Traditional Tariff-Free Zones: Entertainment and Beauty Stocks Show Renewed Strength

Pharmaceutical Stocks Breathe Easier with Exemption from Reciprocal Tariffs

As the US imposed a tariff bombshell causing major export stocks to scream in unison, some companies with upgraded target prices have attracted attention in the securities market. Most of these are cosmetics, entertainment, and pharmaceutical/bio stocks, which have been noted as tariff-free zones.

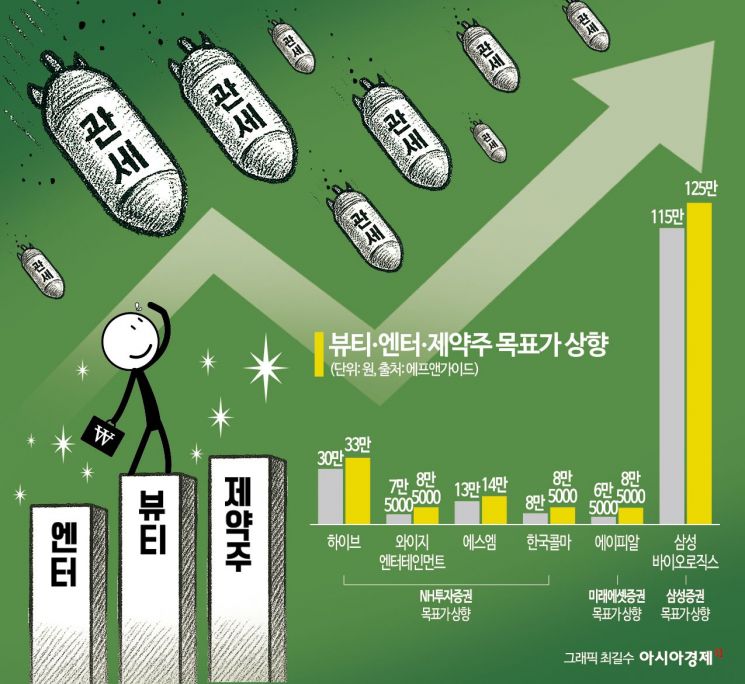

According to FnGuide on the 4th, among more than 70 corporate analysis reports released in the securities market the day before the crossfire of reciprocal tariffs by US President Donald Trump, 13 companies had their target prices raised. About half of these (HYBE, YG Entertainment, SM, APR, Kolmar Korea, Samsung Biologics) are cosmetics, entertainment, and pharmaceutical/bio companies, which have been labeled as tariff-free zones.

On that day, the target prices of Kolmar Korea and APR in the cosmetics sector were each raised to 85,000 KRW. Earlier, there were concerns that the K-beauty industry, which for the first time last year surpassed France to rank first in exports to the US (about 2.5 trillion KRW), might fall under tariff scrutiny, but based on the competitiveness of individual companies, the mood is rather turning crisis into opportunity.

In particular, Kolmar Korea attracted attention as global demand for 'Korean-made sunscreen' is explosively increasing, while its local production capacity in the US is also being strengthened. Jiyoon Jung, an analyst at NH Investment & Securities, said, "Kolmar Korea's US subsidiary has shown remarkable progress since the beginning of the year," adding, "US Plant 1 has maintained a quarterly sales profit trend of around 20 billion KRW since Q4 last year, and Plant 2, after an initial temporary loss during startup, is expected to increase its contribution to the US subsidiary's profits."

In the entertainment sector, the target prices of HYBE, SM, and YG Entertainment were raised to 330,000 KRW, 140,000 KRW, and 85,000 KRW, respectively. All three entertainment companies have seen their stock prices soar by about 30% on average this year, buoyed by the return of major artists and expectations of the lifting of the Chinese ban on Korean entertainment (Hallyu ban). Above all, the intangible services such as music streaming, performances, and appearance fees, which are the main revenue sources of K-pop, are considered a unique strength as they are difficult to impose tariffs on. Hwajeong Lee, an analyst at NH Investment & Securities, evaluated, "Even aside from favorable external factors such as China, exchange rates, and tariffs, the industry itself appears to have entered a positive growth cycle."

In the pharmaceutical/bio sector, Samsung Biologics smiled alone with a 6% rise amid a decline in top KOSPI stocks. The exemption of pharmaceuticals from the 25% reciprocal tariffs imposed by President Trump on Korea acted as a positive factor for the stock price. With expectations of sharp earnings growth this year due to increased operating rates of Plant 4 and expanded additional orders for Plant 5, the fact that the US sales proportion is not large at 25% is also considered a merit.

Shin Suhan, an analyst at Samsung Securities who raised Samsung Biologics' target price to 1,250,000 KRW, said, "Although there remains a possibility that the US will announce tariffs by item later, the current uncertainty has been resolved," adding, "Concerns about weakened price competitiveness of domestic CMO companies and customer attrition due to tariff imposition also seem to have been alleviated."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)