Amid Strong K-Food Exports, "Trump Tariff" Poses Major Obstacle

Food Companies Without U.S. Factories on High Alert

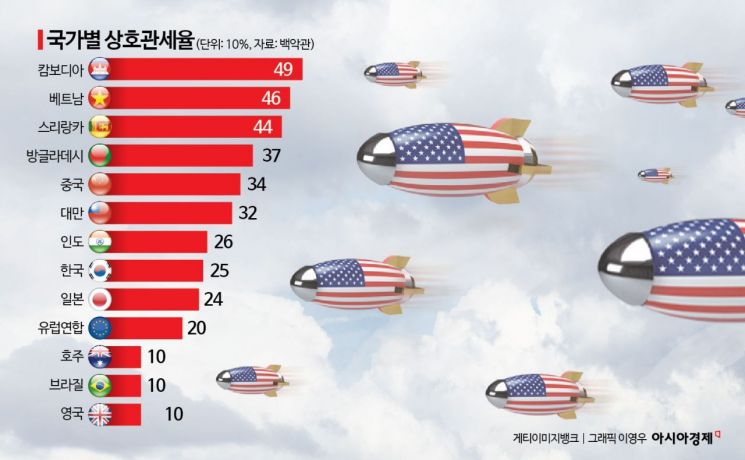

The United States' decision to impose a 25% tariff on Korean food products has put the domestic food industry on edge. In particular, food companies without production facilities in the U.S. are deeply concerned that this measure could halt their export growth.

On the 3rd, U.S. President Donald Trump directly named South Korea while announcing a high tariff policy targeting major export countries under the pretext of "reciprocal tariffs." The industry expects that the so-called K-food category, including kimchi, ramen, gochujang, and soju, will be subject to tariffs.

According to the Ministry of Agriculture, Food and Rural Affairs, the export value of "K-Food Plus," which encompasses agricultural food products and agriculture-related industries, reached $3.18 billion (approximately 4.6 trillion KRW) in the first quarter of this year, up 7.9% compared to the same period last year. Among this, agricultural food exports amounted to $2.48 billion, marking a 9.6% increase from the previous year and setting a record high for the first quarter. Exports to the North American market rose by 21.7% to $487 million. Notably, ramen exports surged 27.3% year-on-year to $344 million, driving export growth.

Companies such as CJ CheilJedang, Nongshim, and Daesang, which already have production plants in the U.S., are expected to be less affected by this tariff war. These companies have established local production and distribution structures, allowing them to avoid or minimize tariff application.

In the case of CJ CheilJedang, 84% (4.7138 trillion KRW) of its overseas food business sales (5.5814 trillion KRW) come from the U.S. CJ CheilJedang operates 20 factories locally and is constructing a new plant in South Dakota. Nongshim runs two factories in the U.S., with about 40% of its overseas sales (1.3 trillion KRW) coming from the U.S. A CJ representative stated, "Products sold in the U.S. are primarily produced locally, so the impact of tariffs is limited."

The 'Splash Buldak' advertisement video being displayed in New York Times Square.

The 'Splash Buldak' advertisement video being displayed in New York Times Square. [Photo by Samyang Foods]

On the other hand, companies like Samyang Foods, Ottogi, Binggrae, and HiteJinro mostly produce their products domestically and export directly to the U.S., thus bearing the full burden of tariffs. Samyang Foods' "Buldak Bokkeum Myun" has become a representative product leading the K-ramen craze in the U.S., but with the added 25% tariff, a price increase for consumers is inevitable. Last year, Samyang Foods' overseas sales accounted for 77% of its total sales (1.728 trillion KRW), with 28% of that from the Americas. Ottogi's export ratio is about 10%, and it is currently pushing forward with plans to establish a factory aimed for completion in 2027 to secure a production base in the U.S.

An industry insider explained, "K-food does not directly compete with local groceries, but the imposition of tariffs will inevitably weaken price competitiveness," adding, "In the long term, this could lead to a decline in local consumer purchasing power." The industry expects that consumer prices for products in the U.S. will rise by about 20-30% due to the tariff impact. Another insider noted, "A 25% tariff is enough to undermine price competitiveness," and "a price increase for consumers in the U.S. is unavoidable." They added, "We are closely monitoring the situation while exploring various options with local sales subsidiaries, such as diversifying export regions or expanding local production."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)