Trading Volume Continues to Decline After Peaking at 27 Trillion KRW in 2021

Growth of Virtual Asset Market and Rise of Seohak Ants Have an Impact

"Increase in Trading Volume Is Temporary... Decline Expected to Continue"

The domestic stock trading volume, which had significantly increased due to the Donghak Ant Movement that began in 2020, has been continuously declining. The main reason is attributed to the mass exodus of domestic investors to the virtual asset market and overseas markets such as the United States.

According to FnGuide on the 3rd, the average daily trading volume of stocks (combined KOSPI and KOSDAQ) last month was 17.1734 trillion KRW, a 24.48% decrease compared to 22.74 trillion KRW recorded during the same period last year. Additionally, the average daily trading volumes in January and February this year were 16.5567 trillion KRW and 21.1782 trillion KRW respectively, down 14.53% and 5.51% year-on-year.

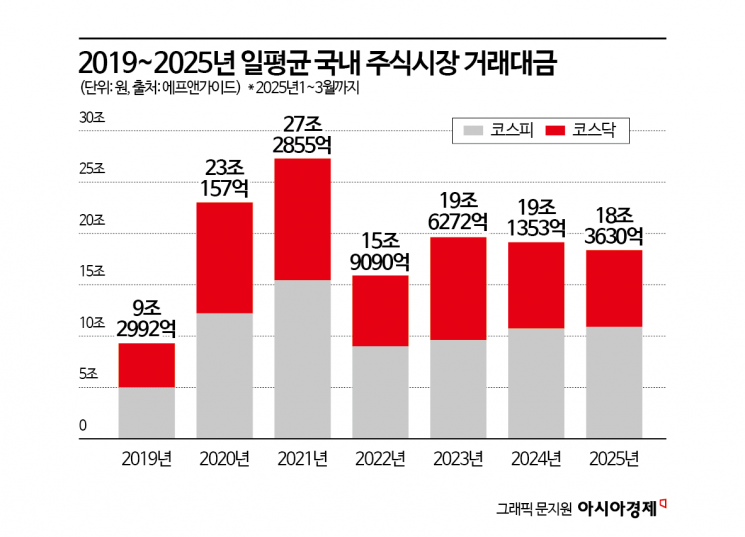

The average daily trading volume of domestic stocks, which was 9.2992 trillion KRW in 2019, surged to 23.0157 trillion KRW in 2020 and 27.2855 trillion KRW in 2021.

The main cause was the Donghak Ant Movement (mass purchase of domestic stocks) triggered by the COVID-19 pandemic. As a result, in 2021, the KOSPI surpassed the 3,000 mark, and the KOSDAQ exceeded 1,000.

Hwang Se-woon, a research fellow at the Korea Capital Market Institute, explained, "Before COVID-19, the stock trading volume was around 10 trillion KRW. After the outbreak, a large number of individual investors entered the stock market, increasing the trading volume."

However, in 2022, the U.S. Federal Reserve (Fed) raised policy interest rates and implemented quantitative tightening, and the Russia-Ukraine war broke out, causing a sharp decline in not only the domestic but also the global stock markets. Consequently, the average daily trading volume in Korea decreased to 15.909 trillion KRW.

Although it increased again afterward, it has not recovered to the 2021 level. This time, the Seohak Ant Movement (mass purchase of overseas stocks) had an impact. According to the Bank of Korea, the balance of individual investors' overseas stock investments increased from 15.2 billion USD at the end of 2019 to 116.1 billion USD at the end of last year.

Additionally, the migration of investors to the virtual asset market is considered another major cause. Recently, Ahn Do-gul, a member of the Democratic Party of Korea, analyzed data from the Financial Supervisory Service on the five major domestic virtual asset exchanges (Upbit, Bithumb, Coinone, Korbit, Gopax) and found that the scale of virtual assets held by the public last year reached 105.0107 trillion KRW, a sharp increase from 924.5 billion KRW in 2020.

Research fellow Hwang said, "While the trading volume is likely to be maintained at a higher level than in the past, it is largely temporary. Considering factors such as aging, the population of stock investors is expected to decrease, so a downward stabilization is anticipated."

However, there is also an opinion that the recent decrease in trading volume is due to investors taking a wait-and-see approach amid increased stock market volatility. According to the Korea Financial Investment Association, investor deposits increased from 50.5866 trillion KRW at the end of October last year to 56.0592 trillion KRW in February this year, and 58.4743 trillion KRW at the end of last month, the highest since 61.4062 trillion KRW at the end of April 2022.

Investor deposits refer to money that investors have deposited in securities firms' accounts to buy stocks or money left unclaimed after selling stocks. As standby funds in the stock market, they serve as a basis for expectations of stock price increases but can also be interpreted as indicating a heightened cautious stance among investors.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)