Baemin B Mart Achieves First Annual EBITDA Profit

Commerce Business Transaction Volume Surpasses 1 Trillion KRW

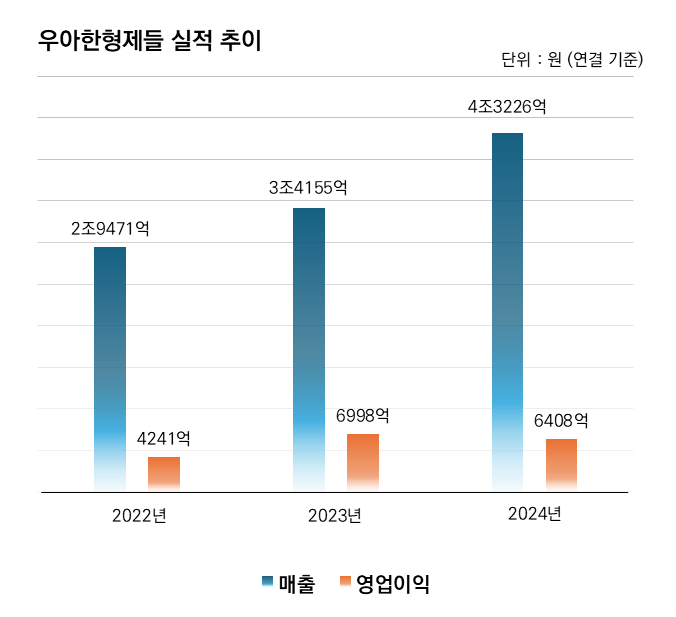

Baedal Minjok surpassed 4 trillion KRW in sales on a consolidated basis last year. However, operating profit declined compared to the previous year due to the impact of free delivery competition last year. Woowa Brothers, the operator of Baemin, announced on the 4th that it recorded consolidated sales of 4.3226 trillion KRW and operating profit of 640.8 billion KRW last year. Sales increased by 26.6% compared to the previous year, but operating profit decreased by 8.4%.

Woowa Brothers explained that from April last year, free delivery for consumers steadily attracted customers, leading to stable growth in its core food delivery service, and improved performance in commerce services such as Baemin B Mart drove sales expansion.

Looking at sales by category, service sales, which represent the performance of food delivery services and intermediary commerce models (grocery shopping and shopping), amounted to 3.5598 trillion KRW, a 30.9% increase from 2.7187 trillion KRW the previous year, contributing to overall sales growth. The food delivery service showed solid growth based on steady customer inflow, including Baemin Club subscription members, as consumer preference for platform-operated self-delivery from order to delivery, centered on free delivery, continued.

In intermediary commerce such as grocery shopping and shopping, offline-based large distribution channels including convenience stores, corporate supermarkets (SSM), and large marts have been continuously entering, expanding their influence. As of December last year, about 23,000 stores across various categories such as marts, convenience stores, side dishes and food, digital, beauty, and daily necessities were registered in grocery shopping and shopping. The number of orders for grocery shopping and shopping increased by 369% compared to the previous year, and transaction volume grew by 309% during the same period. In particular, the total number of orders from convenience stores, corporate supermarkets, and large marts registered in grocery shopping and shopping increased fivefold compared to the previous year.

On the other hand, as delivery demand increased with the platform bearing consumer delivery fees, operating expenses, including outsourced service costs reflecting rider expenses, increased, causing operating profit to decline compared to the previous year. Operating expenses rose 35.6% to 3.6818 trillion KRW from 2.7156 trillion KRW the previous year. In particular, outsourced service costs, which account for the largest portion of operating expenses and are related to rider delivery fees, increased by 73.4% to 2.2369 trillion KRW from 1.2902 trillion KRW the previous year, greatly exceeding the sales growth rate. Due to free delivery and other factors last year, sales increased by about 800 billion KRW, but related costs also rose by about 1 trillion KRW, affecting the decrease in operating profit margin compared to the previous year.

Baemin B Mart Achieves Annual EBITDA Profit for the First Time... Commerce Business Transaction Volume Surpasses 1 Trillion KRW

The product sales of Baemin B Mart (quick commerce), which delivers customer-ordered products within one hour, grew 10% year-on-year to 756.8 billion KRW last year. Additionally, B Mart recorded its first annual EBITDA (earnings before interest, taxes, depreciation, and amortization) profit last year.

This achievement is attributed to continuously expanding the product assortment from food items to daily necessities, meeting customer needs. B Mart is diversifying its sales categories by adding organic eco-friendly products and health diet management items reflecting trends, in addition to existing fresh and processed foods. Furthermore, daily necessities available for purchase at B Mart have expanded to cosmetics, hair and body care products, household goods, and pet supplies.

Moreover, private brand (PB) products exclusive to B Mart, such as ‘Baemin Easy’ and the premium line ‘Baegneature,’ contributed to B Mart’s growth. Currently, there are about 150 PB products including Baemin Easy and Baegneature, with PB product sales increasing by 82% compared to the previous year.

The average order amount per B Mart customer also rose by 2.8%. The number of customers and orders for Baemin’s commerce business, including B Mart and grocery shopping and shopping, increased by 49.4% and 38.8%, respectively, compared to the same period last year. Thanks to this growth, Baemin’s commerce business transaction volume surpassed 1 trillion KRW for the first time last year.

Investment in Delivery Quality Improvement, Strengthening Subscription Benefits, and Activating Pickup and Commerce as Strategic Moves

Baemin plans to expand investment in delivery quality in response to the rapidly increasing share of platform-operated delivery both in the domestic delivery app market and global trends.

Additionally, Baemin intends to continuously enhance Baemin Club member benefits amid intensifying subscription competition across the distribution industry. Plans include expanding popular franchise brand benefits, strengthening discounts for commerce services such as grocery shopping, shopping, and B Mart, and expanding partnership alliances to boost Baemin Club service competitiveness.

A Woowa Brothers official said, “We recorded continuous sales growth based on balanced growth in food delivery and commerce businesses,” adding, “This year, we will maximize customer value through investments in delivery quality improvement, subscription benefit enhancement, pickup orders, and commerce marketing.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)