First Operating Profit Achieved Last Year...

Cumulative Refunds Reach 1.6 Trillion KRW

Crisis as NTS Launches Free Service

"We Will Offer Differentiated Services"

‘SamzzumSam,’ which succeeded in turning a profit for the first time last year, has been put to a new test. This is because the National Tax Service (NTS) has entered the refund platform market by prominently launching the ‘One-Click Tax Refund Service.’

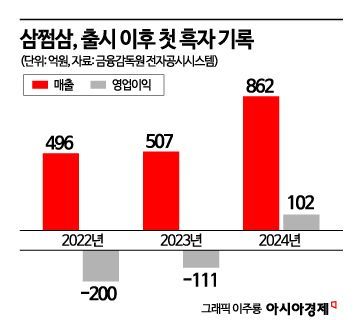

According to the Financial Supervisory Service’s electronic disclosure system on the 3rd, Jarvis & Villains, which operates the tax refund platform SamzzumSam, recorded an operating profit of 10.2 billion KRW last year. After posting an operating loss of 20 billion KRW in 2022, the company gradually reduced its deficit and achieved profitability for the first time since SamzzumSam’s launch in 2020. During the same period, sales also increased significantly. Last year’s sales reached 86.2 billion KRW, up about 70% from the previous year (50.7 billion KRW). Since its launch in 2020, the platform has maintained a steep growth trajectory in both scale and profitability.

This growth was largely driven by a significant increase in refund applications last year. The cumulative refund application amount for SamzzumSam reached approximately 1.6 trillion KRW last year. Considering that the cumulative application amount was 900 billion KRW as of 2023, this means that applications increased by about 700 billion KRW in just one year. SamzzumSam charges a commission of about 10% on the refund application amount.

However, the situation has become complicated as the NTS introduced a free refund service, seemingly to curb the growth of private services. On the 31st of last month, the NTS officially launched the comprehensive income tax refund ‘One-Click’ service. This service displays refund amounts for the past five years at once and allows users to apply for a refund within one minute with a single click. Unlike private services such as SamzzumSam, it is free to use, attracting 80,000 users within six hours of its launch. While the NTS states that the service was created for the convenience of the public, industry insiders predict that the position of private platforms like SamzzumSam may be narrowed. As of last month, SamzzumSam had secured a cumulative user base of 23 million, leading the market.

In response, Jarvis & Villains is putting all its efforts into strengthening service competitiveness. In the second half of last year, it completely eliminated the tax agent verification process required during refunds, resolving issues related to tax accountant consent and greatly improving user convenience. The company also highlights its strengths in data analysis accumulated over many years and its ability to provide tax-saving information. A Jarvis & Villains representative said, “Having provided the service for nearly five years, we have extensive data on various elements that can lead to tax refunds, such as small and medium-sized enterprise exemption programs. Based on this, we will continue to introduce differentiated services.”

Expansion into new businesses beyond SamzzumSam is also underway. In 2022, Jarvis & Villains acquired the mobile startup ‘Smoothie,’ absorbing a large number of talented personnel. Since then, it has enhanced the ‘Comprehensive Real Estate Tax Refund Service’ launched in collaboration with Deloitte Anjin and is also operating the ‘SamzzumSam TA’ service, which directly connects tax accountants and clients.

They are also exploring entry into the global market. In October last year, they established a Japanese corporation and plan to introduce a B2C (business-to-consumer) tax refund service similar to SamzzumSam to the Japanese market.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)