The Proportion of R&D Expenses to Sales Increased

Active Investment in New Technologies Such as AI and Building Information Modeling

When crossing the Banpo Bridge in Seoul, you can see new apartments, old apartments, and apartments under construction all at once in the Sinbanpo area. From the left, the new apartments are Acro Riverview Sinbanpo, the low old apartments are Sinbanpo 2nd Complex, and behind them is the Maple Xi construction site.

When crossing the Banpo Bridge in Seoul, you can see new apartments, old apartments, and apartments under construction all at once in the Sinbanpo area. From the left, the new apartments are Acro Riverview Sinbanpo, the low old apartments are Sinbanpo 2nd Complex, and behind them is the Maple Xi construction site.

Despite the downturn in the construction industry, major construction companies continued or even increased their investment in research and development (R&D) over the past year. They did not let go of the reins in the competition to secure future technologies such as artificial intelligence (AI).

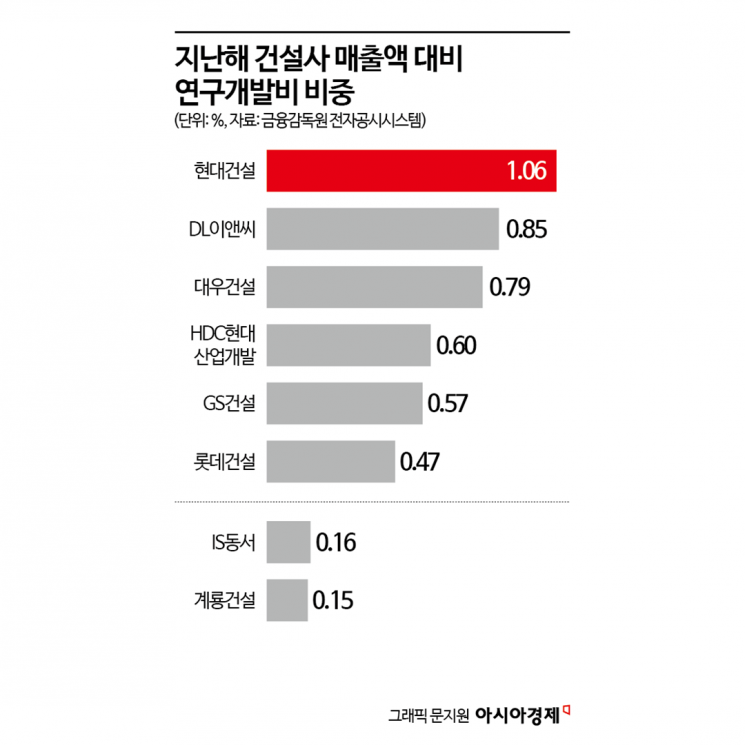

According to the Financial Supervisory Service's electronic disclosure system on the 3rd, last year Hyundai Construction's R&D expenditure as a percentage of sales was 1.06%. This is an increase of 0.02 percentage points compared to 1.04% the previous year. In terms of amount, R&D expenses rose by about 8.3% (KRW 13.615 billion) to KRW 177.866 billion.

Daewoo Construction also saw an increase in the ratio of R&D expenses to sales. It rose by 0.16 percentage points from 0.63% in 2023 to 0.79% last year. During the same period, HDC Hyundai Development Company's R&D expenses as a percentage of sales increased by 0.19 percentage points to 0.6%. GS Construction recorded an increase of 0.3 percentage points to 0.57%. In the case of DL E&C (0.85%), it decreased by 0.06 percentage points compared to the previous year.

Despite the real estate market slump, construction companies continued their technological competition, focusing especially on the AI sector. Hyundai Construction is conducting the 'Construction Site Vision AI Technology Development Phase 1' research project, which aims to identify hazardous materials using images and video data from construction sites. GS Construction developed AI-based real-time concrete quality anomaly detection technology to improve productivity. They also developed 'Xi-Book,' a platform that allows construction standards to be searched anytime using AI. It was introduced at construction sites to enable information retrieval within seconds. Daewoo Construction conducted research on document analysis technology based on large language models (LLM) to quantitatively and qualitatively analyze internal document data.

Capital is also being invested in Building Information Modeling (BIM) related development. DL E&C conducted research on establishing and commercializing a BIM-based quantity calculation system. BIM aims to create accurate virtual models of buildings and other structures digitally. Through this model, information necessary for design, construction, and operation of buildings can be obtained in a three-dimensional environment.

Advancement of modular construction technology is another area where construction companies are focusing their efforts to secure technology. This construction method involves prefabricating 70-80% of the building process, such as basic frameworks and electrical wiring, in factories and then assembling them like Lego blocks. Last year, DL E&C set fire-resistant modular construction technology research as a project.

On the other hand, small and medium-sized construction companies showed poor research performance, largely due to a relative lack of capital input. IS Dongseo's R&D expenses as a percentage of sales last year were 0.16%, an increase of 0.11 percentage points from the previous year. However, this still amounts to only about one-third of that of major construction companies. Gyeryong Construction remained at 0.15%. In the case of Seohui Construction, their business report last year stated regarding R&D activities, "As of August 31, 2016, the 'Busan Food Waste Resource (Power Generation) Private Investment Project Implementation Agreement' was terminated, so there are no relevant matters as of the disclosure preparation date."

An industry insider explained, "Securing technologies for efficiency enhancement, construction cost reduction, and safety is essential to gain an advantage in domestic and international competition. To conduct R&D, organizations and personnel must be formed, which incurs significant costs, so larger companies inevitably tend to be more proactive." He added, "Even if smaller construction companies conduct R&D, their capital limitations mean they tend to focus on specific areas like housing, which ultimately weakens their competitiveness compared to larger companies researching diverse fields such as housing, civil engineering, plants, and environment."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)