Business Briefing on the 9th...

Bidding Announcement Scheduled for This Month

Two Rounds of Bidding Planned for the First and Second Halves of the Year

LG Energy Solution's energy storage system (ESS) battery container product for power grids. Photo by LG Energy Solution, Yonhap News Agency

LG Energy Solution's energy storage system (ESS) battery container product for power grids. Photo by LG Energy Solution, Yonhap News Agency

A rare boon is expected to come to the domestic battery industry, which has been struggling due to the slowdown in the electric vehicle market growth. This is because the government will conduct a nationwide bidding for the first time this year to introduce Battery Energy Storage Systems (BESS) in line with the expansion of renewable energy. The total project scale is estimated to reach at least 800 billion KRW.

According to the battery industry on the 3rd, the Ministry of Trade, Industry and Energy plans to announce the first half BESS central contract market bidding within this month. To this end, the Korea Power Exchange will hold a business briefing session for related industries at the SpaceShare Seoul Jungbu Center on the 9th.

At the business briefing, the overall details of this year’s BESS bidding will be explained, and industry opinions will be gathered. A Ministry of Trade, Industry and Energy official said, "Based on the results of the briefing session, we plan to promptly announce the bidding."

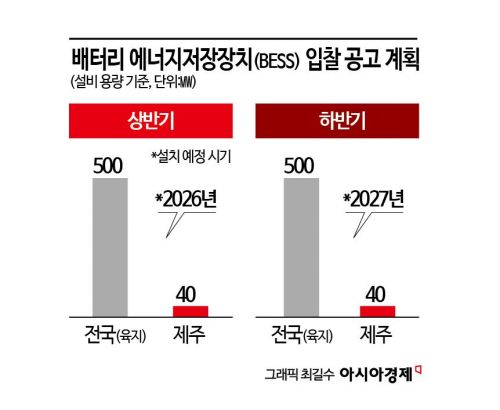

The first half BESS bidding corresponds to the volume scheduled for installation in 2026 under the 11th Basic Plan for Electricity Supply and Demand, with 500 megawatts (MW) nationwide (mainland) and 40 MW in Jeju. According to this plan, the government estimates that a cumulative 23 gigawatts (GW) of ESS capacity will be needed by 2038 due to the expansion of renewable energy. To supply this, the plan is to select operators for 1.25 GW of pumped storage and 2.25 GW of other storage devices (meaning BESS).

The Ministry of Trade, Industry and Energy plans to conduct bidding for the volume scheduled for installation in 2027 in the second half of this year if the first half bidding proceeds smoothly. This means bidding will be held twice a year.

Converting the 500 MW capacity to a 4-hour storage capacity basis results in 2000 megawatt-hours (MWh). Based on past cases, the battery industry estimates that this will amount to a project worth at least 400 billion KRW in the first half of this year alone. Including the Jeju region, the project scale this year is expected to exceed 800 billion KRW in total for both the first and second halves.

This is the first time the government is conducting a long-duration BESS bidding on a nationwide scale. In November 2023, the Ministry conducted a BESS bidding only for the Jeju region, selecting three power plants for a 65 MW (260 MWh) scale. This year, with a larger project scale than before, interest from the battery industry is rising.

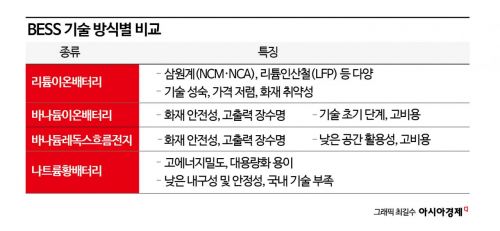

There is also interest in what type of battery will be selected in this year’s bidding. In the 2023 Jeju BESS project, a lithium-ion battery (LIB) operator won the bid. This time, in addition to lithium-ion batteries, non-lithium batteries such as vanadium-ion batteries (VIB), vanadium redox flow batteries (VRFB), sodium-sulfur (NaS) batteries, and sodium-ion batteries are expected to compete.

Among lithium-ion batteries, not only ternary but also the more cost-effective lithium iron phosphate (LFP) batteries are expected to participate in the bidding. A battery industry official said, "To foster a diverse battery industry, we hope that business opportunities will also be given to non-lithium batteries with proven technology."

Meanwhile, ESS refers to systems that temporarily store generated electricity and use it when power is insufficient. Pumped storage and batteries are representative examples. When batteries are used among ESS, it is distinguished as BESS.

ESS is classified into short-duration, medium-duration, and long-duration based on the energy storage period. Generally, storage of 4 hours or more is called long-duration ESS. Short-duration ESS refers to frequency regulation for renewable energy sources like solar and wind, which have high variability.

Recently, with a significant increase in renewable energy, the need for long-duration ESS that stores excess electricity generated during the day and transmits it during peak demand in the evening has been raised. Jeju and Honam regions, which have abundant renewable energy such as solar and wind, are representative areas. In these regions, renewable energy often exceeds demand, leading to frequent output curtailment.

The domestic ESS industry showed rapid growth after 2017 but has been declining since 2020 due to fire incidents and the expiration of government support programs. According to the Ministry of Trade, Industry and Energy, the scale of new ESS installations in Korea reached 3,836 MWh in 2018 but shrank to 252 MWh in 2022, a reduction to one-fifteenth.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)