Trump Administration Sets 25% Reciprocal Tariff on Korean Goods

Korean Cosmetics' Price Competitiveness at Risk

Global K-Beauty Boom Faces Major Setback

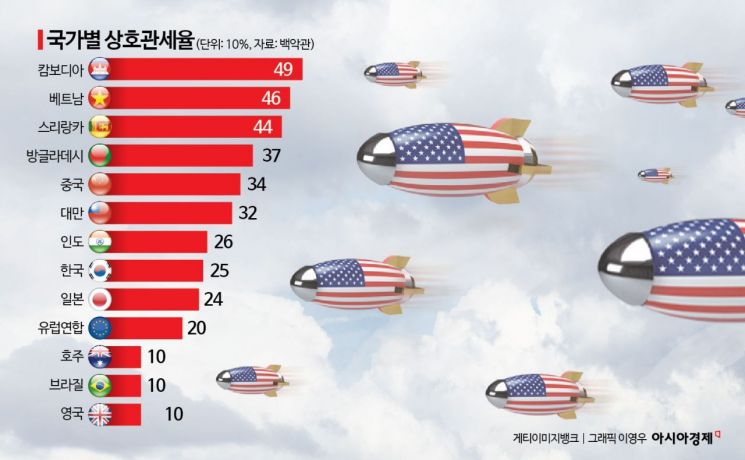

The Donald Trump administration's decision to impose a 25% reciprocal tariff on Korean products is expected to deal a significant blow to the domestic cosmetics industry. Korean cosmetics, which sparked the K-beauty craze in the global market, surpassed France last year to become the top exporter to the U.S. market. However, concerns are rising that the high tariff rate could weaken their price competitiveness.

According to the beauty industry on the 4th, last year, Korea's cosmetics exports to the U.S. amounted to approximately $1.701 billion (2.5 trillion KRW), exceeding France's $1.263 billion, which previously held the top spot.

The reason K-beauty thrived in the U.S. market is its price competitiveness. Korean cosmetics were highly regarded for their quality at about one-tenth the price of French luxury products, leading to brisk sales in the U.S. market. However, with the imposition of a 25% tariff, price increases seem inevitable. There are concerns that the younger consumer demographic, particularly those in their teens and twenties, may turn away. A beauty industry insider said, "While products from Japan and France have established a perception as premium products, K-beauty's core competitiveness lies in being affordable. If price resistance arises, small and medium-sized brands will have to lower their margins further to sell."

Major cosmetics companies are busy preparing countermeasures. AmorePacific, which recently opened the export channel to the U.S., is closely monitoring the market situation to determine whether price increases or promotion cost management are necessary. Meanwhile, Original Design Manufacturer (ODM) companies, not being sellers themselves, are not directly affected but plan to utilize their U.S. subsidiaries to respond to production reductions by brands due to the tariff impact. Both Cosmax and Kolmar Korea have subsidiaries in the U.S.

The beauty industry experienced confusion following the U.S. reciprocal tariff announcement. There was speculation that products such as sunscreens and acne treatments, which are exported to the U.S. as over-the-counter (OTC) drugs, might be exempt from the 25% reciprocal tariff. OTC products straddle the line between cosmetics and pharmaceuticals and must obtain a unique identification number from the U.S. Food and Drug Administration (FDA). President Donald Trump excluded pharmaceuticals, semiconductors, lumber, and copper from the reciprocal tariff list.

However, according to confirmations from the government and the Korea Cosmetic Association, the White House executive order annex indicates that cosmetics, including sunscreens, are subject to reciprocal tariffs. A Korea Cosmetic Association official stated, "(According to the White House annex) there is no confirmation of item exclusion for cosmetic ingredients, so a 25% tariff, not the basic 10%, will be applied." The official added, "From a trade balance perspective, Korea is at a somewhat disadvantageous position," and explained, "(Although no official notice has been sent to member companies) we will closely discuss with the U.S. Cosmetic Association to devise countermeasures."

The fashion industry is also expected to be hit by tariffs, especially ODM companies. The Trump administration announced high reciprocal tariffs on Vietnam (46%) and Indonesia (32%), where domestic ODM companies have production plants. In particular, Hansae Co., Ltd., which exports 85% of its products to the U.S., is preparing various countermeasures.

Currently, Hansae operates production facilities in Vietnam, Indonesia, Guatemala, and El Salvador, and plans to adjust production volumes in regions heavily affected by reciprocal tariffs. Additionally, it plans to increase 'Made in USA' products by utilizing Texollini, a U.S. textile manufacturer it acquired last year, and to diversify production bases by leveraging its subsidiaries in pro-U.S. Latin American countries such as El Salvador.

SeAH Sangyong, a clothing manufacturing and sales company under the global SeAH Group, has production plants in Nicaragua, Guatemala, Honduras, El Salvador, Haiti, Vietnam, and Indonesia. SeAH Sangyong stated that it is monitoring U.S. tariff policies and situations closely while formulating detailed strategies.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.