Rising Expectations for the Upcoming First-Quarter Earnings Season

First-Quarter Earnings Consensus Shifts Upward After Downward Trend

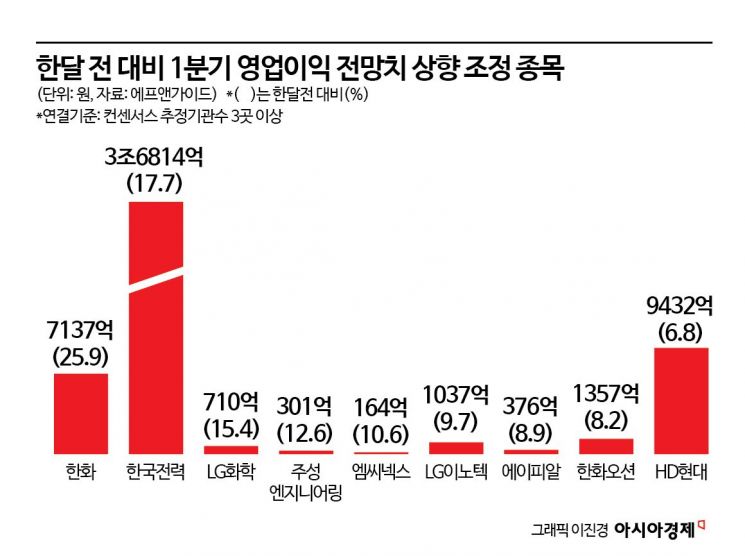

Hanwha Sees Largest Upward Revision in Operating Profit Consensus

Positive Market Trend Expected if First-Quarter Earnings Are Strong

As the stock market shows a sluggish trend due to variables such as Trump's tariffs and the impeachment verdict, the upcoming first-quarter earnings season is expected to serve as a momentum for the future direction of the market. Recently, a positive atmosphere has been forming with upward revisions of first-quarter earnings forecasts, raising expectations that the stock market will get back on an upward trajectory.

According to FnGuide on the 3rd, the combined first-quarter operating profit forecast for 206 domestic listed companies with consensus (average securities firm forecast) from three or more estimating institutions is 56.6239 trillion KRW. This figure represents a 14.8% increase compared to the same period last year and has been revised upward by 1.13% compared to a month ago.

Although the results of last year's fourth-quarter earnings season fell short of expectations, the first-quarter forecasts have been revised upward, increasing anticipation for the earnings season. Changmin Cho, a researcher at Hyundai Motor Securities, explained, "The downward revision of forecasts in January and February reflects the poor fourth-quarter results. As the fourth-quarter earnings season comes to an end, forecasts are switching to upward revisions. The first-quarter earnings forecast is currently being revised upward by 5.3% from the bottom."

Looking at changes in estimates by stock, 77 stocks were revised upward, while 76 stocks were revised downward. The stock with the largest upward revision in operating profit estimates compared to a month ago was Hanwha. Hanwha's first-quarter operating profit consensus rose 25.9% from 567 billion KRW a month ago to 713.7 billion KRW. Following were Korea Electric Power Corporation (KEPCO) with 17.7%, LG Chem with 15.4%, Jusung Engineering with 12.6%, and MCNEX with 10.6%, all recording double-digit upward revisions.

On the other hand, Wonik IPS saw the largest downward revision, with its first-quarter operating profit consensus dropping 41.5% from 7.4 billion KRW a month ago to 4.3 billion KRW. JYP Entertainment was down 27.9%, YG Entertainment 27.5%, Green Cross Corporation 27%, and Hyundai Steel 20.1%, respectively.

The earnings forecast for Samsung Electronics, which holds a significant weight in the domestic stock market, also declined compared to a month ago. The first-quarter operating profit consensus is 51.428 trillion KRW, down 3.6% from a month ago. In contrast, SK Hynix's first-quarter operating profit consensus rose 2.9% from a month ago to 64.98 trillion KRW. Youngho Ryu, a researcher at NH Investment & Securities, analyzed, "Samsung Electronics' first-quarter sales are expected to be 75.1 trillion KRW, up 4.4% year-on-year, and operating profit is expected to increase 28.3% to 4.7 trillion KRW, but this will fall short of consensus. The reduction in the proportion of high-bandwidth memory (HBM), which led DRAM sales growth in the fourth quarter, NAND weakness, and foundry losses will form the bottom of the annual performance."

Myunggan Yoo, a researcher at Mirae Asset Securities, said, "Although Samsung Electronics' profit momentum is sluggish, it is believed to be sufficiently reflected in the stock price. Both Samsung Electronics and SK Hynix are expected to see operating profits increase from the first quarter as the bottom."

Researcher Yoo added, "This year's first-quarter earnings season is important as it follows the unexpectedly weak third and fourth quarters of last year and is the first earnings season after the resumption of short selling. Domestic companies' operating profits are expected to increase from the first to the third quarter this year. If first-quarter earnings exceed consensus, a positive trend in the domestic stock market can continue."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)