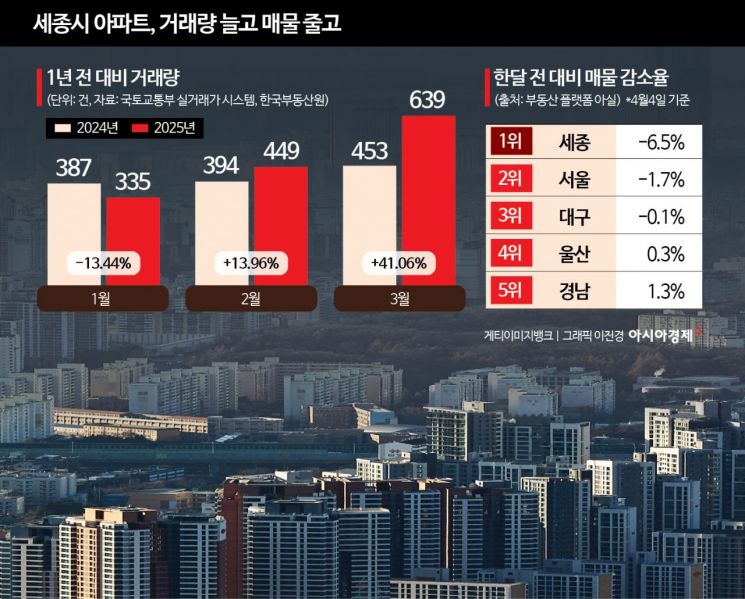

However, recently, Sejong City's real estate has been stirring, riding the 'Lee Jae-myung wave.' According to the Ministry of Land, Infrastructure and Transport's actual transaction price system and the Korea Real Estate Board, Sejong City's apartment transaction volume recorded 639 cases in March. Compared to 453 cases in the same period last year, this is a 41.06% surge. The transaction volume in February this year was about 449 cases. The reporting period for March transactions is until the 30th of this month, meaning the actual transaction volume is even higher.

A real estate agency in Sejong City, Agency A, explained, "Judging by prices, last summer was the bottom, and now it is difficult to find listings at that price range." They added, "The 'low-priced listings' that occasionally appear these days disappear quickly." As the 'house price bottom theory' spreads, there are also phenomena where sellers raise asking prices or withdraw listings. According to the real estate big data platform 'Asil,' the one-month listing decrease rate (as of the 4th) showed Sejong ranked first among 17 metropolitan local governments nationwide. Listings dropped 6.5% from 10,884 to 10,181 in one month. The second place was Seoul, with a 1.7% decrease. Agency A analyzed, "An increase in transaction volume and a decrease in listings are signs of a rising market."

Record High Prices in Complexes One After Another... Driven by Actual Demand and Gap Investment

Record high prices have also appeared in major complexes. Leaders Foret in Naritjae Village 2 Complex in Naseong-dong, known as Sejong City's 'flagship apartment,' recorded a new high on March 3, with an 84㎡ unit changing hands for 1.185 billion KRW. This complex traded at around 800 to 900 million KRW as recently as February. Prices jumped over 300 million KRW in just one month. A real estate agency in Sejong City, Agency B, said, "The jeonse (long-term deposit lease) price of the most expensive Naritjae 2 Complex in Sejong is about 300 to 400 million KRW," adding, "Since gap investment merits are limited, it can be interpreted that actual resident demand has started to move."

Other complexes such as Naritjae Village 3 Complex Jeil Punggyeongchae Winnersky 84㎡ in Naseong-dong, Gaon Village 11 Complex Jiwel Prugio 74㎡ in Dajeong-dong, Doream Village 17 Complex 99㎡ in Dodam-dong, Surubae Village 1 Complex 84㎡ in Bangok-dong, and Eliph Sejong 104㎡ in Jochiwon-eup also recorded new highs last month. The price increases ranged from as little as 1 million KRW (Gaon Village 11 Complex) to as much as 293 million KRW (Naritjae Village 3 Complex). Agency C said, "Compared to Naritjae 2 and 3 Complexes, the relatively cheaper 5th and 6th Complexes had almost no transactions last year, but recently gap investments combined with actual resident demand have been occurring," adding, "There have been steady inquiries from Seoul, especially around preferred areas like Naseong-dong and Eojin-dong."

Sejong City real estate agents view the sales performance of Gyeryong Construction's project, scheduled to be supplied in the 5th living zone of Sejong City in June, as a gauge for the future of Sejong City's real estate market. Agency D said, "The complex supplied in the 5th living zone in January filled subscriptions, but many contract cancellations led to unsold units," adding, "If even the 5th living zone, which is relatively on the outskirts and less preferred in location, succeeds in popularity, it would signal that the current enthusiasm is not just a 'flash' but the start of a mid- to long-term rise."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.